Vital KSK Holdings And 2 Other Strong Dividend Stocks In Japan

As global markets navigate through varied performances, with technological advancements and economic policies influencing indices, Japan's market has shown resilience in the face of international pressures. In this landscape, dividend stocks like Vital KSK Holdings offer a compelling focus for investors seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.63% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.59% | ★★★★★★ |

Globeride (TSE:7990) | 4.02% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.37% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.55% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.47% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.48% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.45% | ★★★★★★ |

Innotech (TSE:9880) | 4.11% | ★★★★★★ |

Click here to see the full list of 376 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Vital KSK Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vital KSK Holdings, Inc. operates primarily in the wholesale and retail sale of pharmaceutical products within Japan, with a market capitalization of approximately ¥63.85 billion.

Operations: Vital KSK Holdings, Inc. generates its revenue primarily through the wholesale and retail distribution of pharmaceutical products.

Dividend Yield: 3%

Vital KSK Holdings has a dividend yield of 3.02%, which is below the top quartile of Japanese dividend stocks at 3.36%. Despite a history of volatile dividends, recent increases over the past decade suggest growth. The company's dividends are well-supported by earnings with a payout ratio of 31.6% and an even lower cash payout ratio at 10.6%. However, recent decisions indicate a reduction in future dividends to JPY 22 per share from JPY 23 last year, reflecting potential concerns about sustainability amidst financial fluctuations marked by significant one-off items impacting results.

Dive into the specifics of Vital KSK Holdings here with our thorough dividend report.

Upon reviewing our latest valuation report, Vital KSK Holdings' share price might be too optimistic.

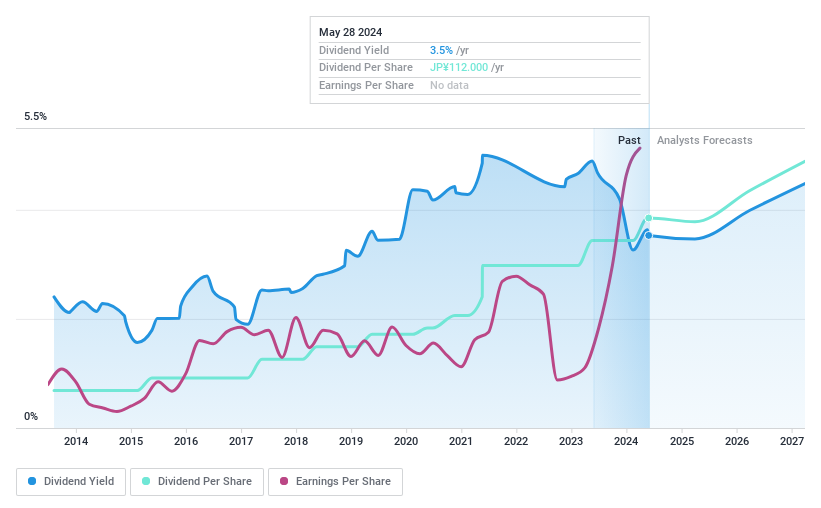

Sompo Holdings

Simply Wall St Dividend Rating: ★★★★★★

Overview: Sompo Holdings, Inc. operates globally, offering property and casualty insurance services, with a market capitalization of approximately ¥3.13 trillion.

Operations: Sompo Holdings, Inc. generates revenue primarily through its Domestic P&C Insurance Business at ¥22.48 billion, followed by Overseas Insurance Business at ¥14.45 billion, with additional contributions from its Domestic Life Insurance Business and Nursing Care and Seniors Business at ¥3.09 billion and ¥1.77 billion respectively.

Dividend Yield: 3.5%

Sompo Holdings recently announced a substantial share repurchase program, planning to buy back up to 40 million shares for ¥77 billion, aiming to enhance capital efficiency and shareholder value. This move follows a stable dividend history with a payout ratio of 23.8% and cash payout ratio of 25%, indicating that dividends are well-supported by earnings and cash flow. Despite this, earnings are projected to decline by an average of 3.8% annually over the next three years, which could pressure future dividend sustainability.

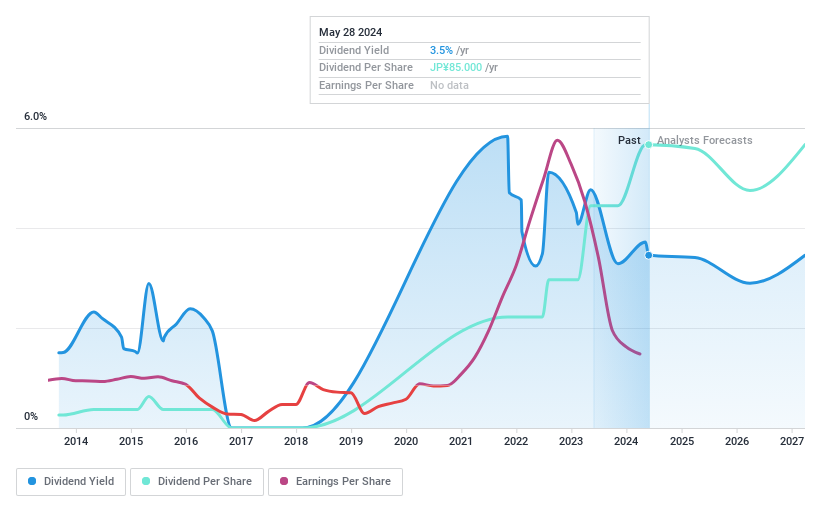

Kawasaki Kisen Kaisha

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kawasaki Kisen Kaisha, Ltd. operates globally, offering marine, land, and air transportation services with a market capitalization of approximately ¥1.67 trillion.

Operations: Kawasaki Kisen Kaisha, Ltd. generates revenue primarily through segments such as Dry Bulk (¥0.30 billion), Resource (¥0.11 billion), and Product Logistics (¥0.55 billion).

Dividend Yield: 3.5%

Kawasaki Kisen Kaisha's recent announcement of a significant share repurchase program for ¥100 billion and the cancellation of these shares underscores their commitment to enhancing shareholder returns. However, the company has reduced its dividend forecast to JPY 42.50 per share following a 3-for-1 stock split, reflecting a substantial decrease from previous payments. Despite these changes, the dividends are well-supported by both earnings and cash flow with payout ratios of 57.4% and 49.6% respectively, suggesting reasonable coverage though future growth in payouts may be constrained given the volatile history and forecasted earnings decline of 18.3% annually over the next three years.

Taking Advantage

Click through to start exploring the rest of the 373 Top Dividend Stocks now.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3151 TSE:8630 and TSE:9107.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance