UOB Kay Hian downgrades AEM Holdings to 'hold' despite record 1HFY2022 revenue

During the 1HFY2022 ended June, AEM reported earnings of $83 million, up 180% y-o-y.

UOB Kay Hian analyst John Cheong has downgraded AEM Holdings to “hold” from “buy” with a lower target price of $5.02, 10% down from his previous target price of $5.60.

“We roll over our valuation base year to FY2023 and peg it to a lower P/E multiple of 10.5x, or +0.5 standard deviation (s.d.) of its historical mean (down from 15.6x, or +2 s.d. to its historical five-year mean),” the analyst writes in his Aug 16 report.

“The reduction in our P/E multiple peg is to capture the potential weaker sentiment in the semiconductor industry as more global players, including Intel, are cautioning for a weaker near-term outlook,” he adds.

In late July, Intel slashed its revenue guidance for the FY2022 by around 12% to US$67 billion ($92.17 billion) after reporting a weaker-than-expected result.

The NASDAQ-listed company highlighted that the sudden and rapid decline in economic activity was the largest driver of the shortfall but 2QFY2022 also reflected its own execution issues in areas like product design and the ramp-up of accelerated computing systems and graphics group offerings, notes Cheong.

That said, the analyst’s positive view on AEM remains unchanged.

“We believe Intel’s IDM 2.0 strategy would benefit AEM. Driving towards that strategy, Intel’s new fabrication plants (fabs) would drive demand for AEM on new back-end testing equipment, while older fabs would contribute to steady demand for AEM’s consumables and services as well as equipment upgrades,” he says.

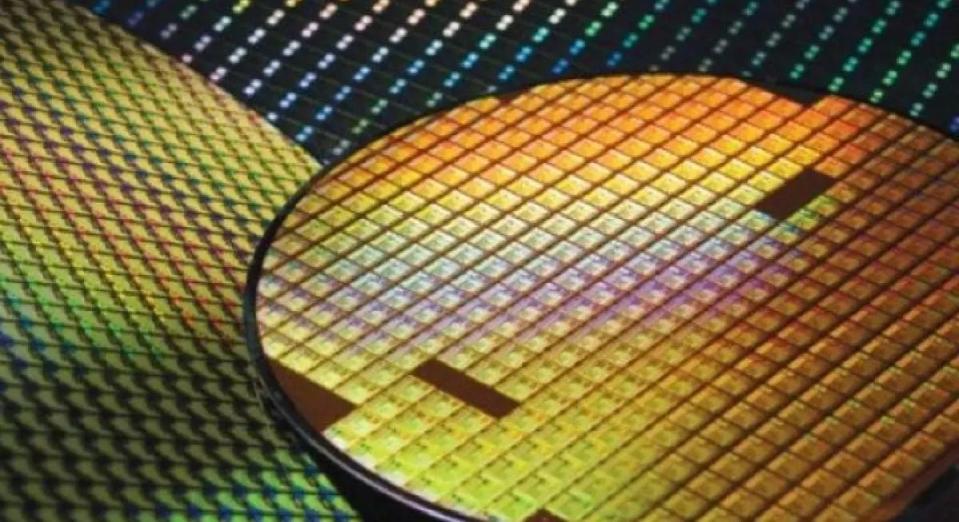

The analyst also likes that AEM is bringing its operations closer to its existing and potential customers by having new research and development (R&D) labs and better manufacturing facilities in its key geographies like Singapore, Malaysia and the US. The group is set to continue investing in its R&D and engineering capabilities as it believes that longer-horizon trends such as 5G, edge computing, artificial intelligence (AI), and electric vehicles will drive the need for more semiconductors and the integrated testing solutions that the group is pioneering.

Record 1HFY2022 results

During the 1HFY2022 ended June, AEM reported earnings of $83 million, up 180% y-o-y. The earnings stood above Cheong’s expectations, forming 75% of the analyst’s estimates for the FY2022.

In the same period, AEM also delivered the highest half-year revenue at $540.5 million, which was up by 181.1% y-o-y. The revenue growth was driven by volume ramp-up for the new generation system level testing handlers, burn-in test handlers, related consumables and peripheral tools, and contributions from CEI Pte Ltd which AEM acquired in March 2021.

The group’s profit before tax (PBT) for the 1HFY2022 also came in at a record high of $102.0 million, 187.4% higher y-o-y.

On the back of its stellar results, AEM’s management is expecting to see a record year. It has also raised its FY2022 revenue guidance to be between $750 million - $800 million from the $700 million - $750 million range previously.

“This implies a revenue growth rate of around 37%, after the $565.5 million achieved in FY2021,” Cheong notes.

To account for the higher revenue guidance, Cheong has raised his revenue estimates for the FY2022, FY2023 and FY2024 by 10%, 2% and 2% to $792 million, $828 million and $853 million respectively.

His earnings estimates will also increase accordingly, by 10%, 2% and 2% for the FY2022, FY2023 and FY2024.

As at 11.48am, shares in AEM are trading 9 cents lower or 1.95% down at $4.53.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

DBS downgrades Q&M to 'hold', lowers TP to 53 cents on delayed expansion plans

CICT seen as 'strongest contender' for Mercatus portfolio among local retailers: DBS

Analysts remain 'overweight' on Singapore banking sector due to NIM improvement

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance