2 Radio Frequency Stocks to Watch in a Challenging Industry

The Zacks Semiconductors - Radio Frequency industry participants are suffering from a challenging demand environment, primarily attributed to a suspension in capital spending by telecom carriers. Industry participants are also suffering from a rise in commodity prices, persistent inflation and heightened global macroeconomic uncertainties. Nevertheless, players like RF Industries RFIL and Akoustis Technologies AKTS are benefiting from continued higher spending on the deployment of 5G networking and the rapid proliferation of the Internet of Things (IoT), Advanced Driver Assistance Systems (ADAS) and Augmented Reality/Virtual Reality devices. The growing need for faster connections, low latency and efficient battery life in wirelessly connected devices has been driving the demand for WiFi-enabled hotspots. The democratization of 5G smartphones has been a tailwind for the industry participants. These factors have bolstered the demand for radio-frequency semiconductor solutions provided by industry players.

Industry Description

The Zacks Semiconductors - Radio Frequency Industry comprises companies that provide radio frequency solutions, front-end modules, low-noise amplifiers, diodes, multi-chip modules, optical components, surface acoustic wave, bulk acoustic wave technology-based antenna-plexers and film bulk acoustic resonator filters to enable smartphone devices to function more efficiently in congested RF spectrum. They serve a wide array of industries with their solutions, finding ample applications in 5G and smartphone equipment, aerospace and defense, optical networks, cellular base stations, automotive, and smart home applications. Most of these companies utilize robust wafer fabrication technologies, as well as ZigBee, Bluetooth Low Energy, Thread, silicon germanium, and Gallium Nitride technologies, to stay ahead of the competition.

4 Trends Influencing the Prospects of the Semiconductors - RF Industry

Accelerated 5G Deployment is a Tailwind: The rapid implementation of 5G networking infrastructure and the robust adoption of cloud computing applications look promising for the wireless communication market. The coronavirus crisis-induced work-from-home wave has necessitated the need for higher bandwidth and triggered LTE advancements, which are expected to bolster the demand for RF power amplifiers. Increasing RF content in the latest 5G smartphones is a key catalyst. Further, the growing demand for WiFi hotspots, as the number of wirelessly connected devices increases in households, is enhancing industry prospects. Cisco forecasts that the number of hotspots worldwide will reach 600 million in 2023.

Innovation Opening up Business Avenues: The rapid proliferation of IoT, wearables, drones, VR/AR devices, autonomous cars, and ADAS is expected to drive the demand for RF semiconductor products beyond smartphone devices, favoring industry prospects. Notably, RF Semiconductors are setting the pace for technology modernization by consequently digitizing aspects like connectivity, healthcare, transport, and defense. The diversified utilization of RF Semiconductor products bodes well for the industry players. Moreover, the evolution of semiconductor manufacturing processes from 10 nanometers (nm) to 7 nm, and even 5 nm and 3 nm technology, is anticipated to bolster the industry prospects. Further, the rollout of bands and band combinations has led to considerable design challenges for OEM smartphone manufacturers. Industry participants are looking to address these challenges with a robust range of antenna-plexer portfolios utilizing the BAW technology.

Growing Adoption of Electric Vehicles Aids Prospect: Industry players are gaining from the increasing inclusion of their products in electric vehicles (EVs). The market for EVs is expected to expand fourfold by 2027.

Supply-Chain and Higher Commodity Costs to Hinder Prospects: The industry players are reeling under the impact of supply-chain constraints, as well as the ongoing Russia-Ukraine war. The volatility in prices of certain commodities like copper does not bode well for industry participants.

Zacks Industry Rank Indicates Dim Near-Term Prospects

The Zacks Semiconductors - Radio Frequency Industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #227, which places it in the bottom 9% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bearish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. The industry’s earnings estimates for 2024 have moved down 15% since Jan 31, 2024.

Before we present the top industry picks, it is worth looking at the industry’s shareholder returns and current valuation first.

Industry Lags S&P 500 & Sector

The Zacks Semiconductors - Radio Frequency Industry has underperformed the S&P 500 and its sector over the past year. The industry has declined 0.1% over this period against the S&P 500’s growth of 27.1% and the broader sector’s return of 42.1%.

One-Year Price Performance

Industry's Current Valuation

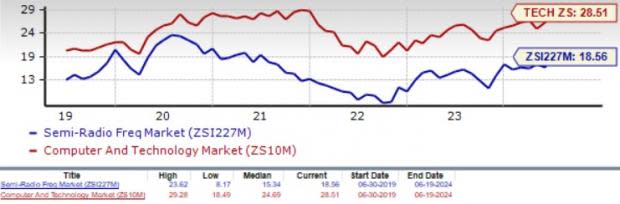

On the basis of the forward 12-month price-to-earnings ratio (P/E), which is a commonly used multiple for valuing the Semiconductors - Radio Frequency stocks, the industry is currently trading at 18.56X, lower than the S&P 500’s 21.58X and the sector’s 28.51X.

Over the past five years, the industry has traded as high as 23.62X and as low as 8.17X, with the median being 15.34X, as the charts below show.

Forward 12-Month P/E Ratio

2 Radio Frequency Stocks to Keep a Close Eye on

RF Industries: This Zacks Rank #2 (Buy) company is benefiting from a strong product portfolio, which is driving up order growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

RF Industries' prospects are improving due to the anticipated resurgence of spending by telecom companies on infrastructure upliftment. Recovery in wireless capital expenditure bodes well for RFIL.

RF industries’ shares have gained 9.2% in the year-to-date period. The Zacks Consensus Estimate for RFIL’s fiscal 2024 earnings has increased to 10 cents per share from a loss of 2 cents over the past 30 days.

Price and Consensus: RFIL

Akoustis Technologies: Shares of this Zacks Rank #3 (Hold) company have plunged 85.2% year to date.

Akoustis has suffered from sluggish demand trends. The closure of a WiFi 6E program by a major carrier customer is hampering its growth prospects in the near term. However, increasing demand for WiFi 7 technology bodes well for the company.

Its expanding portfolio is noteworthy. In the fourth quarter of fiscal 2024, AKTS expects to release at least seven new XBAW filters into production targeting Wi-Fi 7 tri-band and quad-band architectures.

The Zacks Consensus Estimate for AKTS' fiscal 2024 loss has widened by a couple of cents to 70 cents per share over the past 30 days.

Price and Consensus: AKTS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RF Industries, Ltd. (RFIL) : Free Stock Analysis Report

Akoustis Technologies, Inc. (AKTS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance