Why Tenaris Is Significantly Undervalued

Tenaris SA (NYSE:TS) is a leading manufacturer of a full range of steel pipes and related services for the world's energy industry and certain other industrial applications. All of its manufacturing facilities use electric arc furnaces, where the feedstock is predominantly steel scrap and is less energy-intensive than the basic oxygen furnace method. Electric arc furnaces are also less greenhouse gas-intensive and typically more productive with less overhead costs. Only 4% of steel pipe costs for Tenaris are due to direct energy (86% of which is supplied from local electricity grids), whilst 23% are derived from steel scrap costs.

The company is headquartered in Luxembourg with global manufacturing facilities in Argentina, Brazil, Canada, China, Colombia, Italy, Japan, Mexico, Romania and the U.S. It operates in four different segments: Drilling, completion and production of oil and gas (Oil Country Tubular Goods, or OCTG), transportation of oil and gas (line-pipe), processing and power generation and industrial and automotive applications.

In 2023, 84% of its revenue came from the OCTG segment, with the remaining 16% evenly split among the others. The principal countries from which Tenaris derives its revenues are the U.S. (39%) and Argentina (15%). The South American operations have seen the most growth over the last four years, with revenue having grown by over 300% and the majority of capital expenditures being directed to the region.

The steel pipe and tube industry can be categorized as having high barriers to entry, low concentration and high revenue volatility (a function of oil and gas demand). In the U.S., Tenaris has the largest market share of the metal pipe and tubing industry (8.20%), with the four largest companies having a combined 20% market share. The industry encompasses dozens of products, so concentration occurs within more niche markets. High capital expenditure requirements, legal barriers, start-up costs and labor costs all combine to erect high barriers to entry that protect the incumbents' margins.

Substitutes come mainly in the form of international imports, accounting for 40% of demand in the U.S., though the country has been stringent in monitoring anti-dumping and protecting domestic manufacturers, as has the Middle East, with Saudi Aramco beginning to increase content from local suppliers. Power of buyers within the industry is high as price competition is fierce among multiple steel pipe suppliers. Power of suppliers is moderate, with 23% of Tenaris' steel pipe costs derived from steel scrap bought from suppliers. This represents a vulnerability to steel scrap prices, though offset by Tenaris' integrated energy supply (two wind farms, one still in construction, in Argentina that supply 50% of the energy for the Campana facilities).

Tenaris' steel pipe and tube manufacturing is most heavily influenced by oil and gas prices, steel prices and environmental regulatory standards. The oil and gas segment is a mature market with growth in excess of gross domestic product unlikely in the medium to long term. Geothermal energy and carbon capture and storage are likely to be the highest-growth segments in the long term, currently only accounting for around 2% of the processing and power generation revenue, but with a very favorable long-term outlook.

Critical factors that drive earnings and free cash flow

Tubes account for 95% of total revenue for Tenaris, with OCTG tubes accounting for 88% of the tubes segment. Revenues are, therefore, driven most by OCTG demand and prices. The economics of the oil and gas drilling industry are critical factors that drive earnings and free cash flow. There is a strong positive correlation between demand for oil and rig count and Tenaris' earnings, as is the case for all steel pipe and tube manufacturers.

Cost of sales account for 58% of revenue, whilst selling, general and administrative expenses account for 13%. Around 61% of the cost of sales is raw materials, energy, consumables and other. Therefore, another major driver of earnings and free cash flow is the direct cost of producing orbuying steel, where purchases of steel scrap are the most explanatory variable for fluctuations in margins from the cost side.

Financial analysis and valuation

As per guidance from Tenaris' fourth-quarter results presentation, sales for OCTG in the first half of 2024 are expected to be flat from the second half of 2023, with growth coming in the second half of 2024. Therefore, I have assumed that in the base case, OTCG growth will be -12%, in line with the prior-year period and flat for the rest of the year. I expect growth in OTCG to increase to 4% (long-term GDP growth) by 2028 and to fall toward 2% by 2038, with a terminal growth rate of 1%, given the long-term outlook for oil and gas drilling is negative due to the shift toward renewable energy sources.

For the other segments, I have taken 2024 growth rates to be slightly negative, given the best case according to Tenaris is flat sales for processing and power generation and industrials. For processing and power generation, given the company's geothermal and carbon capture and storage operations are reported under that segment, I have assumed these two operations to grow at a compound annual rate of 20% for the next 10 years and falling to a terminal rate of 10% given these are the most positive growth areas within the energy industry in the long term as Tenaris has the necessary technologies currently deployed for OCTG drilling that can be switched to these renewable sources if and when called for. I expect the remainder of the segment growing in line with GDP in the base case (4%). Similarly, I expect industrials growth to be in line with GDP growth over the long term, with no meaningful projects lined up for the foreseeable future.

I have taken cost of goods sold and SG&A expenses as a constant percentage of revenue for the modelling period, equal to the 2023 percentages. I have assumed net income margins to remain at 24%, as expected by Tenaris in its base case.

For the weighted average cost of capital calculation, I have taken data from Tenaris regarding its cost of debt (8.90%) and calculated its cost of equity (9.30%) based on a beta of 1.03, a risk-free rate of 4.57% and an equity risk premium of 4.60% according to NYU Stern School of Business estimates.

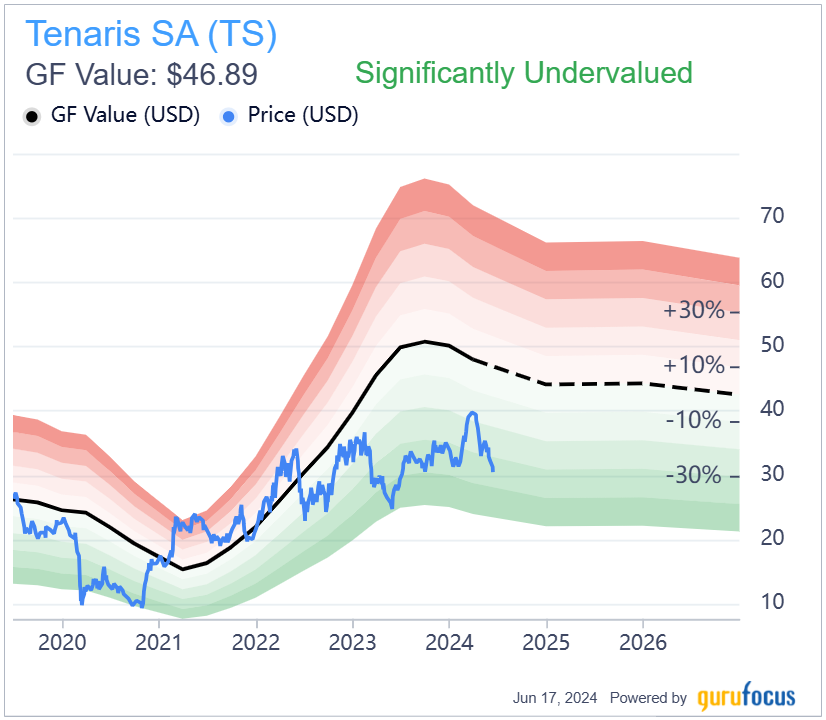

Given these estimates, the implied share price in the base case is $44, suggesting the stock is currently significantly undervalued, which is the same as the GF Value view. Tenaris' strong margins, coupled with short-term growth in oil and gas, will drive this increase in value, giving time for geothermal and carbon capture and storage to develop, which is expected to meaningfully impact revenue by 2030. My bear case suggests the stock is fairly valued, whilst my bull case suggests the stock is undervalued by 50%.

As of year-end 2023, Tenaris has a return on equity of about 26%, an increase of 600 basis points year over year, driven by a reduced tax burden and increased operating profit margins. The company's cash conversion cycle currently stands at 179 days, higher French competitor Vallourec (XPAR:VK), but this is down to the Tenaris RigDirect model that requires significant inventory to be kept at all times so as to serve its customers end to end. This model also enhances its cyclical flexibility in scaling up and down its operations as oil and gas demand fluctuates.

Risks

The greatest risks to Tenaris are the economics of oil and gas, industry regulation and steel scrap prices. Although oil and gas demand is expected to grow for the short to medium term, the rate of growth is slowing as renewable energies become commercially viable. Drilling activity is also expected to increase over the same period off the back of OPEC+ commitments. Regulations also pose a risk; most notably, the European Union emissions trading system, which limits the amount of greenhouse gases that can be emitted, the carbon border adjustment mechanism that subjects steel imports from outside the EU to a carbon levy and, in the U.S., the Clean Air Act, which seeks to reduce air pollutants of all forms. Antidumping regulation is especially stringent in the U.S., with the company having to pay antidumping duty deposits following an investigation into imports of Tenaris and others into the U.S. from Mexico, Argentina and Russia.

Steel scrap prices, which heavily influence Tenaris' margins, also pose a risk. Global steel scrap demand is expected to exceed supply by 2030, with a 15 million tonne deficit, threatening the company's margins in the process.

The U.S. presidential election will also have significant implications for the oil and gas market. Although it is too early to call, we can expect a Republican victory to heavily support oil and gas markets, whilst a Democrat victory will call for a clean energy revolution under the green infrastructure plan set out by the Biden administration. Whatever the result, Tenaris' operations are prepared to shift to geothermal and carbon capture and storage if necessary.

In addition, Argentina's political and economic state poses a risk for Tenaris' South American operations, given that its capital expenditures have predominantly been directed to that region. In December, a new administration led by Javier Milei announced macroeconomic reforms that were set to considerably boost Tenaris' operations. However, they were challenged in court and are struggling to get congressional approval. These political tensions are likely to prevent impactful and much needed reform to take place.

Further, currency and inflation risk pose a threat to Tenaris' margins in Argentina. Although the recent devaluation of the Argentine peso was a positive for the company given they had a net short exposure, and if the current travelling peg remains at around 2% per month, then there should be no negative effects. However, 51% of Tenaris' employees are in South America. So with average inflation in the region of 13%, labor costs pose a significant risk going forward. The company also has significant credit risk in Mexico, with state oil company Pemex delaying payments that account for 20% of Tenaris' total credit exposure.

Investment horizon

Consensus expectations for oil and gas demand is growth over the next five years, according to OPEC and the International Energy Agency, although at a slowing rate. World oil demand in the first quarter was 1.60 million barrels per day, with growth slowing to 1.20 million barrels per day in 2025 and 1.10 million barrels in 2026. Non-OPEC+ is set to drive oil production growth through 2025, led by the U.S., which bodes nicely for Tenaris' OCTG growth, although partly offset by the continued supply cuts by OPEC+.

Profit margins are expected to stay flat in the short term at around a 25% net profit margin. However, as we approach 2030, these margins may compress as steel scrap prices begin to rise given the forecast supply deficit of 15 million tonnes. Free cash flow is expected to fall until 2028, given the current reversion to the mean we are seeing in the Baker Hughes rig count. However, beyond 2028 free cash flow is expected to grow once OCTG tubes revenue begins to grow. By 2025 we can expect the cost of capital to start falling, as I think U.S. interest rates will probably come down on some Federal Reserve loosening.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance