Winnebago (WGO) Hits 52-Week Low: Thinking of Buying the Dip?

Shares of recreational vehicle (RV) giant Winnebago Industries WGO have been in the red territory for a while now, having declined around 19% over the past year.

Image Source: Zacks Investment Research

In fact, the share price hit a 52-week low of $51.71 yesterday to close the session a tad bit higher at $51.89. Now much of the decline is attributed to the broader economic and industry factors.

Recreational vehicles had emerged as a rare travel winner in 2020 and 2021. But the party for this pandemic-winning industry finished in 2022 amid economic uncertainties. Per the RV Industry Association, RV sales have almost halved from their 2021 peak. Motorhomes and towable trailers witnessed their worst year in more than a decade in 2023. Given the macroeconomic softness, elevated interest rates and persistent inflation, industry participants like Winnebago, Thor Industries THO and Camping World CWH have been suffering on the bourses as their fortunes are significantly tied to the economy.

With WGO down 29% year to date and now at a 52-week low, investors might get tempted to buy the stock. But are things looking up from here? And is this the right time to buy Winnebago? Let’s delve deeper.

Winnebago Grappling With Near-Term Woes

Well, WGO’s strategic acquisitions like Grand Design, Newmar, and Barletta have expanded its portfolio and market reach.Product introductions, including the Lineage Series M, are anticipated to drive future growth.However, these positives are overshadowed by several near-term challenges.

WGO missed fiscal third-quarter 2024 earnings and revenue estimates (ended May 25) due to lower unit sales amid soft consumer sentiment. The near-term outlook is clouded by persistent weaknesses in its motorhome RV and marine segments. Delayed interest rate reductions and other challenging macroeconomic factors are impacting dealers' willingness to order. Winnebago does not foresee any notable improvement in segments through the end of this year. It expects fourth-quarter fiscal 2024 revenues to be flat to slightly down sequentially.

Excess inventory levels in the motorhome RV and marine categories are resulting in elevated discounts, thereby weighing on gross margins. In the last reported quarter, gross margins fell to 15%, a decrease of 180 basis points year over year, with expectations of continued pressure on margins and profitability.

The diminishing order backlog, a key indicator of future sales, raises additional concerns. A significant reduction in the backlog for both motorized and towable RV segments in the latest reported quarter reflects the current weak industry demand, leading to further destocking. WGO's market share has also declined, indicating intensified competition within the RV industry. Rising operating expenses, particularly in SG&A, exacerbate the situation, as these costs have increased relative to revenues, further squeezing operating profits.

Given these challenges, the potential for near-term recovery appears limited.

Having said that, there is no denying that WGO maintains a strong balance sheet with high liquidity and manageable leverage. And despite weak results, the company continues to return value to shareholders through dividends and share buybacks, supported by sufficient free cash flow. However, these measures may not be sufficient to justify buying the stock on dips, as the existing challenges could lead to further downside.

Still Not the Right Entry Point for WGO

From a valuation standpoint, while Winnebago might appear attractive relative to the industry, it is still trading above its 5-year low. Going by the price/earnings ratio, the company shares currently trade at 8.18 forward earnings, higher than its 5-year low of 4.16. We don’t think that this premium is justified given the company’s diminishing backlog, contracting margins, declining sales and profits, shrinking market share and a subdued outlook.

Image Source: Zacks Investment Research

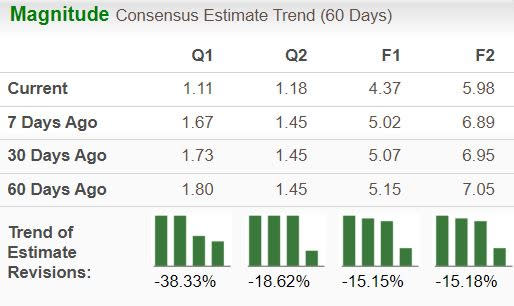

The Zacks Consensus Estimate for WGO’s fiscal 2024 sales and earnings implies a year-over-year decline of 13% and 43%, respectively. Given the company’s current headwinds, analysts also seem to be losing confidence in the stock. This is evident from the downward earnings estimate revisions.

Image Source: Zacks Investment Research

While the company has strategic strengths and a solid financial foundation for long-term growth, the prevailing market and operational conditions, along with downward trending estimates, make us think that this is not the opportune time to buy the stock even at a 52-week low. In fact, the stock could witness more correction in the near term. So, consider selling WGO stock if you own it to avoid bigger losses.

The stock currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

Camping World (CWH) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance