Using ETFs To Hedge Against Rising Rates

The September Federal Reserve meeting passed without much fanfare, quieting markets that had been getting jittery about a rate hike. The central bank―eyeing the uncertainty of a presidential election in November―chose to delay its much-anticipated interest rate increase, but not for long.

After the no-change decision, Federal Reserve Board Chair Janet Yellen told the press that she expects a rate hike sometime this year. That means that an increase may come either at the November or December meeting, with most economists targeting the latter as the likeliest option for a move.

If so, it will be deja vu, for it was last December when the Fed hiked rates for the first time in nearly a decade after months of anticipation. Another hike this December would push the federal funds rate up by 25 basis points to a range of 0.50-0.75% from 0.25-0.50%.

Rates Down From Start Of Year

Market-set rates are up from their lows ahead of the potential rate increase, though they're down significantly from where they were at the start of the year.

The two-year Treasury bond yield, for example, is at 0.75%, up from a low of 0.50% in June, but down from 1.05% on Dec. 31. At the same time, the 10-year Treasury bond yield is at 1.56%, up from a record-low 1.32% in July, but down from 2.27% on Dec. 31.

It's impossible to say whether the next Fed hike will be the catalyst that finally spurs a big rally in interest rates (and sell-off in bonds). But for investors who want to protect themselves, there are many tools available in the ETF world to minimize the impact of higher rates, or even capitalize on them.

Lower Duration Bonds

The classic advice given to investors in a rising rate environment is to reduce the duration of your bond portfolio. Duration is a measure of interest rate risk and is based on a bond's maturity and coupon payments.

A higher-duration portfolio has more interest rate risk than a lower-duration portfolio. By reducing duration―for example, by buying shorter-term bonds―a portfolio will have less interest rate risk. The flip side is that the portfolio will probably have a smaller yield as well.

There are plenty of low-duration ETFs on the market that can help reduce the average duration of an investor's portfolio, including the iShares 1-3 Year Treasury Bond ETF (SHY), the PIMCO Enhanced Short Maturity Active ETF (MINT) and many more.

Inverse Bond ETFs

Another method with which to hedge against rising rates is inverse ETFs. These funds short Treasury bonds, meaning they rise in price when interest rates increase (bond prices and rates generally move inversely).

The ProShares Short 20+ Year Treasury ETF (TBF) provides daily inverse exposure to Treasurys with maturities greater than 20 years.

Meanwhile, the Sit Rising Rate ETF (RISE) shorts futures contracts on two-, five- and 10-year Treasurys with a specific goal of maintaining a duration of negative 10. That means if interest rate rise by 1%, the ETF should rise by 10% (and vice versa).

TBF, RISE and similar ETFs can be used to hedge other bond funds in a portfolio or as stand-alone products to speculate on the direction of interest rates.

Keep in mind, however, that any product that shorts positive-yielding bonds will have to pay a cost to maintain that position over time. This can result in losses even if interest rates remain flat.

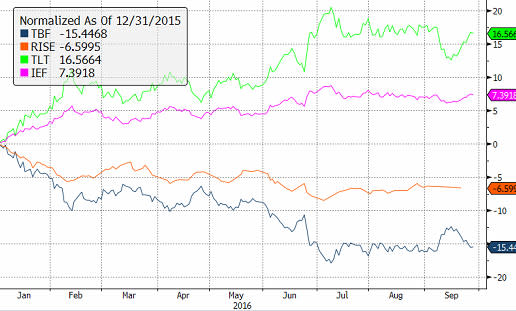

YTD Returns For TBF, RISE, TLT, IEF

Long/Short Bond Funds

Another group of ETFs attempts to reduce duration by simultaneously holding long and short positions in bonds. The WisdomTree Barclays US Aggregate Bond Negative Duration Fund (AGND) holds the bonds in the Barclays Aggregate Bond Index and a short position in Treasurys at the same time. The result is a portfolio of bonds with a duration of negative 5.

Once again, AGND could be used as a stand-alone product to speculate on interest rates or combined with, say, another position in the iShares Core U.S. Aggregate Bond ETF (AGG) (which incidentally has a duration of positive 5) to reduce an investor's interest rate risk.

ETFs that use a similar strategy as AGND’s include the VanEck Vectors Treasury-Hedged High Yield Bond ETF (THHY) and the ProShares High Yield-Interest Rate Hedged ETF (HYHG), which short Treasurys to hedge a portfolio of high-yield bonds. Both target a duration of zero.

YTD Returns For AGND, THHY, HYHG, AGG, HYG

Floaters

For investors who want to do away completely with interest rate risk, a straightforward solution floating-rate ETFs. The iShares Floating Rate Bond ETF (FLOT) holds a basket of bonds with maturities of five years or less. As floating rate notes, the interest rates on these securities resets periodically based on market rates; so if rates increase, the payout increases too (the downside is that rates on floaters will tend to be lower to account for the smaller risk).

Floaters are attractive compared to fixed-rate bonds when rates are expected to increase, but not as attractive when rates are expected to decline.

The PowerShares Senior Loan Portfolio (BKLN) is another type of floating-rate ETF. It tracks an index of the 100 largest bank loans with floating rate coupons. The fund has little interest rate risk, but relatively high credit risk due to its below-investment-grade portfolio.

YTD Returns For FLOT, BKLN, SLQD, HYG

Contact Sumit Roy at sroy@etf.com.

Recommended Stories

Yahoo Finance

Yahoo Finance