Straits Times Index

3,426.47 -3.98 (-0.12%) Nikkei

37,667.41 -202.10 (-0.53%) Hang Seng

17,021.31 +16.34 (+0.10%) FTSE 100

8,285.71 +99.36 (+1.21%) Bitcoin USD

67,821.61 +762.86 (+1.14%) CMC Crypto 200

1,371.53 +40.92 (+3.08%)

Thai Beverage Public Company Limited (Y92.SI)

| Previous close | 0.5000 |

| Open | 0.5000 |

| Bid | 0.5000 x 0 |

| Ask | 0.5050 x 0 |

| Day's range | 0.5000 - 0.5100 |

| 52-week range | 0.4250 - 0.6150 |

| Volume | |

| Avg. volume | 29,617,391 |

| Market cap | 12.564B |

| Beta (5Y monthly) | 0.79 |

| PE ratio (TTM) | 12.50 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.02 (4.48%) |

| Ex-dividend date | 27 May 2024 |

| 1y target est | N/A |

- Reuters SG

UPDATE 2-ThaiBev to exit real estate business by offloading Frasers Property stake

Thai Beverage (ThaiBev) will exit the real estate business by transferring its entire stake in Singapore-based Frasers Property to TCC Assets under a share swap agreement, an exchange filing showed on Thursday. "Streamlining the company's focus towards a pure-play beverage and food business by exiting the property business and increasing its exposure to non-alcoholic beverages and dairy could result in a potential re-rating in line with pure-play beverage and food peers," ThaiBev said in a statement. The drink maker, controlled by Thai billionaire Charoen Sirivadhanabhakdi, said its unit InterBev Investment would transfer its 28.78% stake in Frasers Property to Thailand-based TCC Assets, which in return would transfer a 41.30% shareholding in conglomerate Fraser and Neave to InterBev.

- GuruFocus.com

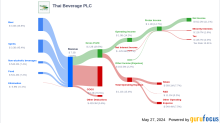

Thai Beverage PLC's Dividend Analysis

Thai Beverage PLC (TBVPF) recently announced a dividend of $0.15 per share, payable on 2024-06-12, with the ex-dividend date set for 2024-05-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Thai Beverage PLC's dividend performance and assess its sustainability.

- Reuters SG

UPDATE 1-ThaiBev profit slips on lower contributions from associated firms, food business

Thai Beverage, chaired by billionaire Charoen Sirivadhanabhakdi, posted a drop in first-half profit on Monday, hurt by the food division and lower contributions from associated companies. The Singapore-listed drinks maker has been looking to aggressively expand its food business in the recent past, and established two units to improve investment in the food sector. It also opened new food stores during the six months, helping push sales revenue from the segment but also increased its pre-operating expenses.