Dividend Investing: The Goldilocks Approach to Building Passive Income

Imagine this: you need to take a break from work.

Wouldn’t it be a relief to do so without the stress of daily expenses?

Dividend investing can be your solution.

Here’s why it’s the perfect recipe for building passive income:

Easy to Start: Unlike some investments, dividend stocks don’t require a huge initial investment.

Stronger Returns: By choosing the right companies, you can potentially earn more than you would with bonds.

It’s like the Goldilocks approach to investing – not too risky coupled with a return that is not too low, just right!

Starting with a small amount of capital

There are a few ways to create passive income.

For instance, renting out a second property is a popular way to generate passive income in Singapore.

However, you need to stump a significant amount of capital upfront and this process also often involves taking on debt.

On the other hand, with dividend investing, you can start investing with just a small amount of money.

For instance, you can own a piece of Mapletree Pan Asia Commercial Trust (SGX: N2IU), which manages VivoCity, for less than S$130.

Even a stake in Singapore’s largest bank, DBS Group (SGX: D05), requires no more than S$3,600.

While the initial dividends you receive for a small capital investment will be modest, the key is to take the first step.

This initial investment is crucial because it gets you off the starting line. In doing so, it can shift your mindset and motivate you to keep growing your portfolio.

Over time, every little action translates into a steady and growing stream of passive income for your future.

Getting significant passive income

But what about bonds?

Singapore Savings Bonds (SSBs) offer a steady stream of income, ideal for long-term investors seeking stability.

However, the interest rates may not be high enough to generate significant returns through compounding.

In fact, the highest 10-year average interest rate since 2015 was 3.47%, while the lowest was only 0.87%. To seek higher returns, dividend-paying stocks are an attractive alternative.

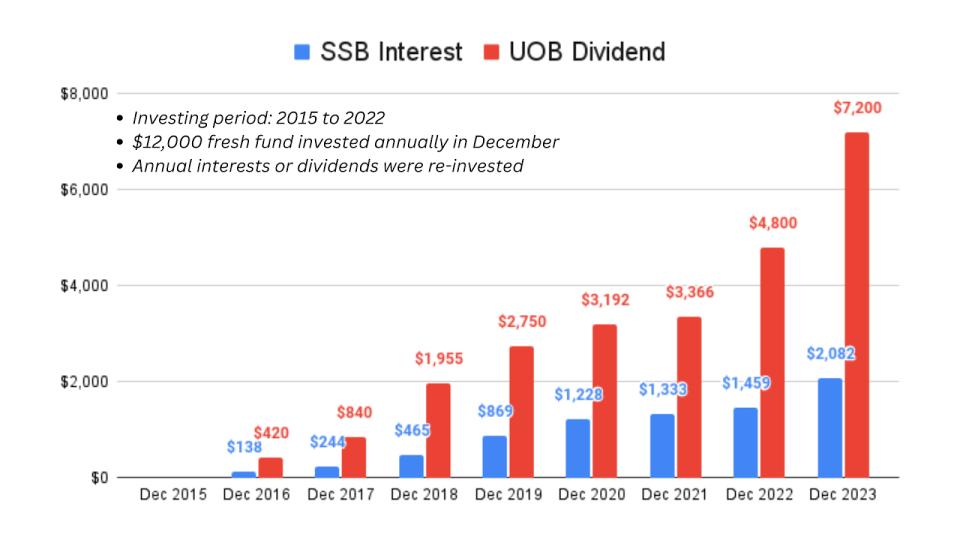

For example, the graph below shows a comparison between investing in SSB and United Overseas Bank (SGX: U11), or UOB, from 2015 to 2022.

Clearly, dividend investing provides a much higher recurring income.

While we cannot predict the future, the past provides the best indication of the future.

We can infer from the above comparison that dividend investing is the better method to build significant future income.

Price volatility is irrelevant

So, how does dividend investing work?

I am glad you asked.

Let’s say you own a durian farm. Year after year, your trees reliably produce delicious fruits, bringing in a consistent income stream.

Sure, the durian farm itself might fluctuate in value due to factors like real estate market conditions. But the income you get from selling durians is independent of that durian farm’s value.

This same concept applies to dividend investing.

The company’s stock price, like the value of your durian farm, can change.

But just like your durian sales, the dividends you receive provide a consistent source of income.

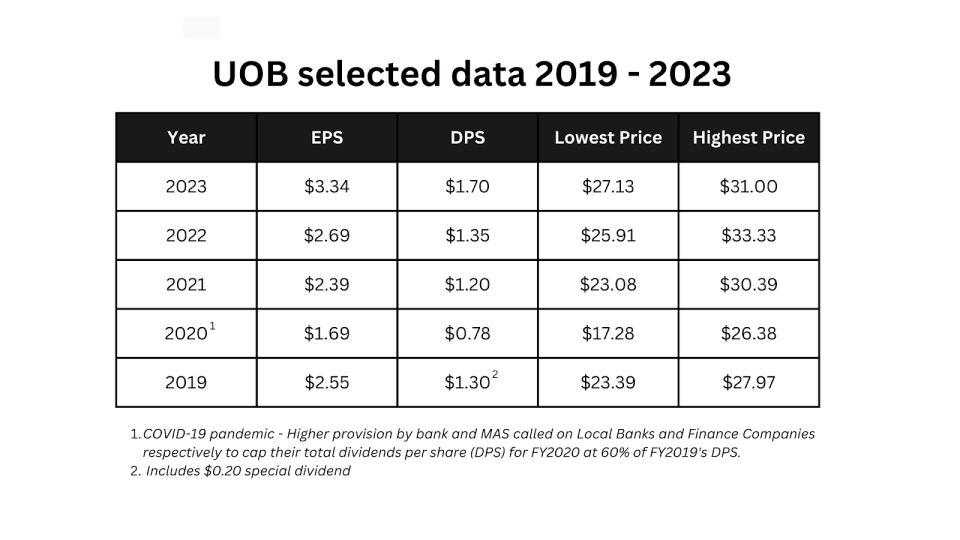

Let’s use UOB’s data from 2019 to 2023 as an example.

With the exception of the year 2020 which was impacted by the COVID-19 pandemic, UOB has grown its earnings per share during this period.

However, the stock price hasn’t mirrored this growth in a straight line. As the data reveals, even with stronger earnings, the stock price dipped below previous highs several times.

Such volatility is a result of market sentiment, which can cause short-term price swings.

While normal, price volatility is not an accurate reflection of a company’s financial performance.

But here’s the beauty of dividend investing: price volatility becomes irrelevant to you.

Your focus as a dividend investor is on the recurring income, that steady stream of cash which comes in like clockwork. The strong business performance by UOB has translated into increasing dividends for its investors.

Since your goal is not about locking in short-term capital gains, you can free yourself from daily market anxieties.

Instead, you can invest your time and energy in understanding the fundamentals of the company.

A company with consistent earnings growth is the key to unlocking reliable passive income.

Is dividend investing risky?

While investing in equities involves risk, staying on the sidelines can be just as risky.

You might miss out on the potential for significant growth, jeopardising your ability to accumulate sufficient passive income for your future self.

The good news is that the risk associated with equities can be managed.

By building a portfolio of stocks that have a history of strong financial performance and consistent dividend payouts, you improve your chances of enjoying a steady stream of future income.

We have just revealed the top 7 US tech stocks poised for remarkable growth. In today’s fast-paced market, betting on these giants could mean more money in your pocket. With a focus on solid fundamentals and innovative prowess, these selections should earn a place in your portfolio. Click here to grab your FREE report now and start investing in the future, today.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Chan Kin Chuah owns shares of DBS, Mapletree Pan Asia Commercial Trust and UOB.

The post Dividend Investing: The Goldilocks Approach to Building Passive Income appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance