Vanguard Markets & Economy Perspective: Technology and Demographics: The Economic Tug-of-War

In March 2024, the Federal Reserve Board released its longer-run economic projections:1

Real economic growth between 1.6% and 2.5% per year, perhaps a percentage point less than the growth rate since World War II.

Annual inflation of 2%.

Short-term interest rates between 2.4% and 3.6%, well below their current level.

The Congressional Budget Office (CBO) and the Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters produce similar projections. The broad economic consensus, in other words, is that our economic future will resemble its recent pastanemic productivity growth, low inflation, and near-zero inflation-adjusted returns on savings instruments such as U.S. Treasury bills.

That's unlikely.

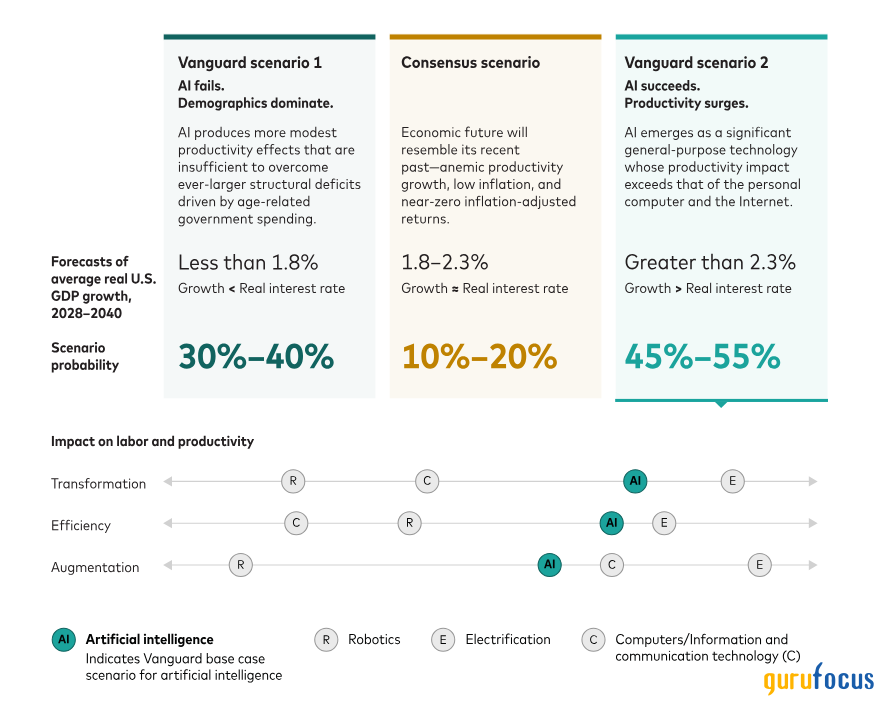

The probability is 10%20%. The most likely outcome, with a probability of 45%55%, is that artificial intelligence (AI) catalyzes a surge in economic growth. Next most likely, 30%40%, is that AI fails to meet our expectations. A slow-growing, aging population fuels government deficits and debt that limit growth and improvement in living standards.

A new megatrends forecasting framework

Where do these forecasts come from?

We generate these insights with a novel framework that integrates the short-term business-cycle variables that drive most economic forecasts with the slower-moving supply-side forces that determine an economy's productive capacity over decades. These megatrend forces include demographics, technological change, deficits and debt, and globalization. (Megatrends and the U.S. Economy, 1890-2040Opens in a new tab reviews our empirical framework and forecasts in detail.)

The analysis indicates that our future depends on a tug-of-war between AI and demographics-driven deficits. The victor, and its margin of victory, will determine the economic and financial outcomes that matter to workers, investors, and policymakers.

Age-related spending and structural deficits

The U.S. government ran a primary surplus in 141 of the 208 years between 1792 and 1999, almost 70% of the time. (A primary surplus means that tax revenues exceed government spending excluding interest payments on the debt.)More recently, this pattern flipped. The U.S. recorded primary deficits in 20 of the 24 years between 2000 and 2023 (83%).2

What explains the flip? An aging population, which means greater government spending on health care and Social Security. Deficits are now a structural feature of the U.S. economy. These deficits, coupled with the post-COVID rise in interest rates, will increase the public debt. According to CBO estimates, by 2054 the ratio of U.S. debt to GDP will exceed 170%, up from about 100% today. These deficits threaten to raise inflation and borrowing costs, limiting economic growth.

But debt (and demographics) need not be destiny. Emerging technologies, notably AI, can boost economic growth, enhancing our capacity to finance and reduce the cost of age-related spending.

The AI opportunity: A productivity surge

Over the past 130 years, technological innovation has been the primary driver of productivity growth and improvements in living standards. Such innovation can be characterized in three ways:

General-purpose technologies (GPTs) such as electricity and the computer.

Automation of routine tasks that free workers to focus on more valuable work.

Labor-augmenting innovations such as power tools.

Since the late-1990s, productivity growth has stagnated. We expect this trend to reverse. In the past, two conditions have preceded the emergence of GPTs: surging capital investment in new technologies and sluggish productivity growth. Both conditions prevail today.

If the AI impact approaches that of electricity, our base case is that growth will offset demographic pressures, producing an economic and financial future that exceeds consensus expectations. But if productivity gains mirror those delivered by robotics, computers, and the Internet, demographics will dominate. Economic and financial outcomes will fall short of consensus estimates.

Sizing the odds of a demographics- or an AI-driven economic future

Notes: We define transformation as a shock to the diffusion of general-purpose technology, efficiency as a shock associated with automation, and augmentation as a labor-augmenting shock where both output and employment rise simultaneously.

Source: Vanguard.

Technology and demographics: an eternal tug-of-war

Technology and demographics have always competed, as Thomas Malthus articulated in An Essay on the Principle of Population (1798). He argued that population growth would lead to war, famine, and disease. In 1798, the earth's population totaled 800 million. But in 2022, 8 billion people inhabited a richer, healthier planet. Technological progress neutralized the Malthusian warning: The power of population is indefinitely greater than the power in the earth to produce subsistence for man.

Yet the tug-of-war continues. Today, the struggle is between a slower-growing, aging population and our capacity to improve, or even maintain, living standards. As economist Ester Boserup observed, however, necessity is the mother of invention. We expect technology to prevailwe'll innovate faster than we age.

1 The Fed doesn't specify a time frame for longer-run projections, noting only that it represents the Federal Open Market Committee members' assessment of the value to which each variable would be expected to converge, over time, under appropriate monetary policy and in the absence of further shocks to the economy.

2 Sources: Vanguard calculations, based on government spending and outlay data from the Global Financial Database (for 17921961) and the Congressional Budget Office (19622023).

Note:

All investing is subject to risk, including the possible loss of the money you invest.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance