Unveiling Top Growth Companies With High Insider Ownership On SIX Swiss Exchange In June 2024

The Swiss market has shown modest activity recently, remaining flat over the past week but experiencing a 4.6% rise over the last year, with earnings projected to grow by 8.3% annually. In this context, growth companies with high insider ownership on the SIX Swiss Exchange present an intriguing focus, as such attributes often suggest strong confidence in a company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

VAT Group (SWX:VACN) | 10.2% | 21.2% |

Straumann Holding (SWX:STMN) | 32.7% | 21% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

Gurit Holding (SWX:GURN) | 30.2% | 35.4% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here we highlight a subset of our preferred stocks from the screener.

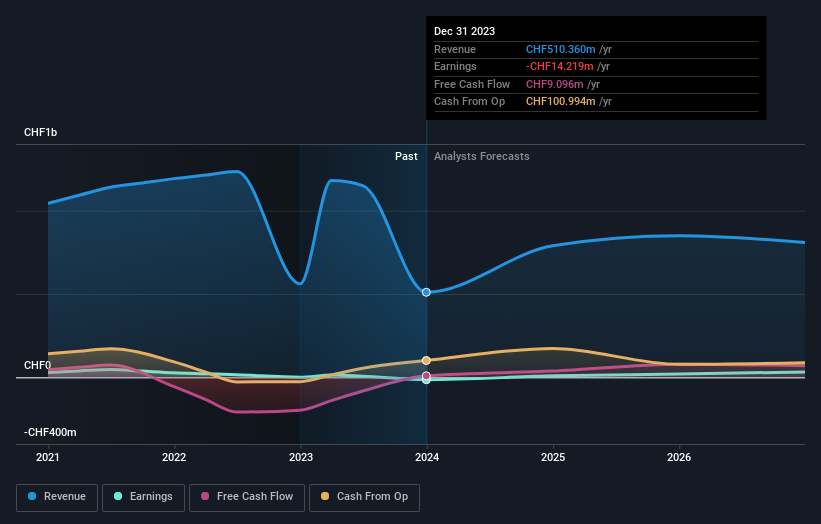

Arbonia

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arbonia AG is a company that supplies building components across Switzerland, Germany, and other international markets, with a market capitalization of approximately CHF 0.89 billion.

Operations: The company generates revenue primarily from its Doors segment, including sanitary equipment, which amounted to CHF 501.56 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 100.1% p.a.

Arbonia is poised for notable growth with expected profitability within three years, aligning with above-market average projections. Despite a low forecasted return on equity at 3.8%, the company's earnings are anticipated to surge by 100.06% annually. Additionally, revenue growth at 9% per year outpaces the Swiss market's 4.4%. However, there is no recent insider buying or selling activity to report, reflecting a stable but cautious ownership stance as of mid-2024.

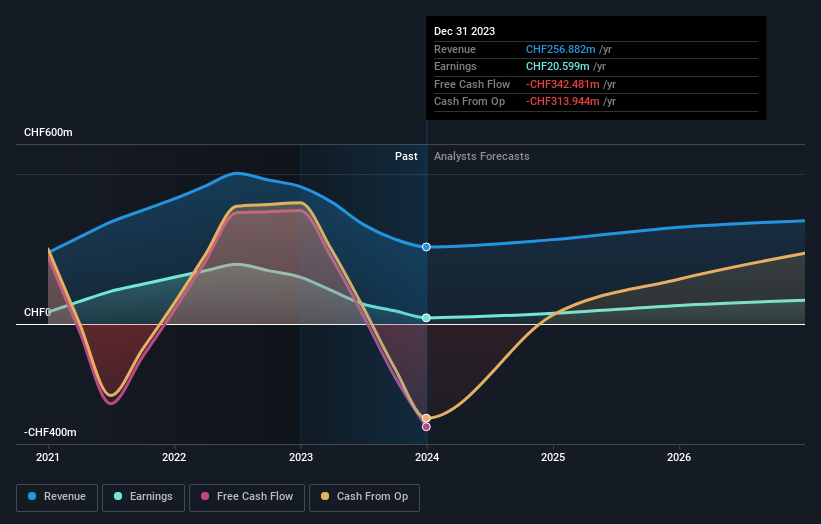

Leonteq

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG is a financial services provider specializing in structured investment products and long-term savings and retirement solutions across Switzerland, Europe, Asia, and the Middle East, with a market capitalization of CHF 409.07 million.

Operations: The company generates CHF 256.88 million from its brokerage services.

Insider Ownership: 12.7%

Earnings Growth Forecast: 26.4% p.a.

Leonteq is trading significantly below its estimated fair value, presenting a potentially undervalued opportunity. The company's earnings are expected to grow by 26.42% annually over the next three years, outpacing the Swiss market's 8.2% growth rate. However, its debt coverage by operating cash flow is weak, and recent executive changes include Hans Widler’s appointment as CFO, signaling potential strategic shifts or stabilization in financial management practices.

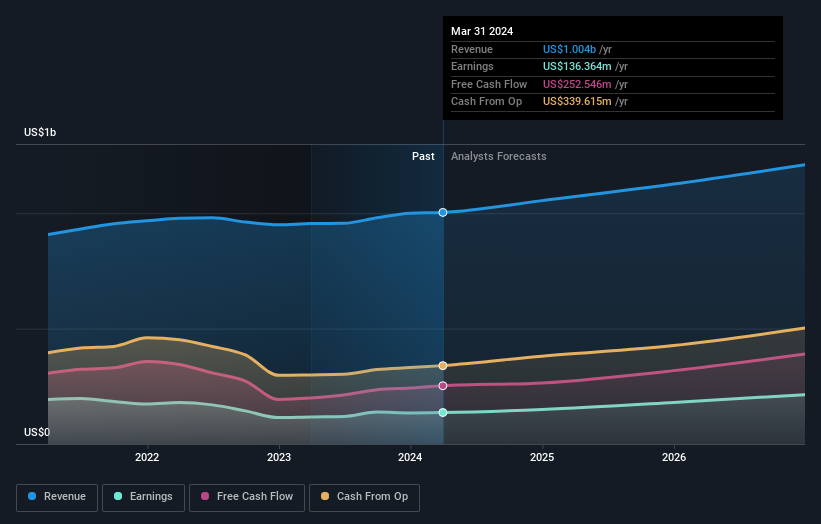

Temenos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving banking and financial institutions worldwide, with a market capitalization of approximately CHF 4.45 billion.

Operations: The company generates revenue from the development, marketing, and sale of integrated banking software systems globally.

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.7% p.a.

Temenos, a Swiss-based growth company with high insider ownership, showcases promising financial dynamics despite its highly volatile share price over the past three months. The firm is trading 26.2% below its estimated fair value and anticipates robust earnings growth at 14.7% annually, outstripping the Swiss market forecast of 8.2%. Recent strategic moves include a CHF 200 million share buyback program and advancements in sustainable banking technology, enhancing its competitive edge in efficient digital transaction processing.

Turning Ideas Into Actions

Unlock our comprehensive list of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:ARBN SWX:LEON and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance