What's in Store for Central Garden & Pet (CENT) in Q2 Earnings?

Central Garden & Pet Company CENT is set to report second-quarter fiscal 2023 results on May 3 after market close. The Zacks Consensus Estimate for revenues is pegged at $897.5 million, indicating a decline of 6% from the prior-year reported figure.

The bottom line of this producer and distributor of various products for the lawn and garden and pet supplies markets is also expected to have declined year over year. The Zacks Consensus Estimate for second-quarter earnings per share, which has fallen 8.2% to 90 cents over the past seven days, suggests a sharp decline from the year-ago earnings of $1.27.

We expect Central Garden & Pet Company to generate revenues of $892.1 million, suggesting a decline of 6.5% year over year, and post earnings of 90 cents a share.

Central Garden & Pet Company has a trailing four-quarter negative earnings surprise of 51.1%, on average. In the last reported quarter, the bottom line of this Walnut Creek, CA-based company outperformed the Zacks Consensus Estimate by a margin of 11.1%.

Key Factors to Note

A challenging operating environment and softness in the Garden portfolio have made things tough for Central Garden & Pet Company. In a recent release, management cited unfavorable weather conditions, soft foot traffic and lower retailer inventory levels behind sluggishness in the Garden segment. Nonetheless, the Pet segment met expectations and gained market share.

Central Garden & Pet Company guided second-quarter earnings to be 90 cents a share, sharply down from $1.27 reported in the year-ago quarter. The company stated that the lower-than-expected performance was materially impacted by poor spring weather.

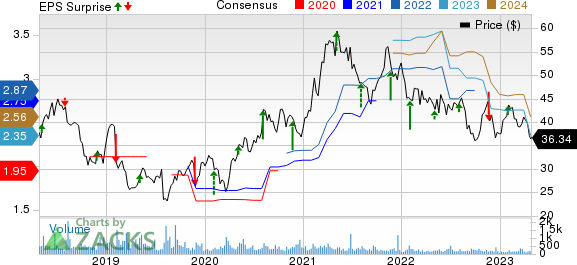

Central Garden & Pet Company Price, Consensus and EPS Surprise

Central Garden & Pet Company price-consensus-eps-surprise-chart | Central Garden & Pet Company Quote

Our estimate showcases a decline of 15.8% to $384.8 million in the Garden segment but an increase of 1.9% to $507.3 million in the Pet segment for the quarter under discussion.

Despite the aforementioned headwinds, we believe that the company’s cost-containment actions, efforts to lower complexity and improve margins, strategic investments in digital marketing, customer insights and brand building might have provided some cushion. Central Garden & Pet Company has been expanding its manufacturing capacity and simplifying the portfolio.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Central Garden & Pet Company this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Central Garden & Pet Company has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Kroger KR currently has an Earnings ESP of +2.56% and sports a Zacks Rank #1. The company is likely to register a bottom-line decline when it reports first-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.41 suggests a decline from the $1.45 reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kroger's top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $45.38 billion, which indicates an improvement of 1.7% from the figure reported in the prior-year quarter. KR has a trailing four-quarter earnings surprise of 9.8%, on average.

Tractor Supply Company (TSCO) currently has an Earnings ESP of +0.30% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports first-quarter 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.69 suggests a rise of 2.4% from the year-ago reported number.

Tractor Supply's top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.30 billion, which suggests an increase of 9.2% from the prior-year quarter. TSCO has a trailing four-quarter earnings surprise of 5.6%, on average.

BJ's Wholesale Club BJ currently has an Earnings ESP of +6.76% and a Zacks Rank of 2. The company is likely to register a top-line increase when it reports first-quarter fiscal 2023 results. The consensus mark for BJ’s quarterly revenues is pegged at $4.8 billion, which suggests a jump of 6.8% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for BJ's Wholesale’s bottom line has remained unchanged at 84 cents per share in the past 30 days. The consensus estimate indicates a 3.5% drop from the year-ago quarter’s reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance