Why Cytokinetics (CYTK) Stock Price Was Down 17% on Thursday

Shares of Cytokinetics CYTK lost more than 17% on May 23 after it announced a funding deal with Royalty Pharma RPRX, which investors found complicated. It also announced the pricing of its recently floated public offering of common stock, which was at a 16% discount to the closing price on May 22.

The funding deal expands the company’s existing strategic collaboration with Royalty Pharma, allowing the company to receive up to $575 million in total.

The deal with Royalty Pharma has many parts, providing Cytokinetics with funds to support the commercial launch of heart drug aficamten and advance the development of two other heart drugs in its pipeline.

Cytokinetics will receive $50 million in upfront capital from Royalty Pharma and could draw an additional $175 million within 12 months of approval of aficamten in obstructive hypertrophic cardiomyopathy (oHCM). This capital will be repayable over 10 years in quarterly installments.

The deal also revises a previous royalty deal between RPRX and CYTK around aficamten. Royalty will now receive 4.5% up to $5 billion of annual net sales of the drug and 1% above $5 billion of annual net sales. Previously, the deal was set at 4.5% up to $1 billion of annual net sales and 3.5% thereafter.

The company will also receive $100 million in upfront capital to fund a new late-stage study on another heart drug, omecamtiv mecarbil, in patients with heart failure and reduced ejection fraction. If this study is positive and the drug secures FDA approval within a specified timeframe, Royalty Pharma will receive fixed payments totaling $100 million plus an incremental 2% royalty on annual net sales and/or fixed quarterly payments. If not, then Cytokinetics will repay Royalty Pharma up to $237.5 million over 18 or 22 quarters.

Cytokinetics will also receive $50 million in upfront capital to fund a proof-of-concept phase II study evaluating another heart drug, CK-586, in patients with heart failure and preserved ejection fraction. Royalty will have the option to invest up to $150 million more to fund a late-stage development of the drug in exchange for a $150 million milestone payment on FDA approval plus a 4.5% royalty on annual net sales. In case Royalty does not exercise this option, it will still be eligible for a 1% royalty on annual net sales of the drug.

Royalty Pharma will also make an investment of $50 million in Cytokinetics’ common stock. Overall, Cytokinetics will receive $250 million on the closing of the transaction.

Though the new funding will help boost the company’s existing cash balance, which stood at around $634 million at the end of March, the complex structure of the deal did not sit well with the investors. Some investors even pointed out that the terms of the deal largely favor Royalty Pharma, given that it is eligible to receive major payments even if the Cytokinetics’ drugs fail clinical studies.

Per Wall Street, the deal lowers the chances of a potential buyout of Cytokinetics since it will now become liable to make several payments to Royalty Pharma over the long term. Earlier this year, some reports suggested that pharma giant Novartis NVS was closing in on buying the company. However, no such deals materialized as Novartis reportedly dropped out of the race.

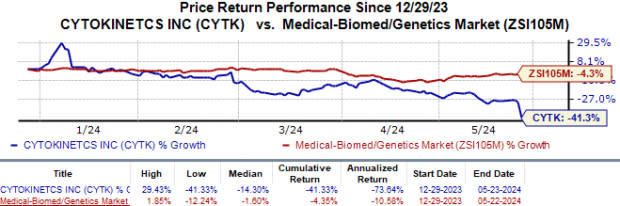

Year to date, the stock has lost 41.3% compared with the industry’s 4.4% fall.

Image Source: Zacks Investment Research

In a separate press release, management also announced it is floating a secondary issue of around 9.8 million shares of its common stock to the public at an issue price of $51 per share, amounting to $500 million. The offering is expected to close on May 28.

CYTK also granted an option to underwriters of the issue to purchase an additional 1.47 million of shares of common stock at the public offering price less underwriting discounts and commissions.

If the underwriters fully exercise their rights, the company will raise a total of $575 million from the public offering. Management intends to use these proceeds to support the commercial launch readiness activities for aficamten and also advance the development of its pipeline.

However, investors were also not happy with this offering. While the terms of the offering were not complex when compared to the Royalty Pharma deal, the $51 issue price per share was at a discount to the closing price on May 22, with the stock closing at $59.23.

With no marketed products in its portfolio, Cytokinetics is entirely dependent on its pipeline for growth. While both deals provide the company with the necessary funds to support its business operations, the funding deal with RPRX dampens buyout prospects.

Earlier this month, management announced plans to submit a regulatory filing for aficamten in oHCM indication with the FDA in third-quarter 2024. It also intends to submit a similar filing with the EMA in fourth-quarter 2024.

If aficamten is approved by the FDA for oHCM indication, it will compete with Bristol Myers BMY, which markets Camzyos, the first and only FDA-approved drug for treating oHCM. The Bristol Myers drug is also approved for a similar indication in Europe.

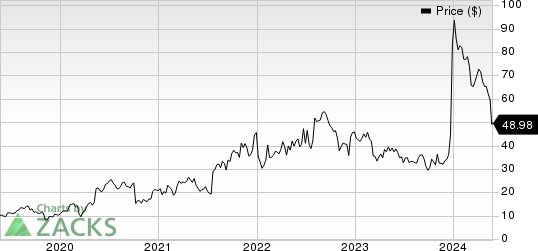

Cytokinetics, Incorporated Price

Cytokinetics, Incorporated price | Cytokinetics, Incorporated Quote

Zacks Rank

Cytokinetics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Royalty Pharma PLC (RPRX) : Free Stock Analysis Report

Cytokinetics, Incorporated (CYTK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance