Unveiling the potential of pan-Asian living strategies: A path to sustainable urban development

Investing in residential property within the Asia Pacific region can offer the potential for diversification and enhanced risk-adjusted returns, says M&G (Picture: Samuel Isaac Chua/The Edge Singapore)

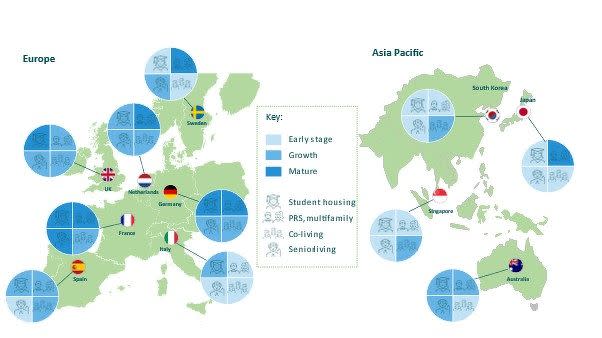

Across the Asia Pacific region, the varying development stages of key real estate markets, coupled with demographic trends, signal a vast potential for targeted development and investment for assets in the living sector across the region.

For example, mature markets like Japan offer stability and proven frameworks for investment, while emerging economies such as Indonesia present higher growth potential but at relatively greater risks.

Even in established segments such as Japan’s substantial multi-family market and Australia’s burgeoning purpose-built student accommodation (PBSA) sector, there is room for capital to grow if properly framed with targeted development and investment strategies.

Read also: Singapore top source of global capital in 1H2023: Colliers

We believe that the prevalence of market fragmentation and relative development immaturity of certain residential sectors are among the reasons why Asia Pacific residential assets have remained at just 7% of most institutional investment portfolios for the past 15 years.

However, we expect this to change swiftly in the coming decade due to ongoing urbanisation efforts, government policy adjustments that facilitate private rental developments, and growing institutional interest in residential assets in the region.

In many aspects, the growth and development trajectory of key residential markets and segments in the Asia Pacific region parallels the profile of key European markets. In Europe, the landscape of the residential market is also fragmented and diverse.

For instance, the multi-family markets in countries such as Germany, the Netherlands, and some of the Nordic markets are relatively mature. But Spain, Italy, and Ireland have experienced relatively robust growth over the past few years, although their markets are smaller compared to their established European counterparts.

Over the past five years, we have seen over EUR10 billion ($14.6 billion) raised from private investment in pan-European strategies focused on private rental residential, student housing, and senior living assets. This surge has significantly accelerated the share of these assets within European real estate portfolios.

The Asia Pacific market can take a page from this experience, leveraging pan-Asian strategies to optimise diversification, scale, and risk-adjusted returns. We see pockets of potential growth in this region that parallel the European experience.

Read also: APAC commercial property sales plunge 40% y-o-y in 2Q2023: MSCI

Singapore’s co-living sector

In Singapore, the development of the co-living sector appears to parallel the growth of the co-living sector in Spain. Both countries maintain a relatively high homeownership rate, but a shift in attitudes that brought on growing acceptance of flexible, community-oriented living solutions precipitated the emergence of an established co-living sector in both countries.

Across mature residential markets in the Asia Pacific region, this trend is buoyed by rising rental prices and immigration rates. It also underscores changing preferences among young professionals and the potential for more widespread co-living development in Asia.

For example, Singapore’s recent policy shift towards facilitating alternative forms of rental housing may be indicative of emerging opportunities in the city-state.

The government recently awarded a Government Land Sale site on Zion Road to a joint venture between Mainboard-listed property group City Developments and Japanese developer Mitsui-Fudosan. The 164,439 sq ft site is the first plot sold by the government that includes a new type of long-stay serviced apartments.

Known as Serviced Apartments II, this pilot housing typology was rolled out by the government to expand the range of long-term rental housing options in the local market. The long-stay serviced apartments can be rented out for a minimum of three months or longer and coexist alongside shorter-stay serviced apartments with the existing seven-day minimum-stay requirements. Both types of serviced apartments cannot be strata-subdivided for sale.

Furthermore, the government has sought to lease out more state-owned properties that could be repurposed with co-living uses. Recent examples include the repositioning of the former Bukit Timah Fire Station at 260 Bukit Timah Road by real estate group LHN, under its Coliwoo co-living brand. Another prime site in Bukit Timah, at 26 Evans Road, was awarded to homegrown real estate management company Cover Projects, which will turn it into an upmarket co-living space.

Read also: M&G Real Estate forges ahead with US$1.8 bil deals in Asia Pacific amid uncertainty

Investment opportunities in South Korea and Australia

Demographic trends are also propelling the demand for senior living in some Asia Pacific markets, but this sector is still in its nascent stage in this region. For instance, France and South Korea exemplify the varying maturity levels of the senior living market. France’s established senior housing market, with a significant portion run by non-profit operators, contrasts with South Korea’s emerging senior living options.

In South Korea, the sector is spurred by changing family structure and a declining birth rate. It highlights the critical need for adaptable housing solutions that cater to the needs of the ageing population. This demand for appropriate senior living solutions is only set to grow in the coming years, and it indicates a significant investment opportunity for investors.

It is not just seniors who need housing. Looking ahead, Australia’s PBSA sector is an area that investors may be eyeing for targeted investment strategies.

Australia’s PBSA sector parallels that of the UK in that both countries rank among the top five countries globally for international tertiary students. Both PBSA markets are dynamic, driven by significant increases in tertiary education enrolment and international student population.

However, the UK’s more established PBSA sector boasts a provision rate of bed-to-student at 25%, around three times higher than Australia. While these figures reflect the different stages of market maturity of the UK and Australia, it also underscores a common trend — the growing demand for student accommodation.

Seizing opportunities in Asia Pacific

The Asia Pacific region is at a critical juncture in its urban development journey. Overall institutional investment in living sector assets is one of the lowest globally and there are specific market demand and market maturity levels for astute investors to capitalise on.

Investing in residential property within the region can offer the potential for diversification and enhanced risk-adjusted returns, particularly considering the sector’s defensive nature and historical performance during economic downturns.

As rental markets across the region mature, the opportunity for investors to capitalise on low volatility and value appreciation can be significant, potentially increasing this sector’s share of total investment volumes over the next decade.

Regina Lim is head of research, Asia Pacific, at M&G Real Estate

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

APAC commercial property sales plunge 40% y-o-y in 2Q2023: MSCI

M&G Real Estate forges ahead with US$1.8 bil deals in Asia Pacific amid uncertainty

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance