Unveiling Three UK Exchange Stocks Estimated As Undervalued Gems For Your Investment Consideration

Amidst a fluctuating landscape marked by the FTSE 100's attempt to halt a three-day losing streak and broader economic signals, the United Kingdom's financial markets remain a focal point for investors seeking value. In this context, identifying undervalued stocks becomes crucial as they may present opportunities for those looking to invest in potential growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

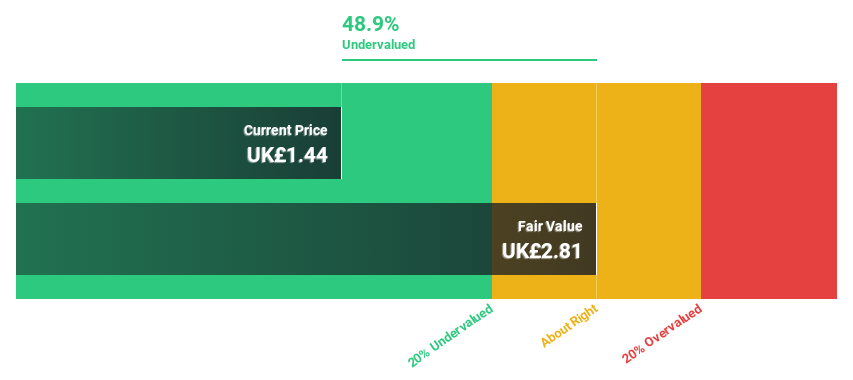

Kier Group (LSE:KIE) | £1.438 | £2.81 | 48.9% |

WPP (LSE:WPP) | £7.41 | £14.13 | 47.6% |

LSL Property Services (LSE:LSL) | £3.31 | £6.51 | 49.2% |

Ibstock (LSE:IBST) | £1.81 | £3.43 | 47.3% |

Auction Technology Group (LSE:ATG) | £4.815 | £9.22 | 47.8% |

Accsys Technologies (AIM:AXS) | £0.553 | £1.07 | 48.3% |

Ricardo (LSE:RCDO) | £4.92 | £9.50 | 48.2% |

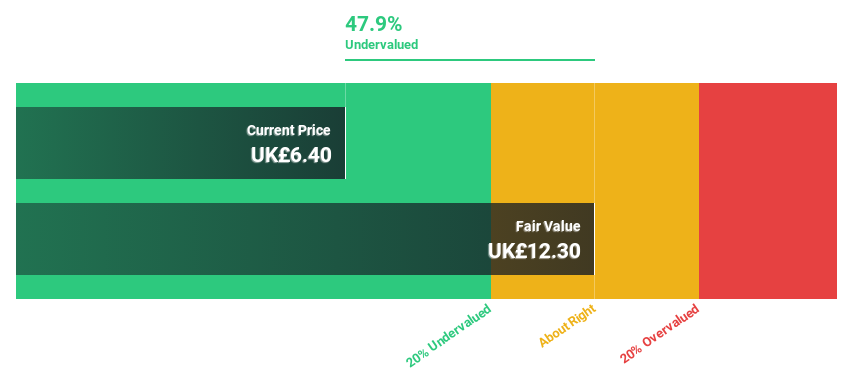

Entain (LSE:ENT) | £6.40 | £12.30 | 47.9% |

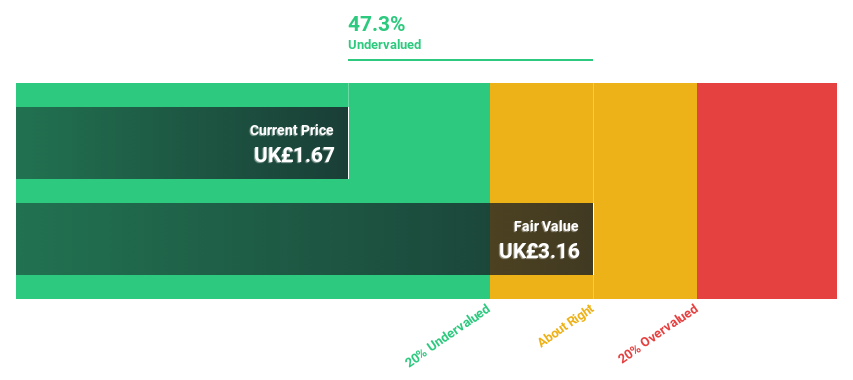

Franchise Brands (AIM:FRAN) | £1.665 | £3.16 | 47.3% |

M&C Saatchi (AIM:SAA) | £2.04 | £3.99 | 48.9% |

We'll examine a selection from our screener results.

Franchise Brands

Overview: Franchise Brands plc operates a franchising business with activities across the United Kingdom, North America, and Europe, maintaining a market capitalization of approximately £320.05 million.

Operations: The company's revenue is generated from several segments, including Azura at £0.75 million, Pirtek at £41.95 million, B2C Division at £6.11 million, Water & Waste at £48.88 million, and Filta International at £27.12 million.

Estimated Discount To Fair Value: 47.3%

Franchise Brands, with a recent earnings report showing a significant sales increase to £121.27 million from £69.84 million year-over-year, appears undervalued based on cash flows, trading at 47.3% below its estimated fair value of £3.16. However, the company's net profit margin has declined to 2.5% from 11.6%, reflecting some operational challenges despite high expected annual earnings growth of 40.7%. Recent executive changes and the appointment of Andrew Mallows as interim CFO could signal strategic shifts or stabilization efforts ahead.

Entain

Overview: Entain Plc is a sports-betting and gaming company with a market capitalization of approximately £4.09 billion.

Operations: The company generates revenue primarily through its Online and Retail segments, with £3.37 billion from online operations and £1.38 billion from retail activities.

Estimated Discount To Fair Value: 47.9%

Entain, priced at £6.4, is considerably below its fair value of £12.3, suggesting it is undervalued based on cash flow analysis. Despite a dividend coverage issue, with a yield of 2.78% not well supported by earnings, the company shows promise with expected earnings growth of 96.76% annually and anticipated profitability within three years. Recent strategic reviews affirm a robust portfolio and operational enhancements aimed at long-term growth, although revenue growth projections are modest at 3.9% per year.

Kier Group

Overview: Kier Group plc operates primarily in the construction sector both in the United Kingdom and internationally, with a market capitalization of approximately £650.14 million.

Operations: The company generates revenue through its Property, Corporate, Construction, and Infrastructure Services segments with respective incomes of £16.60 million, £43.30 million, £1.86 billion, and £1.87 billion.

Estimated Discount To Fair Value: 48.9%

Kier Group, with a current price of £1.44, is significantly undervalued against its estimated fair value of £2.81, reflecting a 48.9% discount. Despite challenges like unstable dividends and one-off financial items impacting earnings quality, Kier's revenue and earnings growth are promising. Expected to outpace the UK market average, its revenue could rise by 5.7% annually while earnings might surge by 23.17% per year due to strategic advancements and market conditions.

Seize The Opportunity

Dive into all 58 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:FRAN LSE:ENT and LSE:KIE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance