Zions' (ZION) Ratings Reiterated by Moody's, Outlook Stable

Zions Bancorporation’s ZION ratings and outlook have been affirmed by Moody's Ratings, a division of Moody’s Corporation MCO. The reiteration reflects the bank’s solid performance and underlying challenges. This affirmation includes the company’s standalone Baseline Credit Assessment (BCA), Adjusted BCA of baa1 and a long-term issuer rating of Baa2. The ratings affirm the bank's stability despite some ongoing issues.

Further, the outlook for Zions' long-term issuer rating and long-term deposit rating remains stable.

Key Factors Behind the Affirmation

Strong Deposit Franchise and Asset Quality:

Moody’s acknowledges Zions' robust deposit base, sound asset quality and favorable liquidity profile. These strengths are essential in maintaining its credit ratings.

Per the rating agency, Zions has shown improvement in its capitalization, with its tangible common equity (TCE) to risk-weighted assets (RWA) ratio increasing to 10.0% as of Mar 31, 2024, from 8.9% at the end of 2022. However, the company’s commercial real estate (CRE) concentration remains a concern, which Moody's views as a potential risk due to its inherent volatility.

Liquidity and Funding Improvements:

Moody’s noted that Zions has made significant strides in improving its liquidity and funding position. Market funds as a percentage of tangible assets declined to 6.4% by Mar 31, 2024, from 14.6% a year earlier.

Also, the proportion of brokered deposits increased to 7.9% from 1% over the same period, indicating a shift in the company's funding strategy. Despite this, Zions' reliance on short-term Federal Home Loan Bank borrowings and brokered deposits is a credit negative compared with peers.

Profitability Pressures:

Zions' net income to tangible assets declined to 0.71% in the first quarter of 2024 from 0.93% a year ago. The company's profitability has been under pressure due to rising deposit costs outpacing yields on interest-earning assets. Further, the net interest margin decreased to 2.85% from 3.25% over the same period, reflecting increased funding costs.

CRE Concentration and Asset Performance:

A significant factor in Moody's ratings was Zions' concentration in CRE, which poses a risk due to its volatility. Per Moody’s, Zions' CRE concentration accounted for 2.3 times its TCE as of Mar 31, 2024, one of the higher levels among rated U.S. banks.

Yet, the rating agency noted that asset performance remains strong, with non-performing assets at 0.44% of total loans and leases and annualized net charge-offs at 4 basis points.

Rationale Behind Stable Outlook

Moody’s stable outlook for Zions indicates an expectation that unrealized losses will gradually recover, and the company will continue to build its TCE/RWA ratio in the 10-11% range. Earnings normalization, supportive funding and liquidity, alongside better-than-peer asset quality, are likely to maintain the current rating.

Our Take

While Zions exhibits strong asset quality and an improving liquidity profile, challenges remain in the form of CRE concentration and profitability pressures. Moody's ratings affirmation reflects a balanced view of these strengths and weaknesses, with a stable outlook suggesting gradual improvement and cautious optimism for the bank's future.

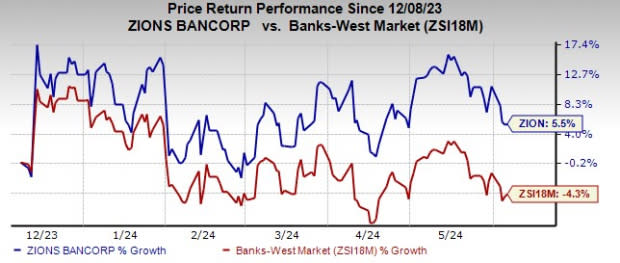

Shares of this Zacks Rank #3 (Hold) company have rallied 5.5% in the past six months against the industry’s decline of 4.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Similar Action Taken by Moody’s on Another Bank

Associated Banc-Corp’s ASB outlook has been reaffirmed as stable by Moody's. The rating agency has also reiterated the company’s Baa3 standalone baseline credit assessment. Further, the company’s issuer rating of Baa3 for long-term senior unsecured notes remained unchanged.

Per Moody’s, ASB’s ratings affirmation reflected the balance between its credit headwinds due to its significantly concentrated portfolio in CRE loans and the offsetting qualitative and quantitative risk mitigating factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance