Unveiling High Insider Ownership Growth Companies On Chinese Exchange May 2024

As of May 2024, Chinese markets are showing signs of robust recovery, buoyed by increased holiday spending and positive trade data that suggest a resilient economic backdrop. In this context, exploring growth companies with high insider ownership on Chinese exchanges can offer insights into firms where leadership has significant skin in the game, potentially aligning interests with minority shareholders especially during promising economic conditions.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.8% |

UTour Group (SZSE:002707) | 24% | 27.3% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

We're going to check out a few of the best picks from our screener tool.

360 Security Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: 360 Security Technology Inc. is an internet security company based in China, offering Internet and mobile security products, with a market capitalization of approximately CN¥62.30 billion.

Operations: The company generates its revenue primarily through the provision of internet and mobile security products in China.

Insider Ownership: 11.7%

Earnings Growth Forecast: 101.1% p.a.

360 Security Technology is expected to see its revenue grow at 15.9% annually, outpacing the Chinese market forecast of 14.1%. The company's earnings are also projected to surge by approximately 101.12% each year, signaling robust profit growth ahead as it moves towards profitability over the next three years. Despite these positive indicators, the firm's dividend sustainability is questionable, with a low coverage by earnings and cash flows. Recent financials show a reduction in net losses and an improvement in sales performance compared to the previous year.

Ganfeng Lithium Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ganfeng Lithium Group Co., Ltd. is a global company based in China that manufactures and sells lithium products across Mainland China, Asia, the European Union, North America, and other international markets, with a market capitalization of approximately CN¥68.79 billion.

Operations: The company generates its revenue by manufacturing and selling lithium products across various regions including Mainland China, other parts of Asia, the European Union, and North America.

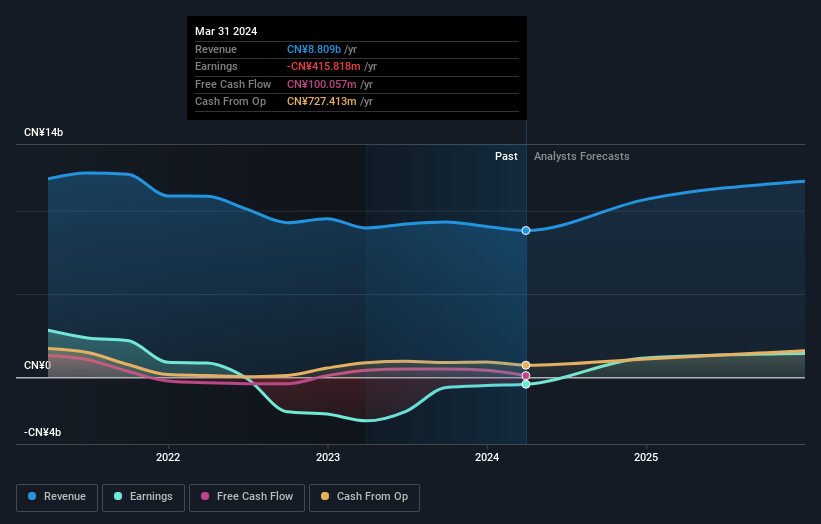

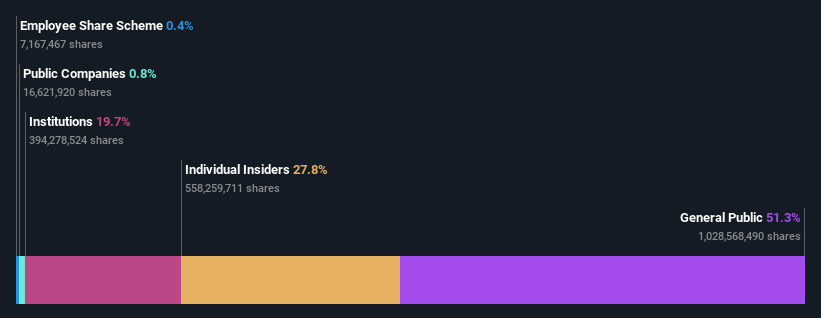

Insider Ownership: 27.8%

Earnings Growth Forecast: 29.4% p.a.

Ganfeng Lithium Group, despite its high insider ownership, faces challenges. Its recent quarterly report showed a significant revenue drop to CNY 5.06 billion and a shift from profit to a net loss of CNY 438.9 million. However, the company's earnings are expected to grow by 29.4% annually over the next three years, outpacing the Chinese market's forecast of 23.4%. This growth is supported by strategic alliances like the joint venture with Pilbara Minerals for a lithium chemical plant project.

Shenyang Xingqi PharmaceuticalLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic medications in China, with a market capitalization of approximately CN¥36.07 billion.

Operations: The company generates its revenue primarily through the production and sale of ophthalmic medications in China.

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.2% p.a.

Shenyang Xingqi Pharmaceutical Co., Ltd. has demonstrated strong financial performance with its first-quarter sales increasing to CNY 349.88 million from CNY 286.56 million year-over-year, and net income rising to CNY 34.75 million from CNY 19.35 million. The company's earnings are expected to grow by 35.15% annually over the next three years, significantly outpacing the Chinese market forecast of 23.4%. However, its dividend coverage is weak, indicating potential challenges in sustaining shareholder payouts amidst rapid growth.

Turning Ideas Into Actions

Click through to start exploring the rest of the 405 Fast Growing Chinese Companies With High Insider Ownership now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:601360 SZSE:002460 and SZSE:300573 .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance