US Growth Companies With High Insider Ownership To Watch

Amid a mixed performance in the U.S. stock market, with recent downturns in tech-heavy sectors like semiconductors impacting indices such as the Nasdaq, investors might find stability and potential growth opportunities in growth companies with high insider ownership. These firms often demonstrate alignment between company leadership's interests and those of shareholders, which can be particularly appealing during periods of market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here we highlight a subset of our preferred stocks from the screener.

Afya

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Afya Limited is a medical education group based in Brazil, with a market capitalization of approximately $1.47 billion.

Operations: The company's revenue is primarily derived from its undergraduate and continuing education programs, generating R$2594.56 million and R$154.03 million respectively.

Insider Ownership: 27.2%

Earnings Growth Forecast: 23.5% p.a.

Afya, a growth-oriented company with high insider ownership, is demonstrating robust financial health and strategic shareholder engagement. The firm recently reaffirmed its 2024 revenue guidance between BRL 3.15 billion and BRL 3.25 billion following strong student intake. Afya's earnings have significantly outpaced market averages, with a notable 23.46% yearly growth forecast and substantial value recognition, trading at 44.2% below estimated fair value despite recent operational write-offs of BRL 19,000 in Q1 2024.

Click to explore a detailed breakdown of our findings in Afya's earnings growth report.

The valuation report we've compiled suggests that Afya's current price could be quite moderate.

Innovid

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovid Corp., operating an independent software platform for ad serving, measurement, and creative services, has a market capitalization of approximately $264.28 million.

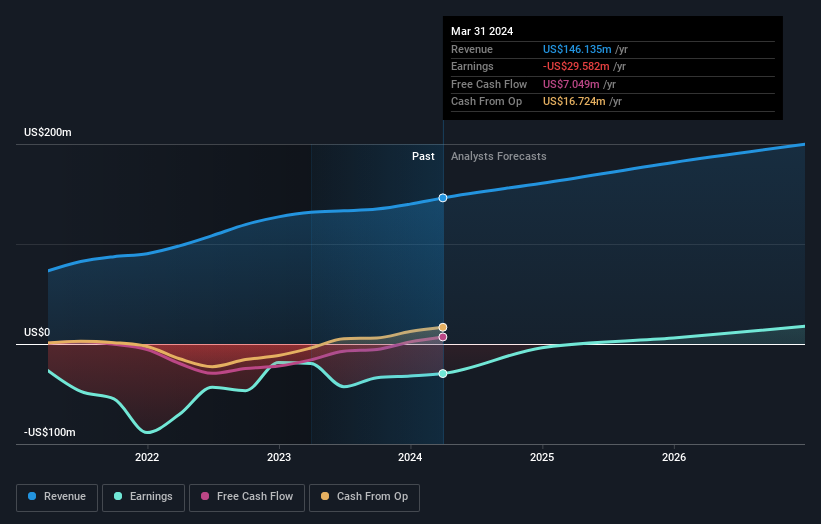

Operations: The company generates revenue primarily through advertising and creative services, totaling approximately $146.14 million.

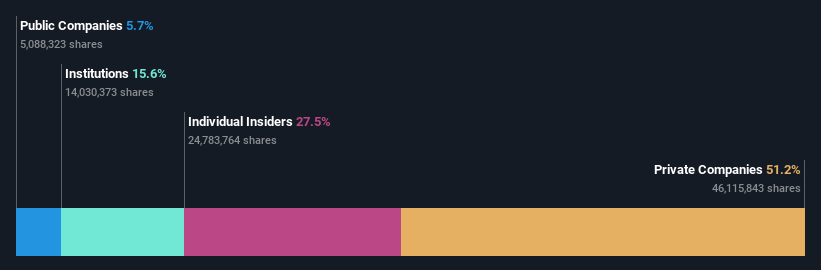

Insider Ownership: 10.9%

Earnings Growth Forecast: 122% p.a.

Innovid, a company with significant insider transactions recently, reported a reduced net loss in Q1 2024 to US$6.23 million from US$8.56 million year-over-year and anticipates revenue growth of 9% to 14% in Q2. The company's strategic initiatives include the "Harmony" product for optimizing CTV advertising efficiency and the collaborative report with Target’s Roundel, enhancing shopper engagement through CTV ads. Despite these positive developments, Innovid's Return on Equity is expected to remain low at 4.3%, reflecting slower than ideal growth projections in profitability and revenue compared to market averages.

Click here to discover the nuances of Innovid with our detailed analytical future growth report.

Our expertly prepared valuation report Innovid implies its share price may be lower than expected.

Endava

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc is a global technology service provider specializing in consumer products, healthcare, mobility, and retail sectors across North America, Europe, the United Kingdom, and internationally, with a market capitalization of approximately $1.65 billion.

Operations: The company generates £736.13 million in revenue from its computer services segment.

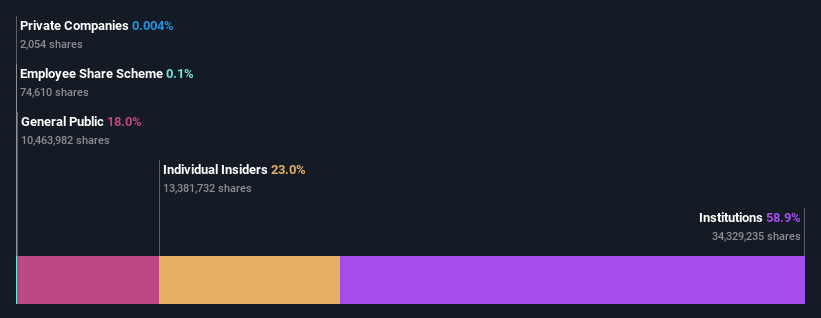

Insider Ownership: 23%

Earnings Growth Forecast: 35.9% p.a.

Endava has forecasted a notable decline in year-over-year revenue growth for FY 2024, ranging from a 4.0% to 4.5% decrease, despite expecting an increase in Q4 revenue by up to £197 million. The company's recent quarterly earnings showed a shift from a net income of £24.36 million to a net loss of £1.74 million, indicating potential challenges ahead. However, Endava's innovative launch of the Morpheus AI accelerator could enhance its market position by offering advanced solutions across regulated industries.

Turning Ideas Into Actions

Navigate through the entire inventory of 185 Fast Growing US Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AFYA NYSE:CTV and NYSE:DAVA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance