Why iRobot Stock Spiked 16% in January

What happened

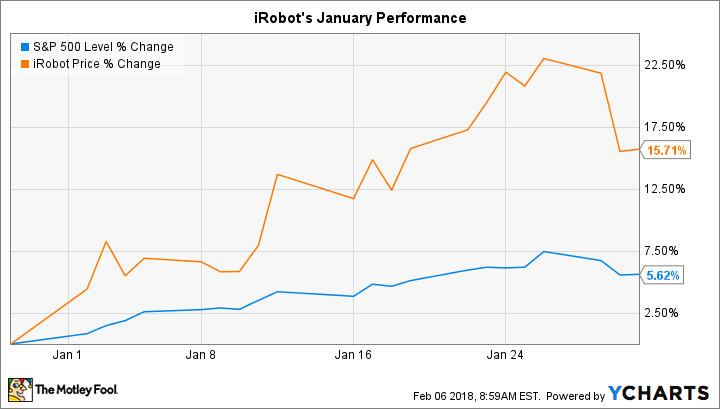

Robotic vacuum specialist iRobot (NASDAQ: IRBT) beat the market last month, rising 16% compared to a 6% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

The spike added to the stomach-churning volatility that shareholders have been experiencing lately. iRobot's stock has been up as much as 70% -- and down by as much as 10% -- in just the past 52 weeks.

So what

January's rally reflected rising optimism that iRobot had a solid holiday sales quarter. After all, Amazon.com announced in late December that robotic vacuums were among its best-selling items during the holiday rush, and that bodes well for the industry leader. (iRobot owns roughly 64% of the market for premium vacuum devices.)

Image source: Getty Images.

Now what

At its latest quarterly check in in late October, iRobot raised its outlook after sales spiked 22% in the third quarter. CEO Colin Angle and his executive team believe revenue will now stop at $875 million at the midpoint of guidance.

Investors will find out on Feb. 7 whether the company hit that aggressive target or instead had to settle for something lower as competition ate away at its dominant market share in the robotic vacuum industry.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and iRobot. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance