Where will growth come from in the next decade? A geographic deep dive into the Future 50

Every year, Fortune publishes the Future 50, a ranking of the world’s largest public companies by their long-term growth prospects, co-developed with Boston Consulting Group (read more on the Future 50 and our methodology). In this series, we assess trends related to the future growth potential of businesses. Our previous articles outlined why technology will remain the economy’s growth engine and why companies need more age diversity in their leadership ranks.

Growth is key to long-term value creation, but identifying which sectors or regions—let alone companies—are positioned to grow is harder than ever. For example, the tech sector seemed to be on the ropes in 2022, with mass layoffs and corrections in valuations, only to come roaring back boosted by excitement around generative AI. China, hard-hit by the pandemic and a restrictive zero-COVID policy as well as a trade feud with the U.S., nonetheless ended 2023 with the second-highest GDP growth among OECD countries.

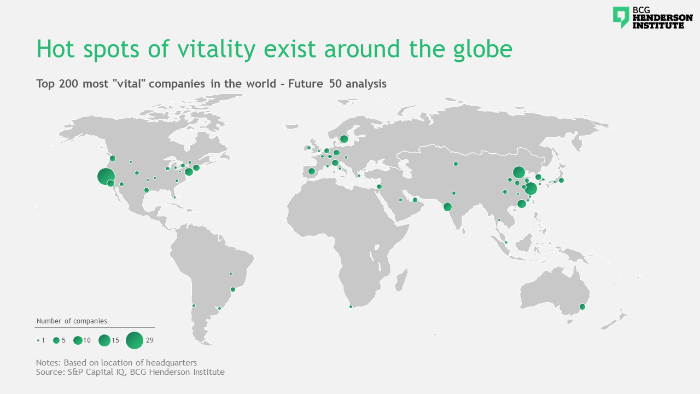

In 2024, geopolitical instability and wars, a shifting macroeconomic landscape, and elections in 40 countries around the globe will continue to cause turbulence. To help investors gauge where future growth will come from, Fortune and Boston Consulting Group have co-developed the Future 50, an annual ranking of public companies based on our proprietary, AI-driven measure of vitality. In this article, we dive deeply into the geographic distribution of growth potential by evaluating the 200 most vital firms around the globe.

Where the lion’s share of growth potential lies: the U.S. & China

The greatest concentration of future corporate growth potential is in the U.S., which 33% of the 200 most vital firms in the world call home. Buoyed by a dominant tech sector and an economy that has successfully threaded the needle in 2023—achieving reductions in inflation and low unemployment rates in parallel to GDP growth—the U.S. remains the world’s economic growth engine.

The Greater China region follows close behind, capturing 27% of the top 200 spots. Finally, Europe continues to lag well behind on vitality, with structural weaknesses—including a fragmented consumer market and limited availability of venture funding—being exacerbated by the war on the continent. Among the 200 most vital firms, 17% are from Europe, and only three firms made it into the Future 50 ranking for 2023.

Hot spots of vitality around the globe

Within the U.S. and China, there are geographic hot spots of vitality, with the majority of the top ranked companies being based on the two “gold coasts”—the west coast of the U.S., including Silicon Valley, and China’s east coast, including the Shanghai/Hangzhou and Hong Kong/Shenzhen regions.

Beyond these two dominant regions, there are smaller hot spots around the globe which host multiple high-vitality firms—showing that achieving growth is possible anywhere:

Within Europe, Italy and Spain achieve particularly strong representations, featuring six and five of the top 200 companies, respectively. In Italy, several fintech players are among the most vital, including payments company Nexi and online bank and broker FinecoBank. While the Italian fintech space has lagged behind the rest of Europe for a long time—attracting only 2% of all capital invested across the continent in 2019—the gap has started to narrow considerably, with funding shooting up and transaction value expected to grow markedlyas Italian consumers increasingly move to mobile solutions for their financing needs.

Israel is home to three of the 200 most vital firms, all of them in the tech sector, in which the country has established itself as a key player. However, with funding taking a nosedive in 2023—due to political instability and the ongoing war—challenging times are ahead for Israeli startups.

Brazil makes a strong showing with four companies featured in the top 200, including Future 50 member Rede D'Or São Luiz, the country’s largest private hospital group; and the São Paulo-based stock exchange B3, which is the largest in Latin America—set to benefit from growing interest of retail investors and increased flows of foreign funds.

Finally, South Korea is host to six of the most vital firms, including local tech giant Naver (which runs the country’s dominant search engine, as well as various communication, social media, and entertainment offerings) and several industrial players active in battery tech (such as Samsung SDI).

Different regions, different industry mixes

In terms of industry mix, the Future 50 is historically dominated by players from the IT and communication services sectors—which also comprised 36% of this year’s index. A geographic breakdown reveals, however, that this distribution is not uniform across regions. Rather, the tech concentration is, in large part, driven by North America: 61% of the U.S. and Canadian firms featured among the global top 200 are from the IT and communication services industries—driven by world-class education, a high availability of capital, and a thriving startup ecosystem.

Meanwhile, in the Asia-Pacific region, these two sectors achieve representation more in line with global averages, while industrials and consumer staples firms capture particularly high proportions of the top 200. Consumer staples players include the online pharmacies featured in the Future 50 (JD Health and Alibaba Health), as well as an assortment of alcoholic beverage companies, which have benefited from the rise in disposable income among Chinese consumers. Now these players are gearing up for growth by introducing premium options to compete with international luxury brands and low- or no-alcohol variants of their drinks to cater to increasing health consciousness. In the industrials space, battery-technology and solar-energy companies are dominant—boosted by China’s ambitious renewable energy targets, as well as its dominant position in the mining and processing of many crucial raw materials.

Finally, Europe is particularly light on IT and communication services players, which represent just 21% of the European firms ranked among the global top 200. In contrast, strong representation—relative to the global distribution—is achieved in the financial sector (including the aforementioned fintechs) and in utilities, where companies spearheading the European Union’s green energy transition score particularly highly on vitality: This includes Danish firm Ørsted, which managed a transformation from being one of the most coal-intensive energy companies in Europe to being a leader in sustainable energy in just 10 years, as well as Spanish player EDP Renováveis, which is among the world’s leaders in wind power.

Turning growth potential into reality

Our measure of vitality identifies growth potential. To turn it into reality, each region needs to navigate its own set of short- and long-term challenges.

For the U.S., this means locking in its economic advantages by achieving a “soft landing” in 2024, as pressure on households increases due to restarted student loan repayments and climbing mortgage rates. In the longer term, the U.S. needs to reconcile its social and political divisions, which are causing economic uncertainty. The 2024 elections will be the crucial next pulse check in this regard.

In China, the fulfilment of growth potential is greatly dependent on the government. Currently, sectors like green and clean tech dominate the vitality rankings, bolstered by renewable energy targets and significant subsidies. Meanwhile, the entertainment industry, which achieved strong representations in past rankings, has dropped out of the list following pressure from the Chinese Communist Party—including restrictions on internet usage by minors and proposed measures to curb spending and the use of rewards that encourage the playing of video games, which wiped nearly $80 billion off the market value of China’s two biggest gaming companies.

To not create undue uncertainty and turbulence, lawmakers will have to strike a delicate balance going forward. In the long term, China will have to contend with its looming demographic challenge: In 2022, the country experienced its first population decline in more than six decades; before 2100, it is projected by the United Nations to be the oldest country in the world. As the labor force declines, pressure on social as well as health systems increases, and demand patterns shift, governments and businesses will face the hard task of creating a flourishing aging society.

Of course, the fates of the U.S. and China are interlinked, with their cooled-off relations limiting the growth potential of both markets (and the world). This manifests itself in our vitality analysis, where most of the highly-scoring Chinese players are concentrating their efforts on the domestic market, rather than the global stage—e.g., e-commerce players like Meituan, software makers like Beijing Kingsoft, and EV manufacturers like BYD (which recently surpassed Tesla as the world’s biggest seller of EVs, but made over 90% of those sales in China). While President Biden and General Secretary Xi Jinping have signaled a desire to improve U.S.-China relations, tensions remain elevated due to the situation in Taiwan, the elections in the U.S., and continued tight U.S. export regulations on chips for AI development.

Europe, meanwhile, has to meet its structural disadvantages driven by fragmentation head on, by making further efforts to harmonize its markets—including the one for venture capital funding. Moreover, while the EU is rightfully lauded for its strong consumer protection and data privacy laws, its regulations are seen by some as growth constraining. With AI now emerging as the key technology driving future growth potential, EU lawmakers—already on the forefront of AI regulation—need to view this as an opportunity to catch up to the U.S. and China, by creating an environment conducive to, rather than stifling, innovation.

Finally, it is down to individual firms to deliver on their growth potential in the context created by governments and markets. In these times of turbulence, this may mean embracing new business and operating models. For one, with higher interest rates likely being here to stay—at least in the western world—firms will need to more efficiently innovate and develop options for future growth and competitive advantage. Moreover, as geopolitical tensions lead to decoupling and the creation of economic blocs, the need arises for defining a new global model for the firm—which involves rethinking how to leverage a “home advantage”, how to participate geopolitically distant markets, and how to set up resilient international supply chains.

Martin Reeves is a senior partner at BCG and chairman of the BCG Henderson Institute. Adam Job is director of the Strategy Lab at the BCG Henderson Institute.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance