Warren Buffett Reduces Stake in Liberty Live Group

Overview of Recent Transaction

On June 14, 2024, Warren Buffett (Trades, Portfolio)'s firm made a notable adjustment in its investment portfolio by reducing its stake in Liberty Live Group (NASDAQ:LLYVA). The transaction involved the sale of 65,330 shares at a price of $33.88 each. Following this move, the firm still holds a substantial total of 4,986,588 shares in the company. This adjustment represents a minor change in the firm's overall portfolio, with the position now accounting for 0.05% of its total investments and 5.44% of the total shares of Liberty Live Group.

Warren Buffett (Trades, Portfolio): Investment Titan

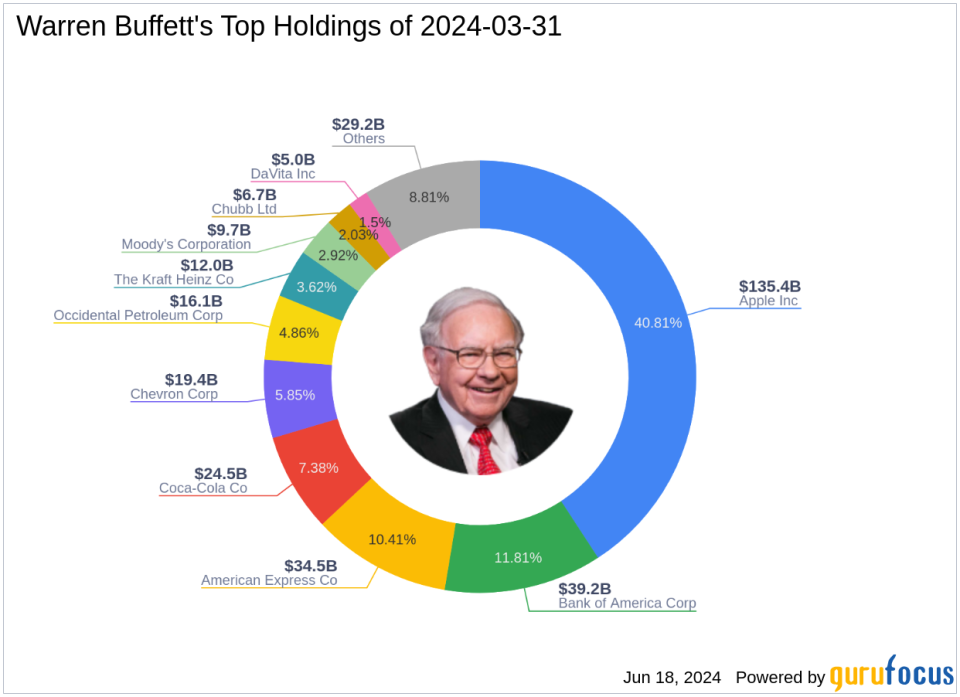

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a towering figure in the investment world. As the chairman of Berkshire Hathaway, Buffett has transformed a modest textile company into a major conglomerate, primarily focusing on insurance and other diverse investments. Buffett's investment philosophy, deeply rooted in Benjamin Graham's principles of value investing, emphasizes understanding a business deeply, investing with a margin of safety, and choosing companies with long-term value. Berkshire Hathaway's top holdings include significant positions in major corporations such as Apple Inc, American Express, and Coca-Cola, showcasing a strong inclination towards technology and financial services sectors.

Liberty Live Group at a Glance

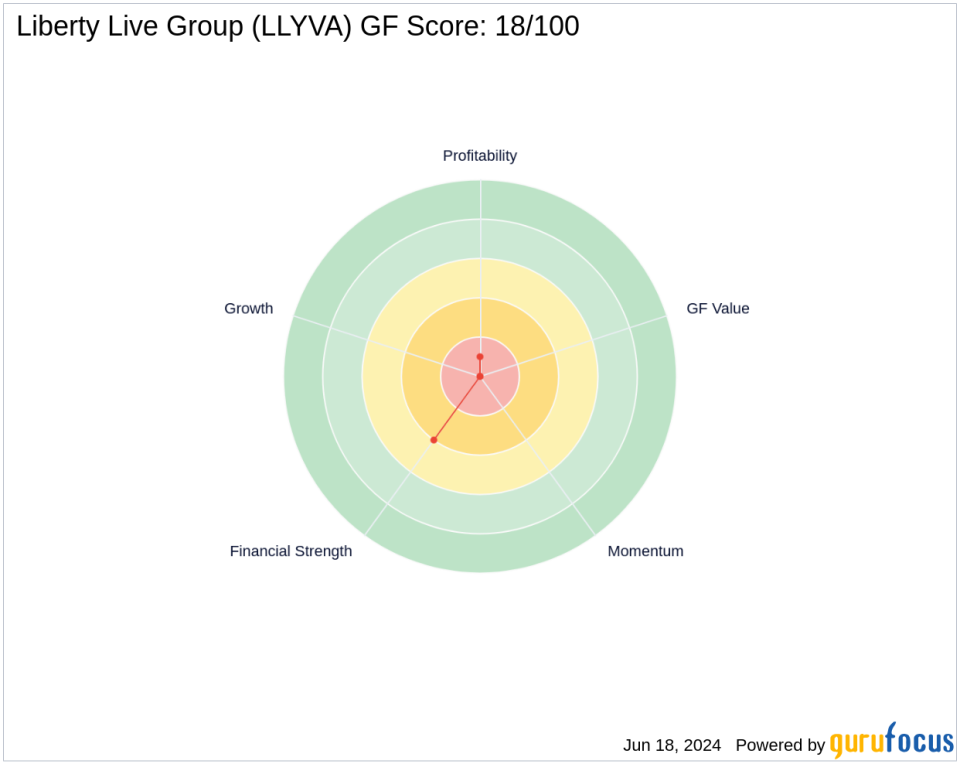

Liberty Live Group, operating under the ticker LLYVA, is a player in the Media - Diversified sector with a market capitalization of $3.19 billion. Since its IPO on August 4, 2023, the company has been focused on maximizing the value of its investments in Live Nation and other assets. Despite its strategic initiatives, the company's financial metrics such as the GF Score of 18/100 indicate challenges in growth, profitability, and market momentum.

Impact of Buffett's Trade

The recent reduction in Buffett's stake in Liberty Live Group could signal a strategic realignment or a response to the company's underwhelming financial performance and market challenges. With a GF Score indicating poor future performance potential and ranks in Profitability Rank and Growth Rank at the lower end, Buffett's decision might reflect a cautious approach towards a stock that hasn't met Berkshire's stringent investment criteria.

Market and Sector Context

The Media - Diversified sector where Liberty Live Group operates is currently experiencing a dynamic shift with challenges in adapting to digital transformation and varying consumer preferences. In comparison to sector averages, Liberty Live's performance has been lackluster, further justifying the cautious stance from investors like Buffett.

Insights from Other Investors

Notably, other seasoned investors such as Wallace Weitz (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio) also hold stakes in Liberty Live Group. Their investment strategies, while diverse, all focus on value creation and long-term growth, providing a broader perspective on the stock's potential and challenges.

Concluding Thoughts

Warren Buffett (Trades, Portfolio)'s recent transaction in Liberty Live Group underscores a strategic adjustment in response to the company's performance and broader market conditions. For investors, this move highlights the importance of vigilance and adaptability in portfolio management, especially in sectors undergoing significant changes. As always, Buffett's investment decisions provide valuable insights and a learning opportunity for the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance