USD/CAD Faces Volatile Week

For the Canadian Dollar (CAD), the Bank of Canada meeting on Wednesday will be crucial, while in the United States, Friday’s Non-Farm Payrolls (NFP) report will be decisive for the direction of the US Dollar (USD).

Other important statistics are also expected throughout the week, including the US ISM Manufacturing PMI today, the US ISM Services PMI on Wednesday, the Canadian Ivey PMI on Thursday, as well as the Canadian trade balance and unemployment rate on Friday.

Will the USD/CAD Keep Falling?

The USD/CAD pair has seen a reversal of fortunes in 2024. After gaining 4.41% by mid-April, it has shed roughly 1.40% since then. The recent decline intensified after May 30th, with prices falling below the Ichimoku cloud and its key lines (Tenkan, Kijun). The Lagging Span also dipped below the price and indicator lines, further strengthening the bearish sentiment. Additionally, the Relative Strength Index (RSI) dropped below 50, indicating a potential downtrend.

The question is whether USD/CAD will continue its descent towards the support levels at 1.36017 and 1.35358, or if it can manage a recovery and climb back above the Ichimoku cloud. While the technical indicators paint a bearish picture, upcoming events this week could influence the direction decisively.

CAD: Monetary Policy Meeting From the Bank of Canada on Wednesday

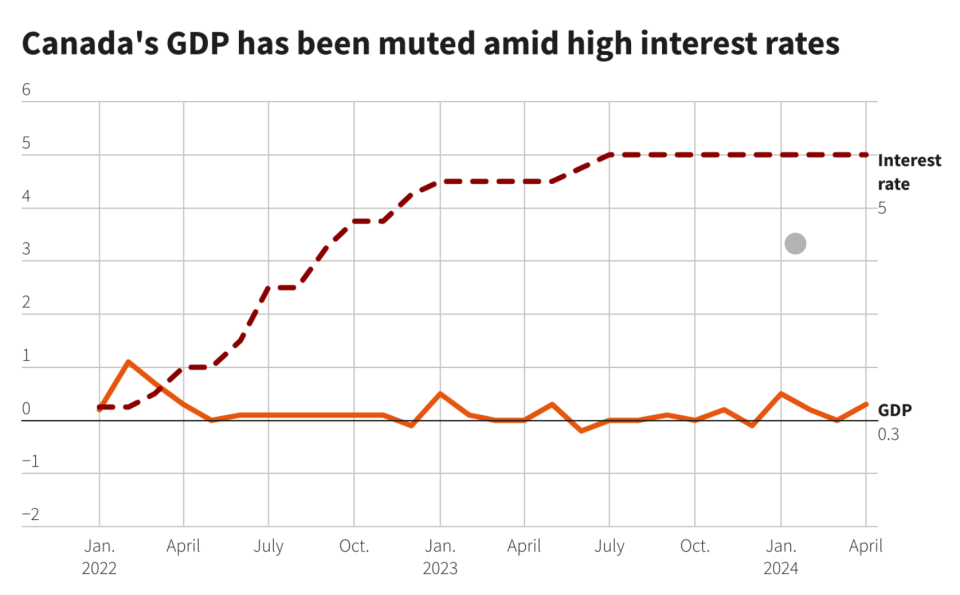

The Bank of Canada (BoC) maintained its key interest rate at 5% for the seventh consecutive month in April 2024. This decision comes amidst a backdrop of a slowing but still positive global economy (around 3% growth) and receding inflation in many developed countries.

For Canada, the BoC is projecting stronger economic growth in 2024 compared to 2023. The BoC forecasts a GDP growth of 1.5% for 2024, rising to 2.2% in 2025 and 1.9% in 2026. This optimism is fueled by factors like:

Robust population growth

Increased household spending

Higher residential investment driven by strong housing demand

On the inflation front, the BoC expects inflation to remain near 3% in the first half of 2024 before gradually easing towards 2.5% in the second half. They anticipate reaching their 2% target by 2025.

This upcoming monetary policy meeting will be crucial for updating economic and inflation projections based on the latest data and statistics. And the Bank of Canada’s upcoming interest rate decision has analysts split. Some anticipate a cut to 4.75% this week, while others believe the central bank will hold at 5% to ensure inflation falls sustainably towards its target.

Canada’s Consumer Price Index (CPI) did show some relief in April, rising 2.7% year-over-year compared to 2.9% in March. However, BoC’s Governor Tiff Macklem cautioned about external risks:

Escalating global tensions

Faster-than-expected Canadian house price increases

High wage growth exceeding productivity gains

These factors, he warned, could push inflation higher. Conversely, a weaker global and Canadian economy could cool demand and inflation too much. In the first quarter of 2024, the Canadian growth grew less than expected and the last quarter of 2023 was also revised downward.

Canada’s economy grew at a slower-than-expected pace of 1.7% in the first quarter of 2024. This fell short of both analyst forecasts (2.2% according to a Reuters poll) and the central bank’s estimate (2.8%). Real gross domestic product increased 0.4% in Q1 2024, after no change in Q4 2023 (revised down from 0.2%).

This lacklustre growth has been fueling speculation that the Bank of Canada may cut interest rates sooner rather than later.

USD: The US Non-Farm Payroll (NFP) Report on Friday

April’s jobs report fell short of expectations, with nonfarm payrolls adding only 175,000 jobs compared to the Dow Jones estimate of 240,000. The unemployment rate also inched up to 3.9%, breaking its streak of holding at 3.8%. April marked the fewest job gains since October 2023.

While a slowdown in job growth has sparked speculation about potential interest rate cuts from the Federal Reserve later this year, recent comments from Fed officials and other economic data paint a more cautious picture.

Fed officials have emphasised the need to stay vigilant on inflation. They suggest current interest rates, near two-decade highs, might need to remain in place for some time to ensure inflation is on a sustainable path towards the Fed’s 2% target.

The upcoming May Non-Farm Payroll (NFP) report is expected to show continued job creation, around 185,000, with interest rates likely staying at 3.9%. However, the Fed’s policy decision will hinge on a broader assessment of inflation and economic data beyond just the May jobs numbers.

Bottom Line

The upcoming policy decisions by the Bank of Canada and the European Central Bank (ECB) are poised to trigger volatility into the foreign exchange market (Forex). With both central banks potentially leaning towards rate cuts, a widening interest rate differential could emerge between them and the Federal Reserve, which is expected to maintain its hawkish stance.

This potential divergence in monetary policy could have a particularly strong impact on the value of the US dollar (USD) relative to the Canadian dollar (CAD) and the euro (EUR). If the BoC and ECB lower their rates, while the Fed stays put, the USD could appreciate against both the CAD and EUR. This is because traders and investors are generally drawn to currencies with higher interest rates, as they offer potential for greater returns.

For the USD/CAD specifically, a rate cut by the BoC combined with a steady Fed rate could weaken the Canadian dollar and push the USD/CAD currency pair higher. This scenario would be especially likely if the market perceives the BoC’s rate cuts as the sign of a weaker Canadian economy compared to the US.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 66% and 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance