What's Going On With Taiwan Semiconductor Stock On Wednesday?

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) plays a crucial role as some Chinese AI chip firms design less powerful processors to comply with U.S. sanctions.

The U.S. imposed export controls on advanced processors and manufacturing equipment to hinder China’s military AI advancements. This affected companies like Nvidia Corp (NASDAQ:NVDA) and limited TSMC’s production capabilities due to its use of U.S. tools.

Meanwhile, the key Nvidia supplier looks to boost prices of its services to tap the AI frenzy. The stock price of TSMC is trading higher Wednesday.

Also Read: ASML and Taiwan Semi Prep for Potential China-Taiwan Conflict with Remote Shutdown Feature

Washington’s sanctions highlight China’s dependency on TSMC for advanced chips. Two leading Chinese AI chip firms, MetaX and Enflame, downgraded their chip designs to meet U.S. restrictions. Both firms have state support and significant backing, Reuters reports.

China’s AI chip sector is under pressure, with U.S. sanctions blocking some firms from overseas production.

Huawei Technologies Co gains from these production challenges.

Despite substantial government investments in chip self-sufficiency, China’s only advanced GPU producer, Semiconductor Manufacturing International Corp, has limited capacity and previously reserved production for Huawei.

Now, SMIC allocates some capacity to sanctioned Chinese AI firms like Cambricon, which faces supply challenges due to U.S. restrictions.

TSMC emerged as the leading global foundry with a 62% market share.

Thanks to the AI frenzy, TSMC predicted 10% annual growth in the global semiconductor industry, excluding memory chips.

Prior reports indicated that the U.S. chip embargo led to an underground market for Nvidia chips, where Chinese vendors sold the chips at a huge premium.

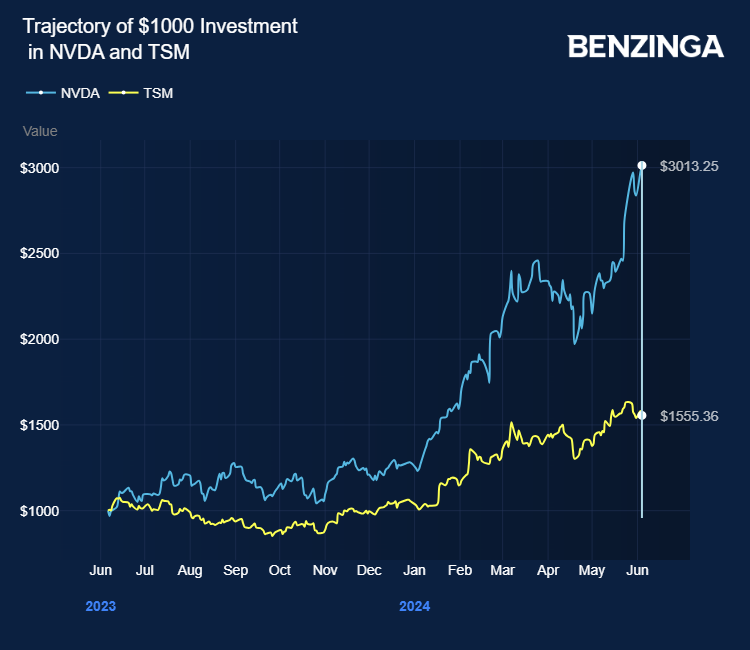

TSMC stock gained 56% in the last 12 months. Investors can gain exposure to the semiconductor sector via ProShares Ultra Semiconductors (NYSE:USD) and Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ).

Price Action: TSM shares traded higher by 2.32% at $156.00 premarket at the last check on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Sundry Photography on Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What's Going On With Taiwan Semiconductor Stock On Wednesday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance