US Growth Companies With High Insider Ownership To Watch In June 2024

As the U.S. stock market approaches historic highs, driven by a bullish outlook on technology stocks and potential Federal Reserve rate cuts, investors continue to show strong interest in equities. In this climate, growth companies with high insider ownership may offer valuable insights into firm confidence and long-term commitment, aligning closely with current market optimism.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.4% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Underneath we present a selection of stocks filtered out by our screen.

Super Micro Computer

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture, operating globally with a market capitalization of $49.45 billion.

Operations: The company generates $11.82 billion in revenue from its high-performance server solutions segment.

Insider Ownership: 14.3%

Super Micro Computer, a key player in the high-growth sector with significant insider ownership, is expanding its Silicon Valley campuses to meet rising demand for AI-driven liquid-cooled data centers. This expansion enhances its delivery capabilities globally and supports energy-efficient AI workloads critical for modern computing needs. Despite facing a recent NASDAQ compliance issue due to board composition, Super Micro has resolved this swiftly, underscoring its responsive governance structure. Moreover, the company's financial outlook is robust with expected revenue growth from US$14.3 billion to US$15.1 billion and an anticipated substantial rise in earnings per share.

Coupang

Simply Wall St Growth Rating: ★★★★☆☆

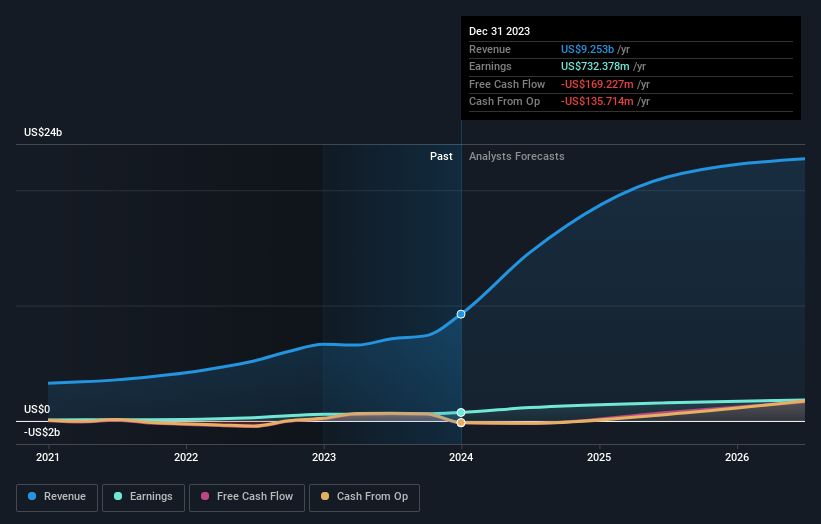

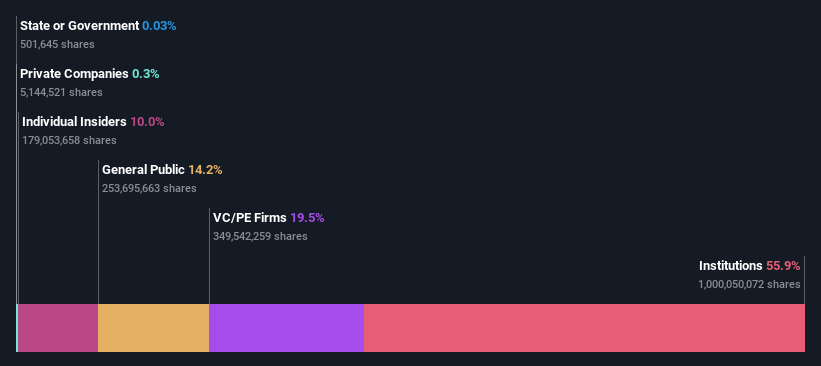

Overview: Coupang, Inc. operates a comprehensive retail business in South Korea through its mobile apps and websites, with a market capitalization of approximately $38.26 billion.

Operations: The company generates revenue primarily through its Product Commerce segment at $24.43 billion, complemented by Developing Offerings which contribute $1.27 billion.

Insider Ownership: 10%

Coupang, with high insider ownership, is trading at 42.6% below its estimated fair value and has shown impressive earnings growth of over 500% in the past year. Forecasted annual earnings growth at 17%, and revenue growth at 15.5% per year, both exceed US market averages. Recent activities include a substantial share buyback of US$177.9 million and mixed quarterly results with a significant revenue increase to US$7.11 billion but reduced net income to US$5 million from last year's US$91 million.

Take a closer look at Coupang's potential here in our earnings growth report.

The valuation report we've compiled suggests that Coupang's current price could be inflated.

Palantir Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding in counterterrorism efforts across the U.S., the U.K., and globally, with a market capitalization of approximately $52.49 billion.

Operations: Palantir's revenue is divided into two main segments: Commercial, generating $1.07 billion, and Government, producing $1.27 billion.

Insider Ownership: 13.4%

Palantir Technologies, a growth company with insider ownership concerns due to recent shareholder dilution, reported a strong partnership expansion with Tampa General Hospital to advance AI in healthcare. Despite this positive development, its revenue growth forecast at 16% per year is below the high-growth benchmark of 20%, though it still outpaces the US market average of 8.7%. Earnings are expected to increase by 24.4% annually, highlighting robust profit potential amidst operational challenges like shareholder dilution.

Taking Advantage

Click through to start exploring the rest of the 179 Fast Growing US Companies With High Insider Ownership now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:SMCI NYSE:CPNG and NYSE:PLTR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance