Unveiling Three UK Growth Companies With High Insider Ownership

As the United Kingdom braces for its forthcoming elections amidst a backdrop of global economic uncertainties, the FTSE 100 shows signs of cautious optimism with slight gains in futures. In such a market environment, growth companies with high insider ownership can offer investors potential stability and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Plant Health Care (AIM:PHC) | 30.7% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

Directa Plus (AIM:DCTA) | 14.8% | 102.5% |

Velocity Composites (AIM:VEL) | 27.8% | 143.4% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Afentra (AIM:AET) | 37.2% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Fintel

Simply Wall St Growth Rating: ★★★★☆☆

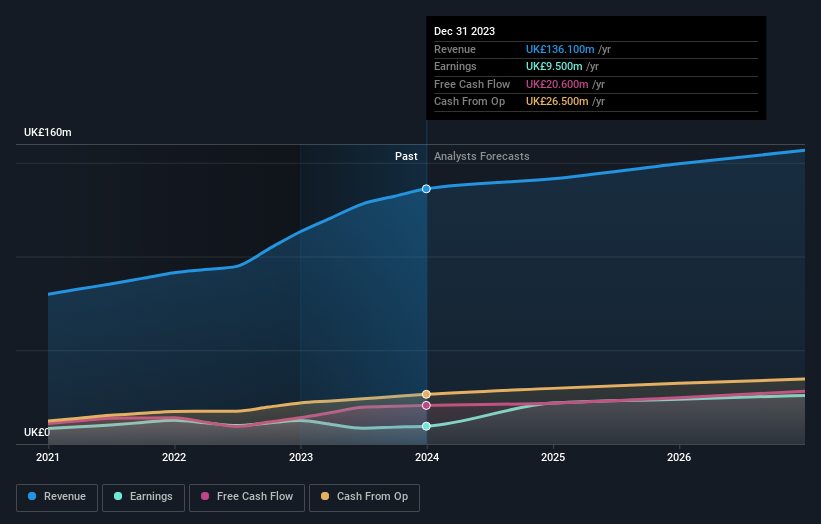

Overview: Fintel Plc operates as a provider of intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market capitalization of approximately £322 million.

Operations: The company generates its revenue primarily through three segments: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

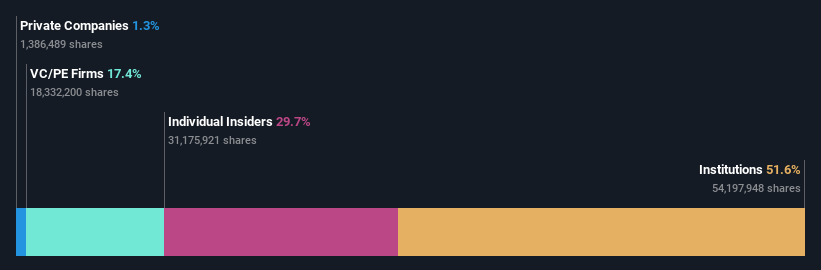

Insider Ownership: 29.7%

Fintel, a UK-based company, is trading 13.9% below its estimated fair value, indicating potential undervaluation. While Fintel's revenue growth is modest at 8.6% annually, it surpasses the UK market average of 3.5%. Earnings are expected to rise significantly by approximately 23.88% per year over the next three years, outpacing the market's 12.6%. However, insider activity has been mixed with significant selling and no substantial buying in recent months, raising some concerns about insider confidence despite recent dividend increases announced at their AGM on May 21, 2024.

Delve into the full analysis future growth report here for a deeper understanding of Fintel.

The valuation report we've compiled suggests that Fintel's current price could be inflated.

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £674.10 million.

Operations: The company generates revenue from two primary segments: Vacuum, which contributes £63.60 million, and Materials Sciences, accounting for £72.50 million.

Insider Ownership: 11.5%

Judges Scientific plc, a UK-based company, has recently enhanced its governance structure and increased dividends to 68.0 pence per share. Analysts predict a 24.5% rise in stock price with revenue growth expected at 4.8% annually, outperforming the UK market's 3.5%. Earnings are forecasted to surge by approximately 25.3% per year over the next three years, significantly above the market average of 12.6%. However, concerns arise from substantial insider selling and a high level of debt impacting financial stability.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

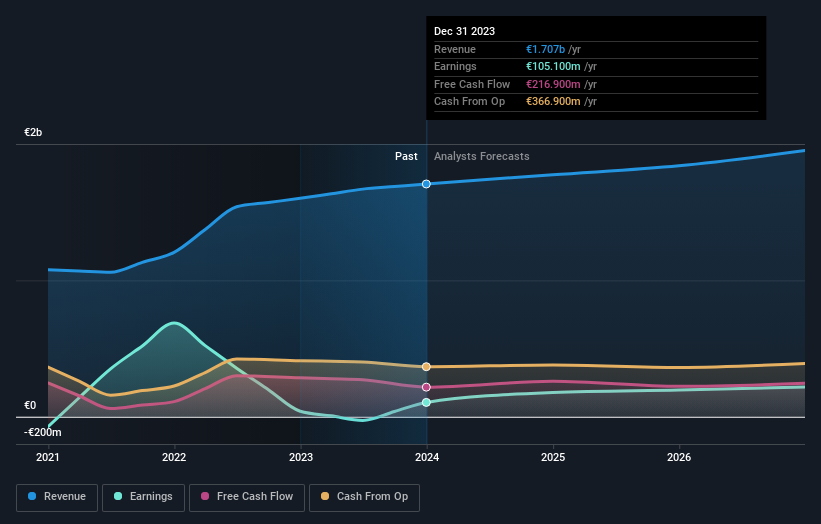

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.42 billion.

Operations: The company's revenue is primarily generated through its Gaming B2B and Gaming B2C segments, totaling €684.10 million and €946.60 million respectively, with additional contributions from B2C operations including HAPPYBET and Sun Bingo which together amount to €91.60 million.

Insider Ownership: 13.5%

Playtech plc is poised for significant growth with earnings forecasted to increase by 20.62% annually, outpacing the UK market's 12.6%. Despite a modest revenue growth projection of 4% per year, it remains ahead of the broader UK market's 3.5%. The company recently announced a strategic partnership with MGM Resorts to enhance its live casino offerings, potentially boosting future revenues. However, challenges include a low forecasted return on equity at 8.9% and financial impacts from large one-off items.

Click here to discover the nuances of Playtech with our detailed analytical future growth report.

Our valuation report here indicates Playtech may be undervalued.

Seize The Opportunity

Click here to access our complete index of 65 Fast Growing UK Companies With High Insider Ownership.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:FNTLAIM:JDG and LSE:PTEC

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance