WESCO (WCC) Expands Portfolio With entroCIM Acquisition

WESCO International WCC expands portfolio with the acquisition of entroCIM — a company specialized in innovating data center and building intelligence software.

The purchase, initially valued at $30 million with potential for additional performance-based earnouts, underscores Wesco’s commitment to enhancing its business-to-business distribution, logistics services and supply chain solutions.

entroCIM's Central Intelligence Manager (CIM), an advanced HTML5 browser-based application, offers businesses actionable insights to optimize costs and operations through seamless device connectivity and remote monitoring.

By leveraging an open application programming interface (API) architecture and robust connectivity, entroCIM is poised to bolster IT/OT convergence and operational visibility across diverse environments.

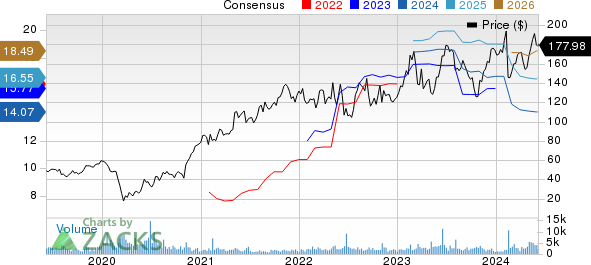

WESCO International, Inc. Price and Consensus

WESCO International, Inc. price-consensus-chart | WESCO International, Inc. Quote

Strategic Deals Boost WESCO’s Prospects

Strategic deals are playing an important role in shaping Wesco’s growth trajectory.

With the acquisition of entroCIM, WESCO is poised well to address the growing demand for building intelligence software across data centers, commercial buildings, airports and universities among others.

The company’s acquisition of Rahi Systems is a major positive. The buyout has been benefiting Wesco’s Communication and Security Solutions segment and its presence in the the booming hyperscale data-center market.

Apart from strategic acquisitions, WCC’s recent divestiture of its Wesco Integrated Supply (WIS) business is noteworthy.

WESCO completed the sale of WIS business to Vallen Distribution for $350 million in April 2024. Wesco intends to utilize the sale proceeds to diminish debt obligations and engage in share repurchases. The divestiture will also allow the company to streamline operations and focus on its core business areas.

However, softness in the service provider market due to weakness in Enterprise Network Infrastructure is a major concern. The weak adoption of security solutions is another headwind. Sluggishness in the broadband end-market and slowdown in 5G build-outs are also headwinds.

These factors might hurt Wesco’s financial performance in the near term.

The Zacks Consensus Estimate for second-quarter 2024 is pegged at $5.55 billion, indicating a decline of 3.35% year over year.

The Zacks Consensus Estimate for second-quarter earnings is pegged at $3.49 per share, indicating a decline of 5.93% year over year.

For 2024, the company revised guidance for sales growth downward from 1-4% to (2)-1%. Organic sales growth is expected to be flat to 3%. The Zacks Consensus Estimate for sales is pegged at $22.21 billion, indicating a drop of 0.77% year over year.

Adjusted earnings are anticipated between $13.75 and $15.75. The Zacks Consensus Estimate for the same is pegged at $14.07, indicating a decline of 3.63% year over year.

Zacks Rank & Stocks to Consider

Currently, WESCO International has a Zacks Rank #3 (Hold).

The stock has increased 2.4% against the Zacks Computer & Technology sector’s growth of 16.4% year to date.

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1(Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 27.3% in the year-to-date period. The long-term earnings growth rate for ANET is pegged at 15.68%.

Badger Meter’s shares have gained 22.6% in the year-to-date period. The long-term earnings growth rate for BMI is currently projected at 15.57%.

Shares of Dropbox have declined 25.7% in the year-to-date period. The long-term earnings growth rate for DBX is pegged at 11.44%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

WESCO International, Inc. (WCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance