UOB Kay Hian maintains 'buy' call for MPACT as merger coincides with easing Covid restrictions in Asia

UOB Kay Hian analyst Jonathan Koh has a target price of $2.22.

UOB Kay Hian analyst Jonathan Koh has maintained his “buy” call for Mapletree Pan Asia Commercial Trust (MPACT) with a target price (TP) of $2.22.

In his report dated Sept 6, Koh noted that the merger between Mapletree Commercial Trust (MCT) and Mapletree North Asia Commercial Trust (MNACT) was executed and completed at an “opportune timing”, with MNACT’s Festival Walk property in Hong Kong benefitting from easing restrictions since April. Festival Walk could also be further strengthened if Hong Kong ends its hotel quarantine requirements as targeted by November, the analyst notes.

In addition, Festival Walk’s negative rental reversion moderated to -7% in the 1QFY2023 ended June, after two consecutive years of steep declines. The mall reported a negative rental reversion of -21% in the FY2021 and -27% in the FY2022, Koh notes.

Furthermore, rental relief granted to Festival Walk was almost “non-existent” at $200,000 in 1QFY2023 compared to $49.8 million in FY2021 and $14.7 million in FY2022. Meanwhile, consumer spending at the mall was stimulated by the first round of consumption vouchers disbursed in April and the second round in August, he adds.

MPACT could also see a potential boost from reopening Hong Kong borders, with its quarantine period for inbound travellers reduced from seven to three days with effect from Aug 12. Hong Kong targets to end hotel quarantine by November, after the 20th Communist Party Congress but ahead of the Hong Kong Institute of Bankers (HKIB) Banking Conference and Hong Kong Sevens rugby tournament.

Looking across to mainland China, Gateway Plaza and Sandhill Plaza registered positive rental reversion, says Koh. “Beijing weathered localised lockdown in 1QFY2023, which reduced the number of employees returning to work in their offices. Nevertheless, Gateway Plaza achieved positive rental reversion of 11% due to two new tenants from the technology and financial services sectors,” he explains.

He notes that occupancy was stable at 92.8%, while a new office building was completed in the Lufthansa sub-market in 1QFY2022 and supply-side pressure is expected to ease in 2HFY2022. Gateway Plaza will benefit as the Chinese government plans to develop Beijing into a global wealth management centre, adds Koh.

Meanwhile, Shanghai is recovering from the strict city-wide lockdown that lasted from end-March to end-May and, as a result, leasing activities have recovered in June 2022 with Sandhill Plaza achieving a positive rental reversion of 3% in 1QFY2023 and occupancy remaining high at 98.9%.

Sandhill Plaza is located in Zhangjiang Science City within Shanghai’s Pudong New Area, which is also known as Silicon Valley of the East, says Koh. While the Zhangjiang sub-market will see a large volume of new business park space in 2HFY2202, he notes that “fortunately”, Sandhill Plaza accounted for only 3.1% of MPACT’s portfolio valuation post merger.

According to CBRE, monthly rent for business parks in Shanghai increased 3.2% year-on-year (y-o-y) to RMB138.70 ($28.05) per sqm in 2Q2022.

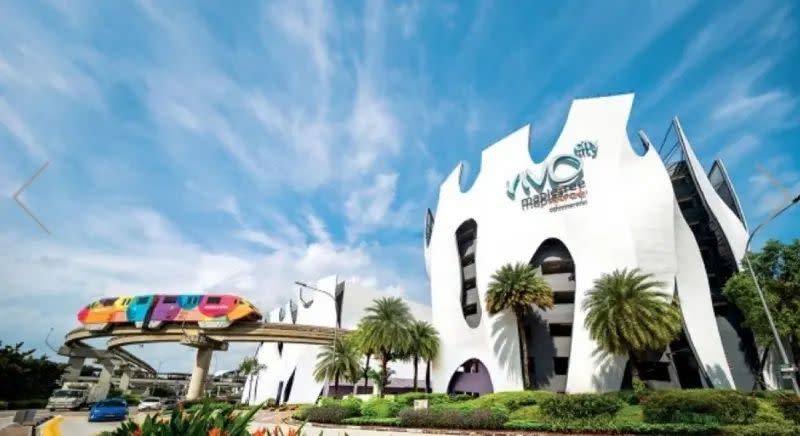

At home, Singapore’s progressively easing social distancing measures have propelled recovery, says Koh. VivoCity benefitted as tenant sales surged 53% y-o-y and 11% quarter-on-quarter (q-o-q) and exceeded pre-pandemic levels in 1QFY2023, while committed occupancy remained high at 98.5% as of June.

Net property income (NPI) from VivoCity rebounded 45% y-o-y and 19% q-o-q due to the easing of Covid-19 related restrictions and lower rental rebates, benefitting from the return of tourists from 2HFY2022 which typically accounted for 20% to 30% of shopper traffic pre-pandemic, writes the analyst.

NPI from Mapletree Business City (MBC) also grew 5.9% y-o-y and 4.9% q-o-q in 1QFY2023, with a committed occupancy rate of 98.2%. “Management sees leasing interest from pharmaceutical and biomedical companies expanding their R&D and laboratory facilities within City Fringe. It also observed less downsizing by banks during lease renewal. Google, the largest tenant at MBC accounting for 25% of gross rental income, has completed construction of its third data centre and is becoming more entrenched in Singapore,” adds Koh.

His share price catalysts include a distribution per unit (DPU) accretion of 8.9% from the merger with MNACT and potential expansion in China and South Korea. He notes that MPACT has five properties located in the HarbourFront area in Singapore, which accounted for 48.4% of its portfolio valuation in aggregate and stands to benefit from the development of the Greater Southern Waterfront and rejuvenation of Sentosa Island and Pulau Brani.

The trust scheme for the merger of Mapletree Commercial Trust (MCT) and MNACT to establish MPACT became effective on July 12; MNACT was delisted on Aug 3. MPACT holds a diversified portfolio of 18 high quality commercial properties across Singapore, Hong Kong, Mainland China, Japan and South Korea, with its assets under management (AUM) expanding by 94% to a combined $17.1 billion, says Koh.

The analyst has kept his DPU forecast relatively unchanged, while his TP of $2.22 is based on a dividend discount model (DDM) with a 7.0% cost of equity and 2.2% terminal growth.

As at 2.32pm, units in Mapletree Pan Asia Commercial Trust were trading 1 cent or 0.54% up at $1.86.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

UOB Kay Hian downgrades SingPost to 'hold', slashes patmi estimates on 'strong headwinds'

China Aviation Oil in reasonably healthy financial position: UOB Kay Hian

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance