Singapore markets closed

Straits Times Index

3,280.10 -7.65 (-0.23%) Nikkei

37,934.76 +306.28 (+0.81%) Hang Seng

17,651.15 +366.61 (+2.12%) FTSE 100

8,139.83 +60.97 (+0.75%) Bitcoin USD

63,088.58 -1,417.57 (-2.20%) CMC Crypto 200

1,304.48 -92.06 (-6.59%)

Tootsie Roll Industries, Inc. (TR)

NYSE - NYSE Delayed price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous close | 30.19 |

| Open | 30.20 |

| Bid | 29.85 x 1100 |

| Ask | 29.93 x 1200 |

| Day's range | 29.80 - 30.32 |

| 52-week range | 28.22 - 39.87 |

| Volume | |

| Avg. volume | 76,497 |

| Market cap | 2.13B |

| Beta (5Y monthly) | 0.14 |

| PE ratio (TTM) | 22.59 |

| EPS (TTM) | 1.32 |

| Earnings date | 24 Jul 2024 - 29 Jul 2024 |

| Forward dividend & yield | 0.36 (1.19%) |

| Ex-dividend date | 05 Mar 2024 |

| 1y target est | N/A |

GuruFocus.com

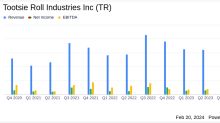

GuruFocus.comTootsie Roll Industries Inc Reports Sweetened Earnings and Sales Growth in 2023

TR's Net Sales and Earnings Per Share Show Notable Increases Year-Over-Year

Simply Wall St.

Simply Wall St.Returns At Tootsie Roll Industries (NYSE:TR) Are On The Way Up

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. In a perfect...

Insider Monkey

Insider MonkeyHere’s What Happened to Tootsie Roll Industries (TR), Bireme Capital’s Short Position

Investment management company Bireme Capital recently released its fourth-quarter 2023 investor letter. A copy of the same can be downloaded here. In 2023, the fund returned 21.3% net of fees underperforming the S&P 500’s 26.2%. The fund was up 448% net since inception in 2016 vs the S&P at 161%, an annual outperformance of 11.7%. Last […]