Weight Loss Drugs Are Poised to Cost New York City Retail, According to Study

The size curve keeps shrinking in New York City as weight loss drugs like Ozempic and Wegovy solidify as a phenomenon — and it’s triggering expensive challenges for brands and retailers, including direct impacts on the buying and allocation processes. Experts suggest companies that are not prepared will see increased lost sales due to stockouts and excess inventory with a significant impact on profitability.

To better understand the future impact of these drugs and how to advise companies’ planning strategies, an AI-based retail planning and forecasting company, Impact Analytics, conducted a multiyear analysis which sales data and losses in specific geographies.

More from WWD

EXCLUSIVE: Tween-favorite Fashion Label Limited Too Is Making Its Comeback

Rising Costs Drive Surge in Online Coupon Use Among U.S. Shoppers

According to Impact Analytics’ new research, New York is leading in GLP-1 drug usage, with a reported 43.8 percent of the city’s GLP-1 drug prescriptions going to users who have not received a Type 2 diabetes diagnosis. These users are predominantly younger and 74.7 percent are female. Usage, they said is also primarily concentrated in Manhattan’s Upper East Side.

“The slimming down of America will have an enormous impact on retailers and could cost them approximately $20 million each year due to incorrect size curves,” said Prashant Agrawal, founder and chief executive officer at Impact Analytics. “These losses will only accelerate as more people take GLP-1 drugs for weight loss. Retailers generally make buying decisions for upcoming seasons at least six months in advance, and if this impact to the curve isn’t addressed, it will have ramifications on retail sales that will extend well into the holiday season and beyond.”

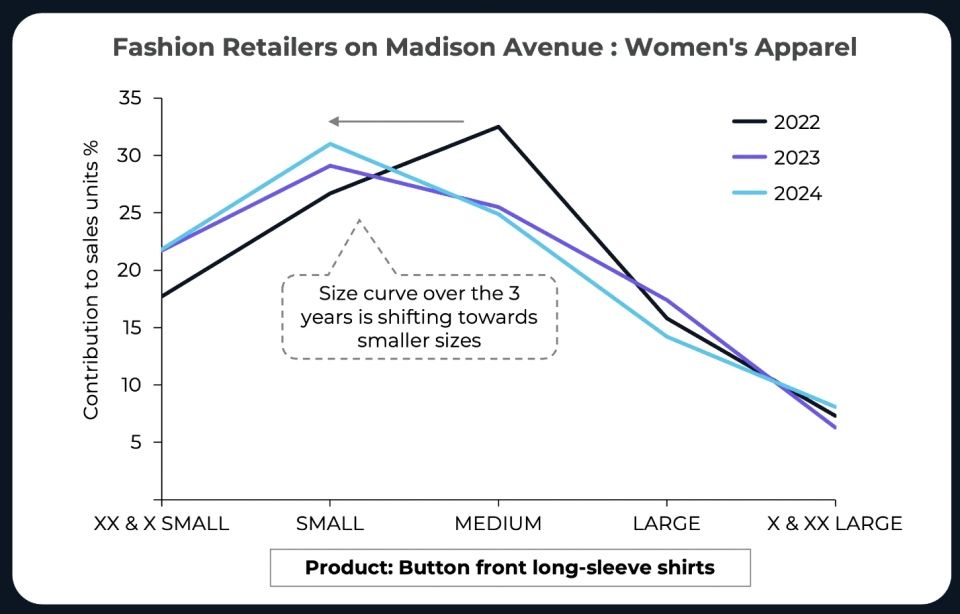

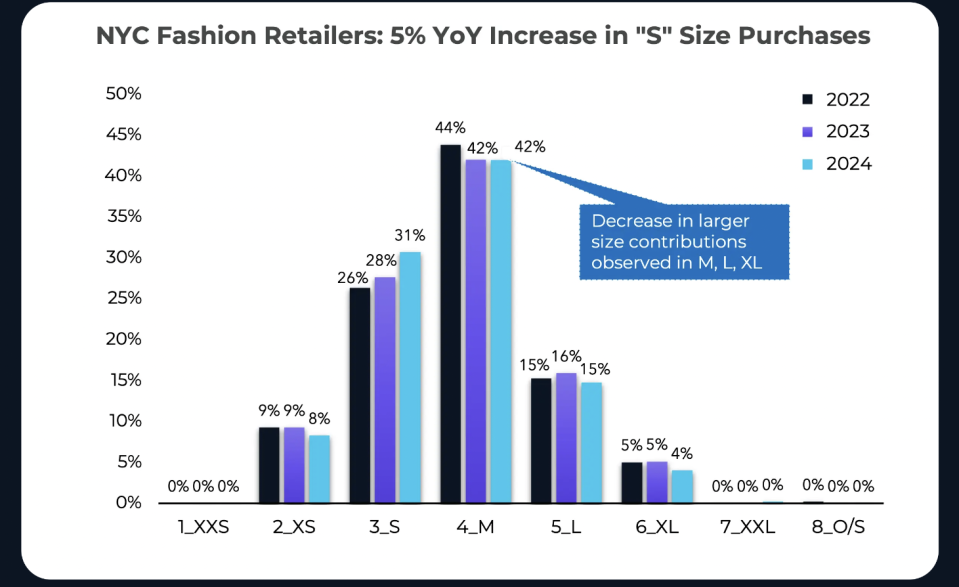

Looking across sales data from 2022, 2023 and 2024, sales of women’s button-down shirts in sizes XXS, XS and S have increased by 12 percent as sales of large sizes — L, XL and XXL — have decreased by almost 11 percent. Size small has become the most popular size for women on Manhattan’s Upper East Side.

Impact Analytics’ data suggests a similar shift in the size curve can be seen across women’s and men’s apparel. The researchers said that the data “spurred Impact Analytics to focus their analysis on shifts in clothing size curves, which reflect both the absolute and relative amounts of particular apparel sizes bought by consumers.”

“Most retailers have clung to the same size curves for years despite evidence suggesting their inaccuracy,” Agrawal said. “The impact of that will continue to erode retailer margin integrity unless immediate action is taken to update them.”

However, while the potentially significant shift in size allocation poses challenges to brands and retailers, Impact Analytics’ team also said there is an opportunity to engage with consumers. As consumers lose weight, data shows that they have been participating in some revenge shopping, taking the time to purchase an entirely new wardrobe and driving a surge in clothing sales. The company noted that for those retailers prepared to adapt, it can be a “golden opportunity.”

With no signs of weight loss drug use slowing down, analysts from Impact Analytics suggest companies examine the efficacy of their current size curves, gain an understanding of how products and consumer segments intersect with the drug’s usage, plan for upcoming seasons with new size curves and begin to automate size curves with weight loss drug use incorporated.

Best of WWD

Yahoo Finance

Yahoo Finance