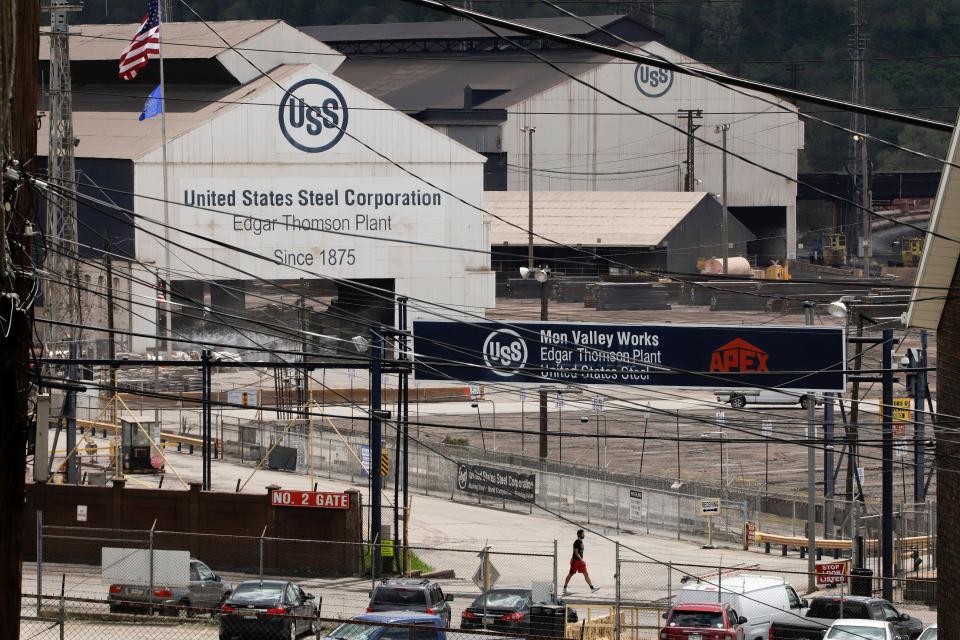

US Steel to be acquired by Japan's Nippon Steel for nearly $15 billion, companies announce

Nippon Steel Corporation, the largest steelmaker in Japan, is acquiring the United States Steel Corporation for almost $15 billion, the two companies announced Monday.

According to a release, Nippon Steel Corporation, or NSC, is acquiring U.S. Steel in an all-cash transaction at $55 per share for a total enterprise value of $14.9 billion. The transaction was unanimously approved by the board of directors at both U.S. Steel and NSC, and is expected to close in the second or third quarter of the 2024 calendar year.

The companies say the acquisition will further diversify NSC's global footprint by significantly expanding its current production in the U.S., and the company's total annual crude steel capacity is expected to reach 86 million tons.

In August, U.S. Steel rejected a $7.3 billion buyout proposal offer from rival Cleveland Cliffs, the Associated Press reported, around half of what NSC offered to acquire the company on Monday.

Even after U.S. Steel is acquired, it will retain its name, brand and headquarters in Pittsburgh, Pennsylvania, where it was founded in 1901 by JP Morgan and steel magnate Andrew Carnegie.

Congressional Budget Office: Expect higher unemployment and lower inflation in 2024

With the acquisition of U.S. Steel, any commitment with its employees, including collective bargaining agreements in place with its unions, will be honored, and NSC said it is committed to maintaining those relationships uninterrupted.

Both U.S. Steel and NSC said they share a commitment to decarbonize by 2050, and that "solving sustainability challenges is a fundamental pillar of a steelmaker's existence and growth."

“We are excited that this transaction brings together two companies with world-leading technologies and manufacturing capabilities, demonstrating our mission to serve customers worldwide, as well as our commitment to building a more environmentally friendly society through the decarbonization of steel," NSC President Eiji Hashimoto said in a release.

David B. Burritt, U.S. Steel's president and CEO, said the announcement also benefits the U.S., "ensuring a competitive, domestic steel industry, while strengthening our presence globally."

US Steel stock price

United States Steel Corporation (X) closed Friday trading at $39.33 per share.

Contributing: Associated Press.

This article originally appeared on USA TODAY: US Steel sale: Japan's Nippon Steel buys corporation for almost $15B

Yahoo Finance

Yahoo Finance