Vishay (VSH) to Boost Inductors Production With New Facility

Vishay Intertechnology VSH recently announced the inauguration of a new manufacturing facility in Gomez Palacio, Durango, Mexico.

The La Laguna S. de R.L. de C.V., an 18,000-square-meter and LEED v4-certified manufacturing facility, will initially focus on the mass production of power inductors.

Notably, the new facility is an addition to its existing production facilities in the United States, Israel and China.

We believe Vishay is likely to gain strong traction across handheld devices, computers and automotive electronics, among other applications, on the back of strengthening power inductor offerings.

Moreover, the underlined facility is expected to aid Vishay in catering to the growing demand for power inductors across the United States and Europe by taking care of the logistical challenges.

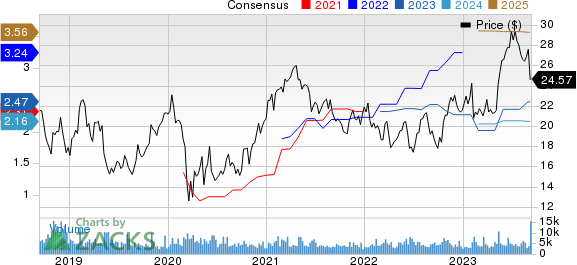

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Growth Prospects

This apart, the company recently collaborated with Immersion Corporation to unveil a new series of IHPT solenoid-based haptic actuators using the latter’s haptic technology, simplifying the design-in process and eliminating the need for separate licenses for haptic effects implementation.

This partnership will likely help Vishay to gain significant traction in automotive and commercial applications, particularly in human-machine interfaces like LCD touchscreens, touch panels, buttons and joysticks.

All these efforts will bolster Vishay’s footprint in the global inductor market with enhanced production.

Per a Future Market Insights report, the global inductor market is expected to witness a CAGR of 6.1% between 2022 and 2032, reaching a market valuation of $21.42 billion by 2032.

We believe that a strengthening footprint in the promising inductor market is likely to instill investor optimism in the stock in the days ahead.

Notably, Vishay has gained 13.9% on a year-to-date basis, outperforming the industry’s decline of 24.9%.

We note that the new facility, along with this partnership, is likely to counter the softness in the Inductors segment.

In second-quarter 2023, the Inductors segment generated revenues of $89.2 million, which decreased 0.4% on a year-over-year basis. This was due to decreased sales to distribution customers and customers in the Asia and Europe regions.

Our model estimate for third-quarter 2023 Inductors revenues is projected at $75.8 million, indicating a year-over-year decline of 9.3%.

Rising inflationary pressure and economic uncertainties remain major concerns for the company in the near term.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Asure Software ASUR, Arista Networks ANET and Badger Meter BMI. While Asure Software sports a Zacks Rank #1 (Strong Buy), Arista Networks and Badger Meter carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Asure Software shares have gained 23.8% in the year-to-date period. ASUR’s long-term earnings growth rate is currently projected at 27%.

Arista Networks shares have gained 61.9% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 18.75%

Badger Meter shares have gained 47.3% in the year-to-date period. BMI’s long-term earnings growth rate is currently projected at 15.05%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance