VCPlus to raise $1.7 million by issuing 170 mil new shares to 5 investors

This will strengthen its financial position, VCPlus directors say.

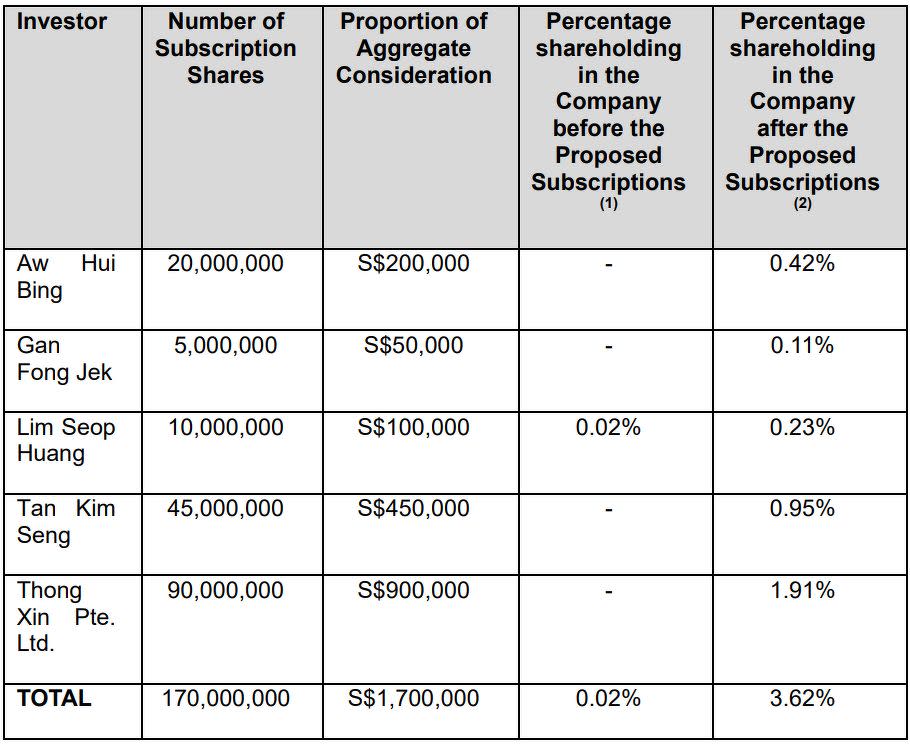

Investment holding firm VCPlus has announced that it will issue 170 million new shares at one cent per share to five investors in five different subscription agreements, raising proceeds of about $1.7 million.

Five investors, namely, Aw Hui Bing, Gan Fong Jek, Lim Seop Huang, Tan Kim Seng and investment holding company Thong Xin have agreed to subscribe for an aggregate of 170 million new ordinary shares.

In the SGX filing, it is said that each of the investors is subscribing for investment purposes, and was introduced to the company by VCPlus’s CEO Clarence Chong through his extended business network.

No introducer fee or commission was paid in connection with the Proposed Subscriptions. VCPlus also disclosed that Lim also currently holds one million shares in VCPlus, representing a 0.02% stake.

The issue price of one cent per share represents a premium of approximately 12.36% to the volume weighted average price (VWAP) of 0.89 cent per share as of Dec 7, the last trading day before this announcement

VCPlus says its directors are of the view that the proposed subscriptions are beneficial, as they will allow it to strengthen its financial position, improve its cash flow and increase the working capital available to the company.

The company will raise net cash proceeds of approximately $1.67 million, after deducting expenses of about $30,000.

In the filing, VCPlus also revealed that 40% of the proceeds will go to fund the commencement of its custodial services business after receiving the in-principle approval from the Monetary Authority of Singapore, while the remaining 60% will be used as working capital.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Catalist-listed VCPlus receives MAS approval to provide custodial services for tokenised securities

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance