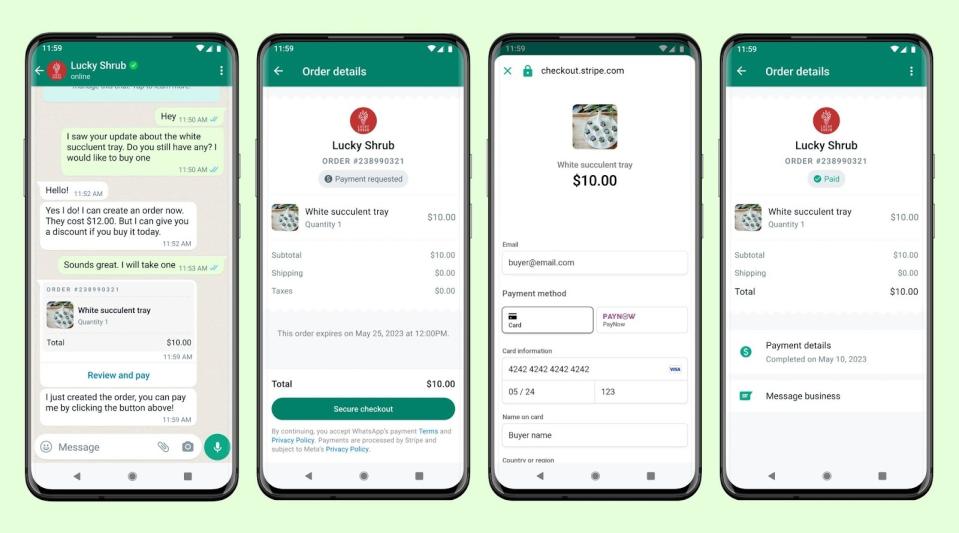

WhatsApp rolls out in-app payments for select Singapore businesses

This will enable Singapore residents with a WhatsApp number registered here to pay using credit cards, debit cards or PayNow.

WhatsApp has rolled out in-app payments to a select group of Singapore-based businesses, announced the Meta-owned messaging app on May 9.

The feature is supported by payments service provider Stripe, and will enable Singapore residents with a WhatsApp number registered here to pay using credit cards, debit cards or PayNow.

According to WhatsApp, the “seamless and secure experience” will let people and businesses buy and sell directly on WhatsApp without having to go to a website, open another app or pay in person.

The payment service is already available in Brazil and India. There is reportedly no limit on transactions, and WhatsApp does not charge any fees for the service.

The option to enable payments on WhatsApp in Singapore is available to local businesses using the WhatsApp Business Platform. According to Meta, interested local businesses can work with one of Meta’s business solution providers, such as launch partners Vonage, Gupshup, 360dialog and Wati.io, to get started.

WhatsApp says it will introduce the feature to “many more” businesses here in the coming months.

Stephane Kasriel, head of fintech at Meta, says: “Starting today, people in Singapore can pay their local merchants on WhatsApp in just a few taps. This seamless and secure experience will transform the way people and businesses in Singapore connect on WhatsApp.”

Sarita Singh, regional head and managing director for Southeast Asia at Stripe, says: “We’re excited to power this new feature for WhatsApp because it’s great for both businesses and their customers in Singapore. Businesses can now expand their revenue streams and access a wider customer base, while customers can make payments conveniently knowing that their payment details are secure.”

Launched in 2010, Irish-American financial services and software as a service (SaaS) company Stripe features more than 100 optimisations that enhance every aspect of the checkout experience, including pre-built payment user interfaces and more than 40 payment methods.

GIC and Temasek are among Stripe’s newest investors. The company announced on March 16 a Series I fundraise of more than US$6.5 billion ($8.62 billion) at a US$50 billion valuation.

Primary investors include existing Stripe shareholders — Andreessen Horowitz, Baillie Gifford, Founders Fund, General Catalyst, MSD Partners and Thrive Capital — as well as new investors Goldman Sachs Asset and Wealth Management, among others.

Irish entrepreneur brothers John and Patrick Collison founded Stripe in Palo Alto, California, in 2009. In 2011, the company received an investment of US$2 million, including from PayPal co-founders Elon Musk and Peter Thiel, Irish entrepreneur Liam Casey, and venture capital firms Sequoia Capital, Andreessen Horowitz and SV Angel.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Meta prepares more layoffs across Facebook, WhatsApp, Instagram

GIC, Temasek take stakes in payment processor Stripe's US$6.5 bil Series I

Meta to cut 10,000 jobs, eliminate 5,000 more vacant positions

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance