Vishay (VSH) Expands Semiconductor Portfolio With SiC MOSFETs

Vishay Intertechnology VSH recently launched 1200 V MaxSiC series silicon carbide (SiC) MOSFETs to expand its discrete semiconductor offerings.

These 1200V SiC MOSFETs, which come in standard packages, will be showcased at the Power Electronics, Intelligent Motion, Renewable Energy and Energy Management (PCIM) Europe 2024 Conference.

Vishay is expected to gain solid traction across industrial applications on the back of these newly launched MOSFETs.

Other semiconductor offerings to be showcased at PCIM include surface-mount diodes, SiC Schottky diodes, microBUCK and microBRICK buck regulators, and automotive and industrial power modules. This further highlights Vishay’s robust discrete semiconductor portfolio.

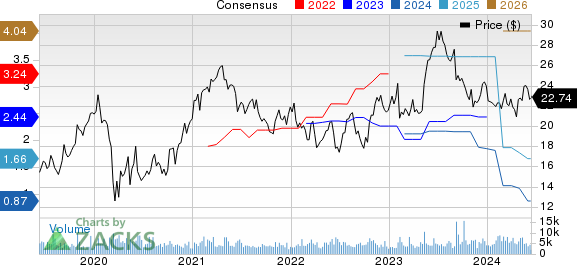

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Growth Prospects

Per a Future Market Insights report, the global power MOSFET market is expected to reach $60.1 billion by 2033, exhibiting a CAGR of 9.3% between 2023 and 2033. Vishay is well-poised to capitalize on this growth opportunity on the back of its strengthening MOSFET product portfolio.

Recently, Vishay launched Siliconix SiZF4800LDT, an 80 V symmetric dual n-channel power MOSFET, which enhances power density, efficiency and thermal performance, reduces component counts and simplifies designs.

The company introduced synchronous buck regulator modules, SiC931, SiC951 and SiC967, with adjustable switching frequencies, current limit, soft start, PMBus 1.3 compliance, ultrafast transient response, tight ripple regulation and a 69% smaller size.

Vishay’s launch of SiHP054N65E, a fourth-generation 650 V E Series power MOSFET, offering high efficiency and power density for telecom, industrial and computing applications, remains noteworthy.

Strength in Portfolio Aids Prospects

Expanding MOSFET offerings bode well for the company’s increasing efforts to strengthen its overall product portfolio.

Vishay recently introduced the Vishay Draloric AC05 WSZ and AC05-AT WSZ lead form for its AC and AC-AT series of 5 W resistors to expand its passive components offerings.

The company launched eight new 850 nm and 940 nm high-power infrared (IR) emitters in a bid to boost its optoelectronics offerings. These AEC-Q102 qualified emitters offer high radiant intensity of up to 6000 mW/sr at 5 A pulse current and 2000 mW/sr at 1.5 A DC current, low thermal resistance, and reduce costs and space by occupying a 20% smaller footprint.

The company expanded its discrete offerings with the introduction of four series of surface-mount transient voltage suppressors (TVS), namely 6DFNxxA, 6DFNxxxCA, T6NxxA and T6NxxxCA.

These efforts will continue aiding Vishay’s top-line performance in the upcoming period.

However, growing inventory adjustments, contracting lead times and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 4.7% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 7%.

The Zacks Consensus Estimate for 2024 revenues is pegged at $3.1 billion, indicating a decline of 10% year over year.

The consensus mark for 2024 earnings is pegged at 87 cents per share, indicating a 64.3% decline from the year-ago figure. The figure has remained unchanged in the past 30 days.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 30.6% in the year-to-date period. The long-term earnings growth rate for ANET is 15.68%.

Badger Meter’s shares have gained 23.3% in the year-to-date period. The long-term earnings growth rate for BMI is currently projected at 15.57%.

Shares of Dropbox have declined 13.5% in the year-to-date period. The long-term earnings growth rate for DBX is 11.44%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance