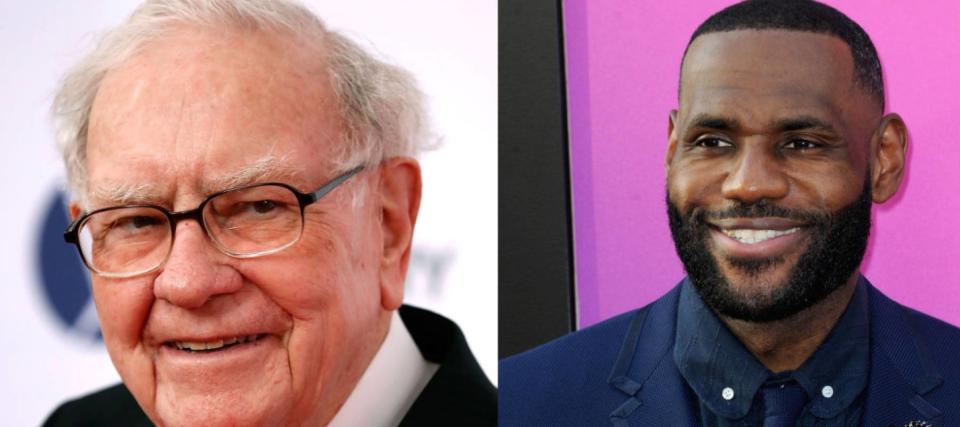

Warren Buffett once told Lebron James to 'own' America over the long haul — and now the NBA superstar is worth a staggering $1B. Here's how you 'can't go wrong' betting on the USA

Leave it to a 93-year-old to show Lebron James how to pull off the perfect slam dunk — at least when the game in question involves investments and the nonagenarian is billionaire Warren Buffett.

The two have been on friendly terms for more than 15 years, ever since James agreed to appear in a 2007 video for Buffett’s Berkshire Hathaway holding company that featured the Oracle of Omaha beating the Los Angeles Lakers superstar in a game of basketball.

Don’t miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Inflation is still white-hot in 2024 — use these 3 'real assets’ to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

“It was clearly comedy,” Buffett recalled in 2019, in a piece he penned in tribute to James for the annual TIME 100 listicle.

But when it comes to praising James’ “money mind,” Buffett is all business.

Buffett’s financial tips for James

Buffett famously offered some solid financial advice to the NBA star in terms of how to make the most of his hefty professional salary. “In terms of earning power, [he should] just make monthly investments in the low-index fund,” Buffett advised via CNBC’s Squawk Box in 2015.

He then suggested James “keep it simple” when investing.

For starters, the Berkshire Hathaway CEO said, James should consider investing primarily in American companies. “Owning the United States at a decent average price bought over time, you really can’t go wrong with that.”

Five years after this advice, James joined Buffett in the billionaires club, making him the only active basketball player to hit a net worth of more than $1 billion.

Granted, James already had a healthy bankroll to start off with: He made $765 million in the first 15 years of his pro basketball career. But he also became a shrewd investor, at one point turning an investment of less than $1 million in Blaze Pizza into more than $25 million in 2017.

“LeBron, in addition to a lot of other talents, [has] a money mind,” Buffett told USA Today in 2018. “And he gets stuff."

The good news is that you don’t have to be an NBA superstar to benefit from Buffett’s wisdom.

Here are four ways to make the billionaire CEO’s strategies part of your championship investing season.

1. Buy the same stocks that Buffett owns

Imitation, aside from being the most sincerest form of flattery, can sometimes provide a nice shortcut to riches.

Buffett is known far and wide for his adherence to value investing, which involves looking for established companies, often those where the stock trades for less than book value.

Bank of America, Coca-Cola and American Express are core holdings in Buffett’s portfolio.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

2. Invest in an index fund

It’s right there in the name: index funds are pegged to the value of a particular index such as the S&P 500.

If the index goes up, so does the fund pegged to it, which makes it a simple way to take advantage of rising markets and instantly diversify. In essence, you’re buying all the stock in a particular index. In the world of investing, it doesn’t get much easier than this.

Buffett recommends index funds as a savings haven, especially in your retirement years.

3. Buy and hold… and hold

In terms of how long Buffett likes to hang on to his investments, he famously said in a 1988 letter to his shareholders: “Our ideal holding period is forever.”

Holding onto stocks, especially during periods of market jitters, can have tremendous advantages.

You’ll avoid irrational selloffs or impulse moves and instead learn to trust in the wisdom that outstanding businesses compound your wealth year after year.

4. Read Benjamin Graham’s ‘The Intelligent Investor’

If you’ve ever wondered why Buffett has shunned the glitz of bitcoin and other unproven (or unstable) tech darlings, then check out the book The Intelligent Investor by Benjamin Graham.

Originally published in 1949, the book has served as Buffett’s investment bible. He’s called it “the best book about investing ever written.”

At its heart, The Intelligent Investor espouses a strategy of studying relevant facts about a business (particularly its past and estimated future profitability) to determine its true worth.

What to read next

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Robert Kiyosaki warns 401(k)s and IRAs will be 'toast' after the 'biggest crash in history' — protect yourself now with these shockproof assets

Credit card debt under inflation's shadow: The 4 potent weapons you need to have for a strong financial resurgence

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance