Unveiling SEHK Growth Leaders With High Insider Ownership In June 2024

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown resilience, with the Hang Seng Index climbing 1.59%. This uptick suggests a cautious optimism among investors, driven by signs of recovery in sectors like real estate. In such an environment, growth companies with high insider ownership in Hong Kong can be particularly compelling as these firms often demonstrate strong alignment between management’s interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 62.3% |

Fenbi (SEHK:2469) | 32.2% | 43% |

Meitu (SEHK:1357) | 38% | 33.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.8% |

Beijing Airdoc Technology (SEHK:2251) | 27.8% | 83.9% |

We're going to check out a few of the best picks from our screener tool.

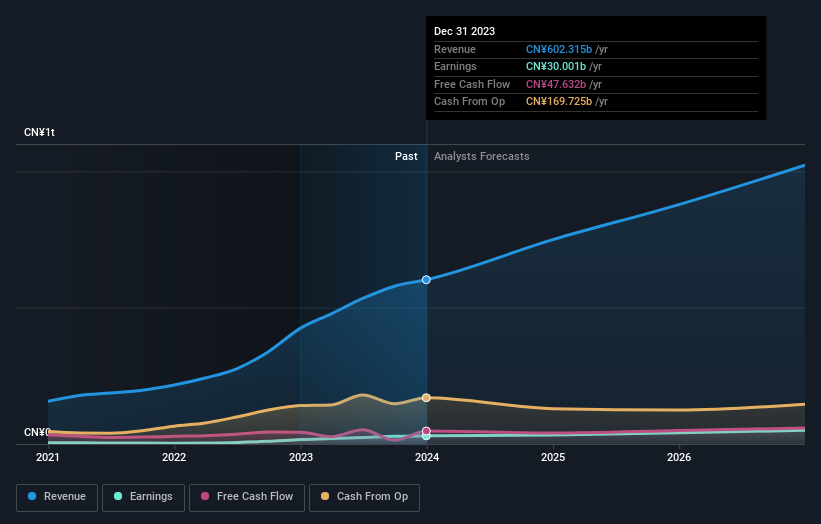

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automotive and battery sectors across China, including Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$708.77 billion.

Operations: The company's revenue is generated from its automotive and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and international markets.

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.5% p.a.

BYD, a prominent player in the electric vehicle sector, has demonstrated robust growth with recent expansions such as the launch of BYD SHARK in Mexico. This new model is set to redefine the global plug-in hybrid pickup market with advanced technology. Additionally, BYD's strong sales and production figures for May 2024 underline its upward trajectory in manufacturing capabilities. Despite these positives, it's essential to note that while insider ownership aligns interests with shareholders, it does not guarantee future performance or mitigate all investment risks.

Dive into the specifics of BYD here with our thorough growth forecast report.

The valuation report we've compiled suggests that BYD's current price could be inflated.

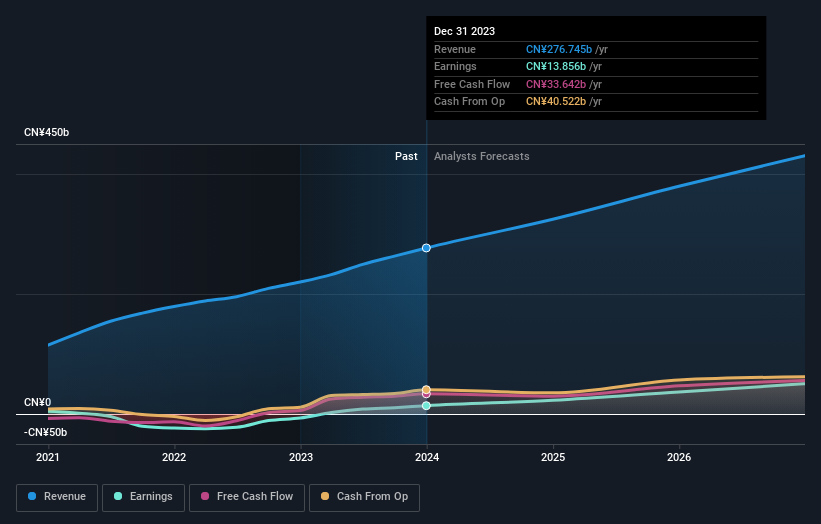

Meituan

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$683.48 billion.

Operations: The company generates revenue through technology retail operations in China.

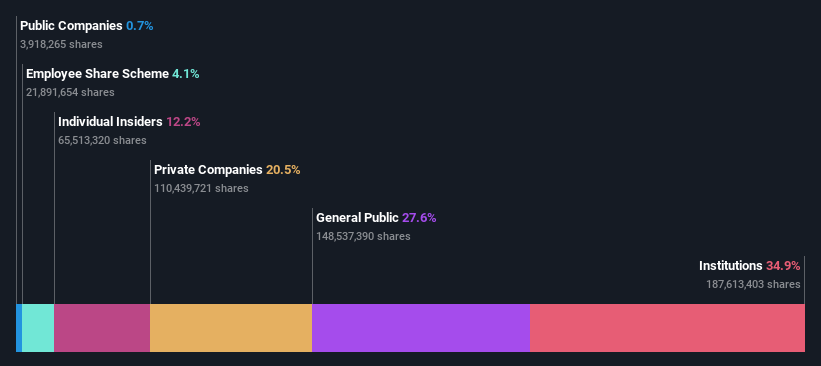

Insider Ownership: 12.2%

Revenue Growth Forecast: 12.6% p.a.

Meituan has shown substantial growth, with its earnings increasing by 568.2% over the past year and forecasted to grow at 31.6% annually over the next three years, outpacing the Hong Kong market's average. Despite trading at 65.2% below its estimated fair value, concerns arise as insider transactions have not shown significant buying activity recently. Moreover, while Meituan's revenue growth is expected to exceed the market average, it remains below the high-growth benchmark of 20% per year.

RemeGen

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on developing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market capitalization of approximately HK$22.18 billion.

Operations: The company generates revenue primarily from its biopharmaceutical research, service, production, and sales segment, totaling CN¥1.25 billion.

Insider Ownership: 12.2%

Revenue Growth Forecast: 26.6% p.a.

RemeGen, a biopharmaceutical company in Hong Kong, has demonstrated rapid revenue growth, with recent earnings doubling year-over-year. Despite this increase and promising advancements like the FDA's fast track designation for its drug telitacicept, the company reported a larger net loss compared to the previous year. RemeGen is expected to become profitable within three years, outpacing average market growth significantly. However, it faces challenges with a short cash runway and no substantial insider buying reported recently.

Delve into the full analysis future growth report here for a deeper understanding of RemeGen.

Our valuation report here indicates RemeGen may be undervalued.

Key Takeaways

Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 50 more companies for you to explore.Click here to unveil our expertly curated list of 53 Fast Growing SEHK Companies With High Insider Ownership.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211SEHK:3690 and SEHK:9995.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance