Vertex (VRTX), CRISPR to Seek FDA Nod for Hemoglobinopathy Therapy

Vertex Pharmaceuticals VRTX secured permission from the FDA to initiate a rolling biologics license application (BLA) submission for its ex-vivo gene-therapy exagamglogene autotemcel (exa-cel). The gene therapy has been developed in collaboration with CRISPR Therapeutics CRSP.

The BLA will seek FDA’s approval for exa-cel to treat sickle cell disease (“SCD”) and transfusion-dependent beta thalassemia (“TDT”). Vertex expects to start the rolling review this November and intends to complete the same by the end of first-quarter 2023.

The filing with the FDA will be supported by data from two ongoing phase I/II/III studies – CLIMB-111 and CLIMB-121 – evaluating exa-cel in patients aged 12 through 35 with TDT and SCD indications, respectively. Both studies have completed enrolling patients.

Earlier in June, Vertex and CRISPR Therapeutics announced updated data from the exa-cel studies, which showed that the therapy could be a one-time functional cure for SCD and TDT.

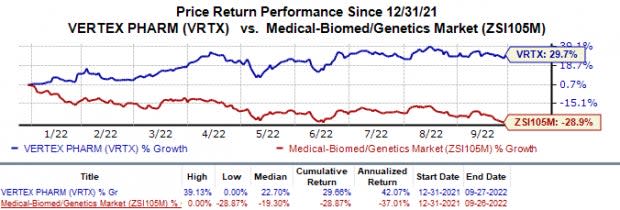

Shares of Vertex have gained 29.7% in the year so far against the industry’s 28.9% decline.

Image Source: Zacks Investment Research

Vertex and CRISPR Therapeutics have also initiated two new phase III studies evaluating exa-cel in pediatric patients with TDT and SCD.

Vertex has already completed discussions on exa-cel for both SCD and TDT indications with European regulatory authorities. Based on these discussions, management intends to submit the regulatory filings in the European Union and the United Kingdom by this year’s end.

SCD and TDT indications have a significant unmet medical need. If successfully developed and commercialized, exa-cel can help Vertex Pharmaceuticals diversify its portfolio of marketed drugs that are currently focused on treating cystic fibrosis (CF). If approved, exa-cel will be Vertex’s first non-CF product and CRISPR Therapeutics’ first marketed product.

While Vertex’s main focus is on the development and strengthening of its CF franchise, the company also has a rapidly advancing mid- and late-stage clinical pipeline across six disease areas beyond CF like acute pain, sickle cell disease, beta-thalassemia, APOL1-mediated kidney diseases (AMKD) and cell therapy for type I diabetes. Vertex is also looking for early-stage companies and products or intellectual property acquisitions that could help it broaden its pipeline beyond CF.

Both Vertex and CRISPR entered into a collaboration agreement in 2015. Apart from exa-cel, both companies are working on developing therapies for cystic fibrosis as well as Duchenne Muscular Dystrophy (DMD) and Myotonic Dystrophy Type 1 (DM1).

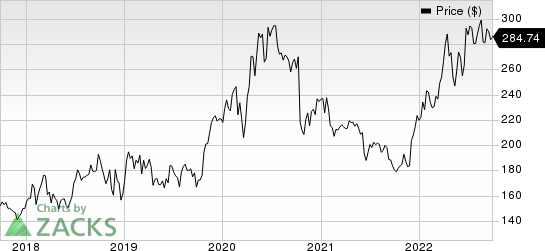

Vertex Pharmaceuticals Incorporated Price

Vertex Pharmaceuticals Incorporated price | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank & Stocks to Consider

Vertex currently carries a Zacks Rank #3 (Hold).A couple of better-ranked stocks in the overall healthcare sector are Morphic MORF and Sanofi SNY. While Morphicsports a Zacks Rank #1 (Strong Buy), Sanofi carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Morphic’s 2022 loss per share have narrowed from $3.38 to $1.80. Loss estimates for 2023 have narrowed from $3.91 to $3.62 during the same period. Shares of Morphic have lost 43.4% in the year-to-date period.

Earnings of Morphic beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 48.29%, on average. In the last reported quarter, MORF delivered an earnings surprise of 183.95%.

In the past 60 days, estimates for Sanofi’s 2022 earnings per share have increased from $4.06 to $4.14. Earnings estimates for 2023 have increased from $4.23 to $4.29 during the same period. Shares of Sanofi have lost 25.7% in the year-to-date period.

Earnings of Sanofi beat estimates in each of the last four quarters, witnessing a surprise of 9.37%, on average. In the last reported quarter, SNY delivered an earnings surprise of 8.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Morphic Holding, Inc. (MORF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance