Here’s Why Bonhoeffer Capital Management Added Arrow Electronics (ARW) to its Portfolio

Bonhoeffer Capital Management, an asset management company, released its first-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the first quarter of 2024, the fund returned 5.9% net of fees compared to 5.7% returns for MSCI World ex-US, a broad-based index, and 5.3% return for the DFA International Small Cap Value Fund. The fund’s stocks have an average EV/EBITDA of 4.4 and a weighted average earnings/free cash flow yield of 12.3% as of March 31, 2024. During the first quarter, the firm continued to replace slower-growing enterprises with durable, faster-growing firms. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Bonhoeffer Capital Management highlighted stocks like Arrow Electronics, Inc. (NYSE:ARW) in the first quarter 2024 investor letter. Arrow Electronics, Inc. (NYSE:ARW) offers products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions. Arrow Electronics, Inc.'s (NYSE:ARW) one-month return was 1.80%, and its shares lost 3.04% of their value over the last 52 weeks. On June 4, 2024, Arrow Electronics, Inc. (NYSE:ARW) stock closed at $129.78 per share with a market capitalization of $6.908 billion.

Bonhoeffer Capital Management stated the following regarding Arrow Electronics, Inc. (NYSE:ARW) in its first quarter 2024 investor letter:

"Arrow Electronics, Inc. (NYSE:ARW) is the world’s largest authorized electronics components distributor (15% market share including larger shares in key markets) serving both electronics OEM customers and component suppliers. Most large component manufacturers buy directly from component suppliers. ARW has over 220,000 customers with a 90% customer retention rate and over 3,700 suppliers. ARW also distributes IT products such as servers, software, storage and computer security products. ARW has over 22,000 employees at over 219 sites located in 85 countries, including 39 distribution centers and 180 offices. Over 67% of its revenue is associated with products that include value-added services such as component design services and supply chain management services. The large portion of components associated with value-added services allows ARW to generate industry leading operating margins of 5.3%.

Arrow Radio, the predecessor to ARW, was founded in 1935 on Radio Row in New York City. In 1946, ARW was incorporated. In 1961, ARW had $4 million in sales and went public via an IPO. In 1968, Mr. Glen, Green and Wadell bought a controlling interest in ARW and executed a leveraged roll-up strategy. By 1970, ARW was generating $9 million in sales and was the 12th ranked electronics distributor. At that time, Avnet was the largest. By 1979, ARW had $177 million in sales and was the second largest distributor listed on the NYSE. In 1980, Mr. Green and Glen were killed in a fire and Mr. Wadell stepped in as CEO until 1982 when Mr. Kaufmann became CEO. In the 1980’s and 1990’s, under Kaufman’s leadership, ARW participated in more than 50 mergers and acquisitions transactions, expanded its range of products distributed and spread geographically around the world. In 1988, Arrow joint ventured (JVed) with Maruban to distribute components in Japan. In 1994, ARW entered the IT products distribution market with the purchase of Gates/FA. In the 2000s, under the leadership of Mr. Duval and Mitchell, ARW continued to purchase 17 distribution firms worldwide. In the 2010s, under the leadership of Mr. Long, ARW purchased an additional 40 distribution firms. In 2022, Mr. Keirnes became CEO, and is currently serving this role. ARW has been recognized over the past 11 years as one of Fortune’s “Most Admired Companies”…” (Click here to read the full text)

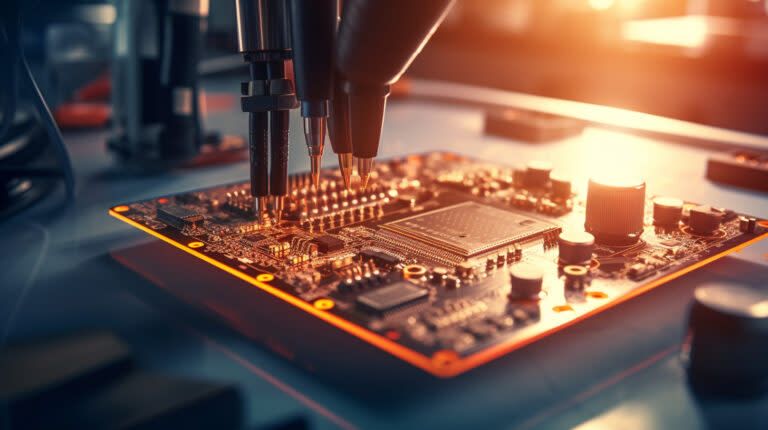

A close-up view of a technician soldering a circuit board in an electronics manufacturing facility.

Arrow Electronics, Inc. (NYSE:ARW) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 36 hedge fund portfolios held Arrow Electronics, Inc. (NYSE:ARW) at the end of the first quarter which was 41 in the previous quarter. While we acknowledge the potential of Arrow Electronics, Inc. (NYSE:ARW) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Arrow Electronics, Inc. (NYSE:ARW) and shared Bonhoeffer Capital Management's views on the company in the previous quarter. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.

Yahoo Finance

Yahoo Finance