Vertex (VRTX) Rises 16.5% YTD: Time to Bet On the Stock?

Vertex Pharmaceuticals Incorporated VRTX has been witnessing strong revenue growth, regulatory approvals and commercial launches, which have driven the stock’s robust price movement.

Vertex enjoys a dominant position in the cystic fibrosis (CF) market. Vertex’s CF sales continue to grow, driven by its triple therapy, Trikafta (marketed as Kaftrio in Europe). Vertex generated more than $10 billion in sales from its CF drugs in 2023. The trend is expected to continue in 2024.

While CF remains the main area of focus, Vertex has seen rapid success in its non-CF pipeline candidates’ development in the past year. Vertex and partner CRISPR Therapeutics’ CRSP one-shot gene therapy Casgevy was approved for two blood disorders, sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT), in multiple regions in late 2023/early 2024. Casgevy’ approval has diversified its commercial opportunity.

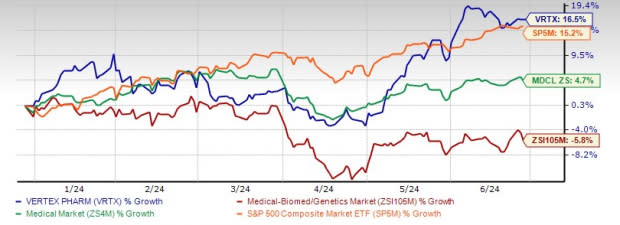

So far this year, the stock has risen 16.5% against the industry’s 4.6% decline. The stock has also outperformed the sector as well as the S&P 500.

VRTX Stock Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Casgevy Diversifies Commercial Opportunity

Vertex and CRISPR Therapeutics’ Casgevy is the first-ever CRISPR/Cas9-based therapy to be approved anywhere in the world. Vertex and CRSP believe Casgevy has the potential to be a one-time functional cure for SCD and TDT patients, with an estimated patient population of approximately 35,000 across the United States and Europe.

Vertex is making rapid progress with the launch of Casgevy and is also making great progress with payers. Vertex expects to record Casgevy sales from the second half of 2024.

New Products on the Way

Vertex has additional near-term launches planned. These include suzetrigine for acute pain and vanzacaftor triple for CF. Vertex is optimistic that both products can be launched this year.

For suzetrigine (formerly known as VX-548), Vertex has initiated a rolling new drug application (NDA) submission process across a broad label in moderate-to-severe acute pain. It is on track to complete the NDA submission soon. Vertex plans to initiate a pivotal phase III program of suzetrigine in diabetic peripheral neuropathy (DPN), a form of peripheral neuropathic pain caused by damage to nerves, in the second half of 2024. Data from the phase II study on suzetrigine in DPN demonstrated a promising safety and efficacy profile of suzetrigine with consistent efficacy seen across all doses studied.

Vertex has also initiated a phase II study of VX-548 in patients with painful lumbosacral radiculopathy, another form of peripheral neuropathic pain. Vertex believes suzetrigine has the potential to transform the treatment paradigm of pain, both acute and neuropathic. Pain is an area with limited treatment options, mostly highly addictive opioid-based medications.

VRTX filed regulatory applications for vanza triple for treating people with CF aged six years and older in the United States and EU in mid-2024. Vanza triple is a combination of vanzacaftor, a CFTR potentiator, deutivacaftor, a CFTR corrector and tezacaftor. This new once-a-day oral combination medicine has the potential for enhanced patient benefit than Trikafta patients. It can potentially treat CF patients who have discontinued Trikafta or other Vertex CF medicines. It can also improve dosing (once daily) and lower the royalty burden.

Robust Pipeline

Vertex is evaluating its medicines in younger patient populations and aims to have small-molecule treatments for most people with CF. Additionally, Vertex is developing an mRNA therapeutic, VX-522, in partnership with Moderna MRNA for approximately 5,000 people with CF who do not make CFTR protein and who cannot benefit from its CFTR modulators.

Vertex has a rapidly advancing mid- to late-stage pipeline in other disease areas like APOL1-mediated kidney diseases, alpha-1 antitrypsin deficiency and cell therapy for type I diabetes. Many of these candidates represent multibillion-dollar opportunities. This year is expected to be a catalyst-rich year for Vertex. Several important clinical milestones are expected over the few months in its CF and non-CF portfolio. The pending $4.9 billion acquisition of Alpine Immune Sciences will add povetacicept to Vertex’s pipeline. The candidate is set to enter into late-stage development for the treatment of IgA nephropathy in the second half of 2024.

Stock Price & Rising Estimates

The stock is trading at a premium to the industry, as seen in the chart below.

VRTX Stock Valuation

Image Source: Zacks Investment Research

However, Vertex’s stock has gone up by 140% in the past three years, mainly due to its solid pipeline progress and strong CF sales. The stock has been trading above its 50-day and 200-day moving averages since early May.

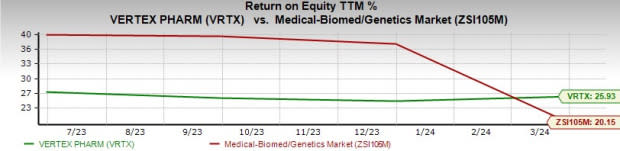

The stock’s return on equity on a trailing twelve-month basis is 25.93%, which is higher than 20.15% for the biotech industry, as seen in the chart below.

VRTX Return on Equity

Image Source: Zacks Investment Research

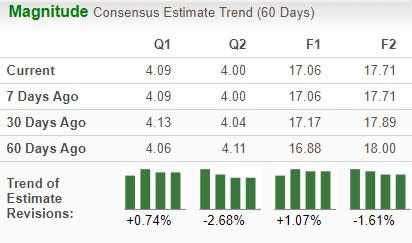

Estimates for Vertex’s 2024 earnings have moved up from $16.88 to $17.06 over the past 60 days.

VRTX Estimate Movement

Image Source: Zacks Investment Research

Conclusion

Vertex’s CF franchise sales are expected to remain strong despite a slight slowdown in the growth rate. Vertex also faces minimal competition in the CF franchise. Casgevy and suzetrigine (if approved) will provide the necessary diversification from the CF franchise. Its dependence on just the CF franchise for growth was a concern for several analysts but the company is gradually resolving it. The new drugs will propel its top line in future quarters.

Vertex is a great stock to have in one’s portfolio based on its strong overall financial performance and robust pipeline progress. Consistently rising earnings estimates clearly highlight analysts’ optimism about its ability to grow and diversify further. Those who already own this Zacks Rank #3 (Hold) stock should retain it. Though VRTX’s stock currently looks expensive, we don’t see any need to sell the stock as the company has growth potential. Those who don’t already own the stock may consider buying it if they want to keep it for a long timeframe.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance