Unveiling Three US Growth Companies With High Insider Ownership

As the U.S. stock market shows signs of resilience with key indices like the Nasdaq and S&P 500 posting gains, investors are keenly observing market trends and economic indicators for strategic opportunities. In this climate, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's review some notable picks from our screened stocks.

Establishment Labs Holdings

Simply Wall St Growth Rating: ★★★★★☆

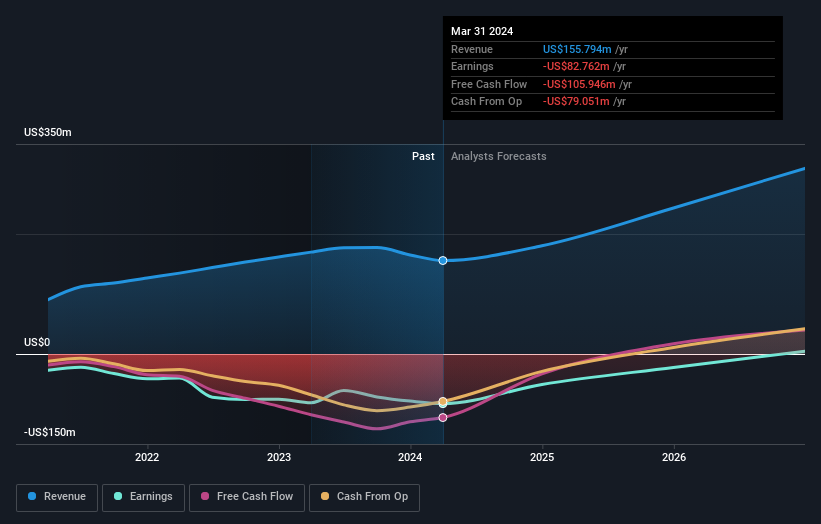

Overview: Establishment Labs Holdings Inc. is a medical technology company that manufactures and markets devices for aesthetic and reconstructive plastic surgery, with a market capitalization of approximately $1.25 billion.

Operations: The company generates its revenue primarily from the medical products segment, totaling $155.79 million.

Insider Ownership: 10.6%

Establishment Labs Holdings is anticipated to shift from unprofitability to profitability within three years, aligning with above-average market growth expectations. Despite recent financial reports showing a decline in quarterly sales from US$46.52 million to US$37.17 million and an increased net loss, the company maintains a positive revenue outlook for 2024, projecting an increase of 5% to 11%. This forecast is supported by substantial upcoming presentations at major healthcare conferences, underscoring its active engagement in growth and visibility initiatives.

Iovance Biotherapeutics

Simply Wall St Growth Rating: ★★★★★☆

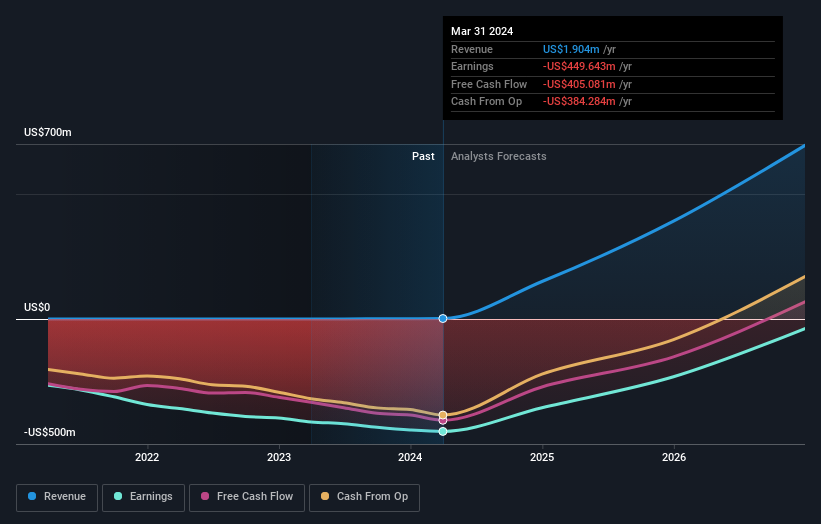

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology firm in the United States that focuses on developing and commercializing cell therapies using autologous tumor infiltrating lymphocyte for treating metastatic melanoma and other solid tumors, with a market capitalization of approximately $2.24 billion.

Operations: The company does not report any revenue segments as the data provided is null.

Insider Ownership: 10.4%

Iovance Biotherapeutics, a company with high insider ownership, recently submitted a marketing authorization application in Europe for its innovative therapy, lifileucel. Despite reporting a net loss of US$112.98 million in Q1 2024, the company is forecasted to become profitable within three years and expects revenue growth of 46.5% annually—significantly outpacing the market average. However, shareholder dilution occurred over the past year, reflecting some financial challenges amidst these advancements.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. is a visual search and discovery platform operating both in the United States and internationally, with a market capitalization of approximately $30.11 billion.

Operations: The company generates its revenue primarily from internet information services, totaling approximately $3.19 billion.

Insider Ownership: 11.4%

Pinterest, despite a recent net loss of US$24.81 million in Q1 2024, shows promising growth with revenue up to US$739.98 million from US$602.58 million the previous year and an expected increase to between US$835 million and US$850 million next quarter. The appointment of Chip Bergh to the Board could bring valuable experience for strategic governance, enhancing Pinterest's appeal in social commerce as evidenced by its new partnership with VTEX aimed at expanding market reach through integrated shopping campaigns.

Delve into the full analysis future growth report here for a deeper understanding of Pinterest.

Our expertly prepared valuation report Pinterest implies its share price may be too high.

Summing It All Up

Reveal the 183 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:ESTA NasdaqGM:IOVA and NYSE:PINS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance