Unveiling Three Premier Dividend Stocks With Yields Up To 9.6%

Amidst a backdrop of global economic fluctuations and varied performance across major indices, investors continue to seek stable returns in an unpredictable market. Dividend stocks, known for providing regular income and potential for long-term growth, stand out as appealing options during times of uncertainty.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.64% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.42% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.19% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 5.84% | ★★★★★★ |

Globeride (TSE:7990) | 3.98% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.63% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.50% | ★★★★★★ |

Innotech (TSE:9880) | 4.15% | ★★★★★★ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

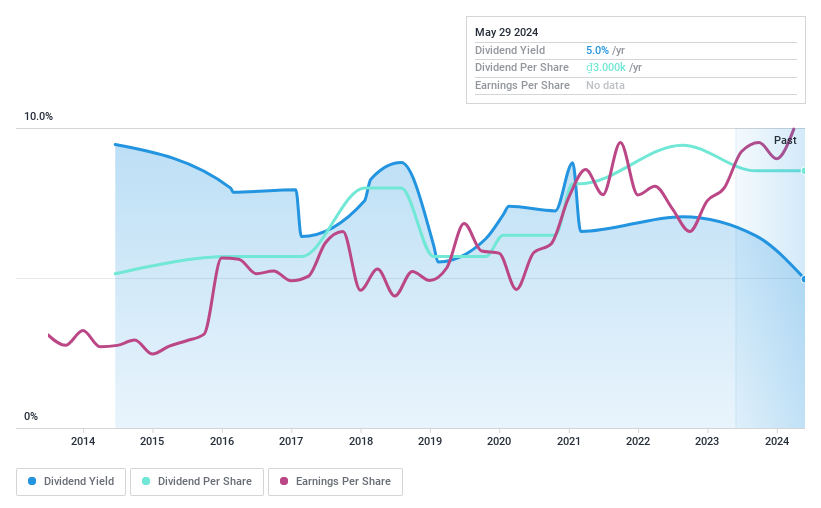

PVI Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PVI Holdings is a company based in Vietnam, specializing in the insurance sector with a market capitalization of approximately ₫13.84 billion.

Operations: PVI Holdings generates its revenue primarily from the insurance sector in Vietnam.

Dividend Yield: 5%

PVI Holdings reported a 23.1% increase in earnings for Q1 2024, with revenues rising to VND 1.91 billion from VND 1.65 billion year-over-year. Despite this growth, the company's dividend history is marked by instability and volatility over the last decade, reflecting an inconsistent return for dividend-focused investors. Although dividends are currently supported by both earnings (70% payout ratio) and cash flows (51.9% cash payout ratio), PVI's dividend yield of 4.96% remains below the top quartile of Vietnamese market payers at 8.72%.

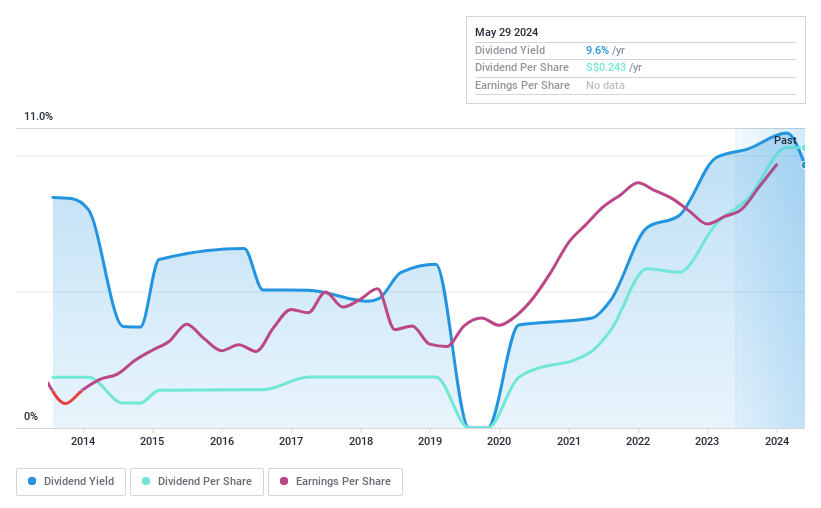

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, an investment holding company with a market capitalization of SGD 213.53 million, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, India, and other international markets.

Operations: Multi-Chem Limited generates revenue through its IT business in India (SGD 40.56 million), Australia (SGD 54.60 million), Singapore (SGD 372.78 million), Greater China (SGD 34.96 million), and other international markets totaling SGD 153.93 million, alongside a smaller PCB business in Singapore contributing SGD 1.79 million.

Dividend Yield: 9.6%

Multi-Chem's dividend sustainability is moderately supported with an earnings payout ratio of 80.7% and a cash payout ratio of 88.1%. While the company has managed to increase its dividend payments over the past decade, its track record shows volatility and unreliability in these distributions. Currently, Multi-Chem offers a high yield of 9.64%, placing it in the top quartile for dividends in its market despite trading at a significant discount to estimated fair value, suggesting potential undervaluation or investor caution due to inconsistent dividends.

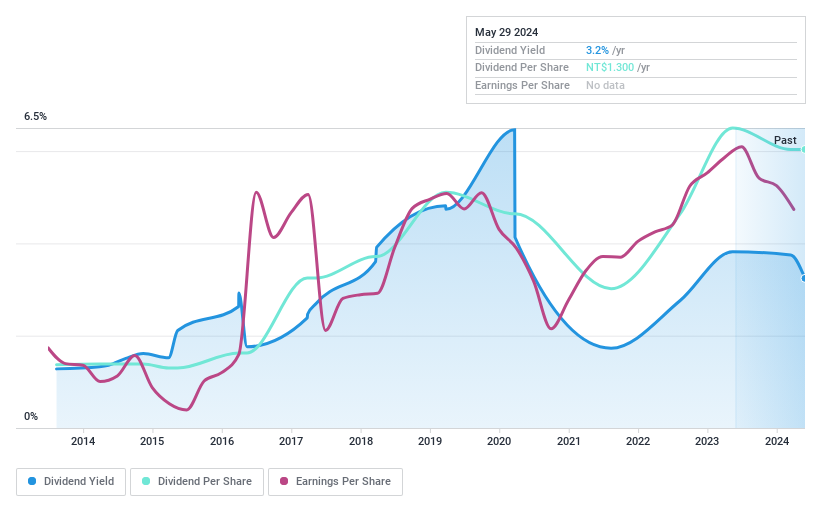

Pan-International Industrial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pan-International Industrial Corp. offers electronic manufacturing services to technology firms across China, Hong Kong, Malaysia, the United States, and Taiwan, with a market capitalization of NT$19.31 billion.

Operations: Pan-International Industrial Corp. generates its revenue by providing electronic manufacturing services across multiple regions including China, Hong Kong, Malaysia, the United States, and Taiwan.

Dividend Yield: 3.2%

Pan-International Industrial's dividend profile shows a blend of strengths and weaknesses. Its dividend yield at 3.24% is below the top quartile average of 4.28% in the TW market, indicating modest attractiveness to income-focused investors. The company's dividends, while covered by both earnings (59.5% payout ratio) and cash flows (34.9% cash payout ratio), have experienced volatility and unreliability over the past decade, suggesting potential concerns about sustainability in its future payments. Recent financial performance also reflects challenges with a noticeable decline in sales and net income as reported on May 15, 2024, which could pressure future dividends.

Next Steps

Explore the 1936 names from our Top Dividend Stocks screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include HNX:PVI SGX:AWZ and TWSE:2328.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance