UOBKH touts 'blue-chip S-REITs' CICT, FLT and MINT as rates may stay higher for longer

The FTSE ST index (FSTREI) declined 3.2% in September, underperforming the Straits Times Index’s (STI) 0.5% fall.

S-REITs have to weather headwinds as interest rates are expected to stay higher for longer, but UOB Kay Hian Research analyst Jonathan Koh is maintaining “overweight” across the board.

Koh is focusing on “blue-chip S-REITs” with resilient balance sheets, “as they are better able to cope with higher interest rates”, according to his September S-REIT update released on Oct 3.

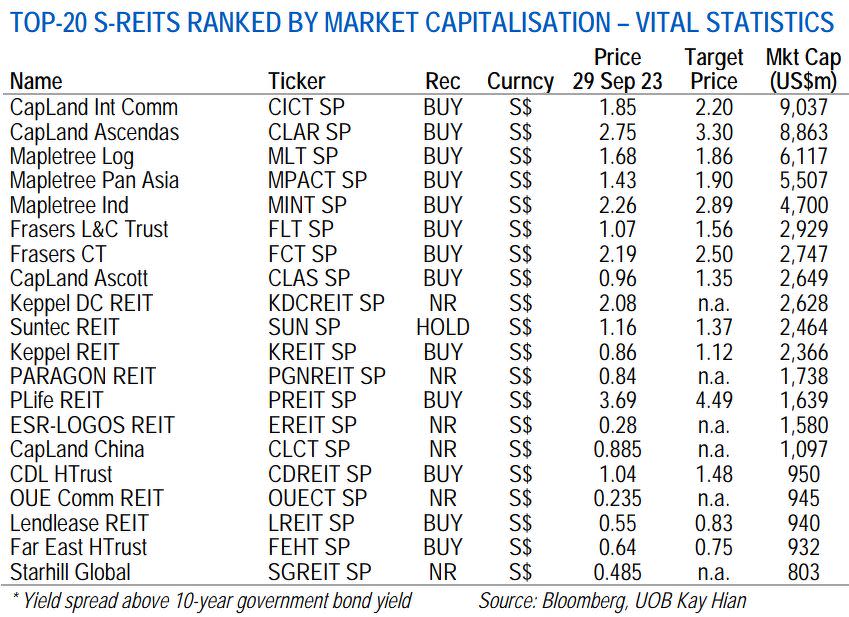

His top picks include CapitaLand Integrated Commercial Trust C38U (CICT), with a target price of $2.20, CapitaLand Ascendas REIT A17u (CLAR) at $3.30, CapitaLand Ascott Trust HMN (CLAS) at $1.35, Frasers Logistics and Commercial Trust BUOU (FLT) at $1.56 and Mapletree Industrial Trust Me8u (MINT) at $2.89.

While Koh remains optimistic across all five segments — healthcare, hospitality, industrial, office and retail — his top picks lie in industrial (CLAR, MINT), diversified (CICT, FLT) and hospitality (CLAS).

Chinese tourists are making their mark, notes Koh. Visitor arrivals from China have surged since July. The number of Chinese tourists eased 7% m-o-m to 214,491 in August, reaching 54% of pre-pandemic levels.

Overall, visitor arrivals increased 80% y-o-y but eased 8% m-o-m to 1.3 million in August, reaching 75% of pre-pandemic levels.

Chinese tourists accounted for 16.4% of total visitor arrivals compared with 19% in 2019. The Singapore Tourism Board expects visitor arrivals to reach between 12 million and 14 million in 2023, up from 6.3 million in 2022.

“Visitor arrivals are likely to hit the higher end of the range given the strong momentum seen in July and August,” says Koh.

The FTSE ST index (FSTREI) declined 3.2% in September, underperforming the Straits Times Index’s (STI) 0.5% fall.

The Fed left interest rate unchanged during the FOMC meeting on Sept 20 but is likely to hike Fed funds rate by another 25 basis points (bps) on Nov 1, notes Koh. “The Fed is expected to hold interest rates at restrictive levels until inflation moves sustainably lower towards the objective of 2%.”

Meanwhile, the yield for 10-year Singapore government bonds rose 26 bps to 3.40% in September.

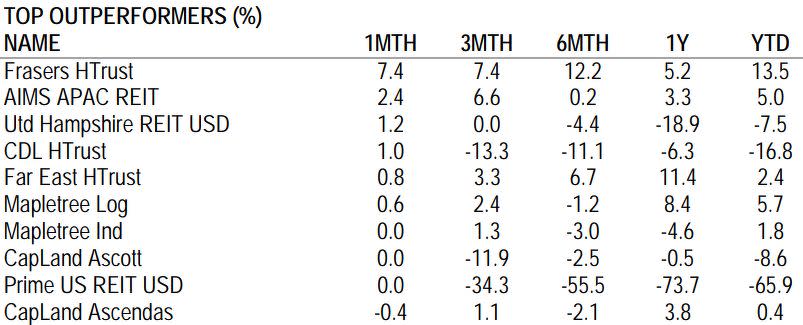

The top outperformers for September were hospitality REITs Frasers Hospitality Trust Acv (FHT), CDL Hospitality Trusts J85 (CDREIT) and Far East Hospitality Trust Q5t (FEHT), which gained 7.4%, 1.0% and 0.8% respectively.

Meanwhile, United Hampshire US REIT Odbu ODBU (UHU) moved against the tide by gaining 1.2%.

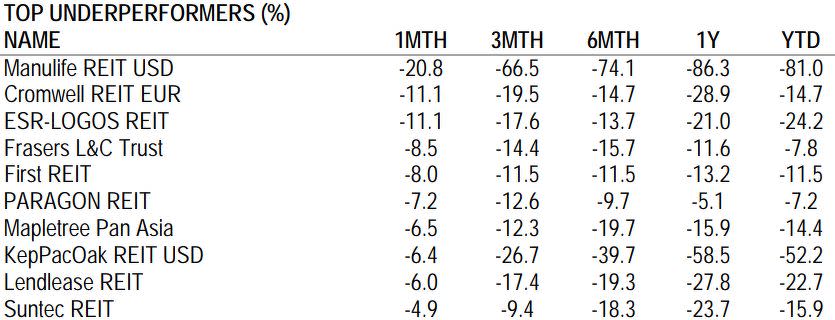

The top underperformers were US office REITs, which led the losers. Manulife US REIT BTOU (MUST) and Keppel Pacific Oak REIT CMOU (KORE) dropped 20.8% and 6.4% respectively.

Cromwell European REIT CWBU (CERT) and FLT declined 11.1% and 8.5% respectively due to their exposure to Europe.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

OUE C-REIT’s prime Singapore portfolio delivers sustained growth

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance