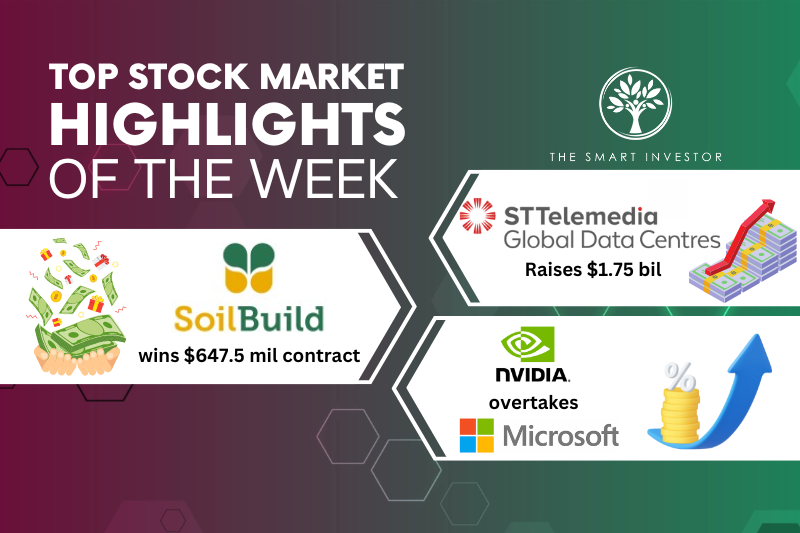

Top Stock Market Highlights of the Week: Singtel, Soilbuild Construction and Nvidia

Welcome to this week’s edition of top stock market highlights.

Singtel (SGX: Z74)

Singtel continues to invest in growing its data centre presence within Southeast Asia.

Just this week, the telco signed a definitive agreement with ST Telemedia Global Data Centres (STT GDC) and KKR to form a KKR-led consortium where KKR and Singtel invest S$1.75 billion in STT GDC.

STT GDC is a leading data centre colocation services provider while KKR is a leading global investment firm.

This transaction represents the largest digital infrastructure investment in Southeast Asia to date.

The initial S$1.75 billion will be invested via the consortium through redeemable preference shares (RPS) with detachable warrants.

Once these warrants are exercised, the consortium will invest another S$1.24 billion.

The proceeds from these cash infusions will be used for STT GDC’s international expansion and growth plans through both organic and inorganic strategies.

STT GDC is headquartered in Singapore and has a portfolio of 95 data centres across 11 regions.

The portfolio has a total combined capacity of more than 1.7 GW and the company provides services such as high-quality colocation, connectivity, and 24-hour support services.

The RPS will earn dividends at a rate of 6.5% per annum or, if any cash dividend remains unpaid or has been deferred, a higher rate of 7.75% per annum.

Singtel believes that this investment will present the group with the opportunity to capitalise on the burgeoning data centre business, which has been boosted by rapid digitalisation coupled with advances in artificial intelligence.

The investment in STT GDC also allows the blue-chip telco to further its collaboration with KKR.

This investment will be funded with internal cash resources.

Soilbuild Construction Group (SGX: S7P)

Soilbuild Construction Group (SCG) announced that it clinched a S$645.7 million contract for the construction of the PSA Supply Chain Hub @ Tuas.

This project includes the construction of warehouse buildings, gate buildings, main intake substations, and ancillary buildings at Tuas Port in Singapore.

The development will form a part of the Tuas Port and will be built to achieve the Green Mark Platinum Super Low Energy, which is an eco-sustainable rating awarded by the Building and Construction Authority (BCA).

This rating will only be awarded to projects that achieve at least 60% energy savings.

By clinching this contract, SCG’s order book has been elevated to S$1.2 billion, a first for the company.

Nvidia (NASDAQ: NVDA)

Nvidia’s red-hot gains this year have propelled it past Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) to make it the world’s most valuable company.

As of 19 June, Nvidia’s share price rose 3.5% to US$135, giving the graphics processing unit (GPU) maker a market capitalisation of more than US$3.3 trillion.

As of this writing, shares of Nvidia have risen nearly 172% year to date and have soared more than 33-fold in the past five years.

The company reported a record quarterly revenue of US$26 billion for the first quarter of fiscal 2025 (1Q FY2025) ending 28 April 2024.

This level of revenue was more than three times higher than the level recorded a year ago.

Operating profit surged nearly eightfold year on year from US$2.1 billion to US$16.9 billion.

Net profit hit a record high of US$14.9 billion, up a stunning 628% year on year.

The GPU manufacturer offered an optimistic outlook for its second quarter.

Revenue is expected to be around US$28 billion, which would be slightly more than double the US$13.5 billion that was reported in 2Q FY2024.

Attention Growth Investors: Our latest report, “The Rise of Titans,” gives you a front-row seat on the 7 most influential US stocks today. If you’re passionate about tech and growth, you can’t go wrong with our research. Downloading this FREE report could be the most strategic move you make this year. Click here to get started now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Apple.

The post Top Stock Market Highlights of the Week: Singtel, Soilbuild Construction and Nvidia appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance