What's in Store for Disney (DIS) After Promising Earnings?

Entertainment behemoth The Walt Disney Company DIS reported encouraging quarterly earnings last week that surpassed Wall Street’s estimates.

The media giant posted fiscal fourth-quarter revenues of $21.2 billion, up 5% from a year ago. Earnings came in at 82 cents a share in the quarter ending in September, up from 30 cents in the year-ago quarter.

An increase in streaming users helped Disney post solid quarterly earnings. Notably, the Disney+ streaming service added almost 7 million core subscribers in the reported quarter and increased the total number of subscribers to 112.6 million.

Disney’s CEO, Robert Allen Iger recently said that acceptance of movies and original series such as Elemental, Guardians of the Galaxy Vol.3, Little Mermaid, Moving, and Ahsoka boosted subscriber growth significantly.

The entertainment segment, which includes movies, generated revenues of $9.5 billion in the fiscal fourth quarter, up 2% from the same period a year ago.

Similarly, the experience segment, which includes hotels, cruises and theme parks, posted revenues of $8.2 billion, up 13% from the same quarter a year ago.

Disney also expects its overall revenues and profits to improve further in the December quarter, while its management vowed to reduce costs.

The company, in reality, is expecting its free cash flow to increase and achieve pre-pandemic levels in the next year. The company assumes $8 billion in free cash flow in fiscal 2024.

However, weaker results at ESPN have primarily impacted the company for quite some time now. The cost of sports rights is increasing at a faster pace than the revenues generated from ESPN, which undoubtedly is a headache for Disney.

In the fiscal fourth quarter, the sports segment, or mostly ESPN, posted revenues of $3.9 billion, but it was more or less flat with the same period last year.

It's also worth pointing out that the growth in the streaming segment is much softer at the moment as the company continues to face stiff competition from other media giants like Apple Inc. AAPL, Amazon.com, Inc. AMZN, Netflix, Inc. NFLX and Comcast Corporation CMCSA. Disney’s move to increase streaming prices in August hasn’t gone down well with users.

To top it off, linear TV viewing has reduced considerably, and along with lower advertising revenues, things are looking challenging for Disney in the near term.

To make matters worse, Disney continues to face a prolonged actors strike, a decline in footfall at Disney World Resort, and ambiguity related to a CEO succession plan.

Therefore, despite posting upbeat results in its latest quarterly earnings, the Zacks Consensus Estimate for Disney’s current-year earnings has decreased 10.3% over the past 60 days.

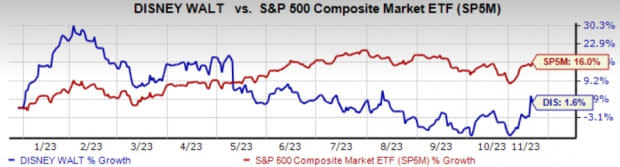

The Zacks Rank #5 (Strong Sell) company’s shares are trading at their lowest level in almost a decade. Shares of Disney have gained a meager 1.6% so far this year, while the S&P 500 Index has soared 16%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance