Unveiling 3 Top German Growth Companies With Insider Ownership And Earnings Growth Of Up To 47%

Amidst a backdrop of moderate gains in the German market, with the DAX index rising by 1.32% recently, investors are keenly observing trends and potential opportunities. In such a market environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

Deutsche Beteiligungs (XTRA:DBAN) | 39.1% | 31.6% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

NAGA Group (XTRA:N4G) | 14.1% | 79.2% |

Exasol (XTRA:EXL) | 25.3% | 105.4% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 21.9% |

elumeo (XTRA:ELB) | 25.8% | 99.1% |

Redcare Pharmacy (XTRA:RDC) | 17.7% | 47.4% |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Let's uncover some gems from our specialized screener.

Hypoport

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE is a technology-based financial service provider in Germany with a market capitalization of approximately €2.06 billion.

Operations: The company generates revenue primarily through its Credit Platform and Insurance Platform, which brought in €155.60 million and €66.29 million respectively.

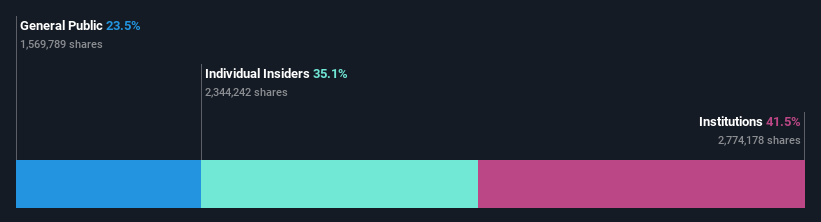

Insider Ownership: 35.1%

Earnings Growth Forecast: 31.9% p.a.

Hypoport SE, a German company, exhibits strong growth prospects with its earnings expected to increase by 31.9% annually, outpacing the broader German market's 18.8%. While revenue growth is also robust at 13.4% annually, it does not reach the high-growth threshold of 20%. Recent financials show a significant year-over-year increase in net income from €0.503 million to €3.04 million and sales from €93.72 million to €107.47 million in Q1 2024, underscoring its upward trajectory despite forecasts of low return on equity (9.1%) in three years.

Click here to discover the nuances of Hypoport with our detailed analytical future growth report.

Upon reviewing our latest valuation report, Hypoport's share price might be too optimistic.

Redcare Pharmacy

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV is an online pharmacy operating across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market capitalization of approximately €2.78 billion.

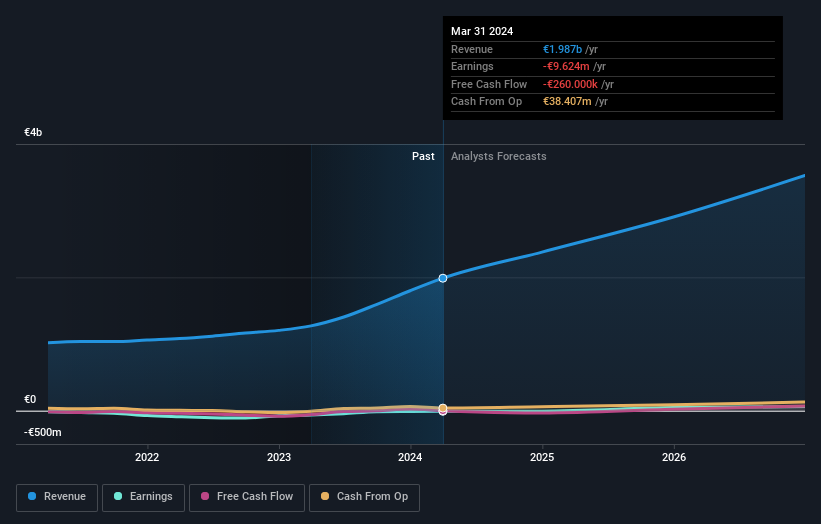

Operations: The company generates €1.62 billion from its DACH segment and €0.37 billion internationally.

Insider Ownership: 17.7%

Earnings Growth Forecast: 47.4% p.a.

Redcare Pharmacy, a German growth company with high insider ownership, reported increased Q1 2024 sales of €560.22 million, up from €372.05 million year-over-year, alongside a reduced net loss of €7.81 million. Despite its highly volatile share price recently and shareholder dilution over the past year, Redcare is forecasted to grow revenue by 17.1% annually and become profitable within three years. However, its expected return on equity remains low at 7.5%, reflecting some challenges ahead despite trading below fair value estimates by 36.5%.

Unlock comprehensive insights into our analysis of Redcare Pharmacy stock in this growth report.

Our expertly prepared valuation report Redcare Pharmacy implies its share price may be too high.

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE is an online retailer specializing in fashion and lifestyle products, with a market capitalization of approximately €6.06 billion.

Operations: The company generates approximately €10.40 billion in revenue from its online fashion and lifestyle platform.

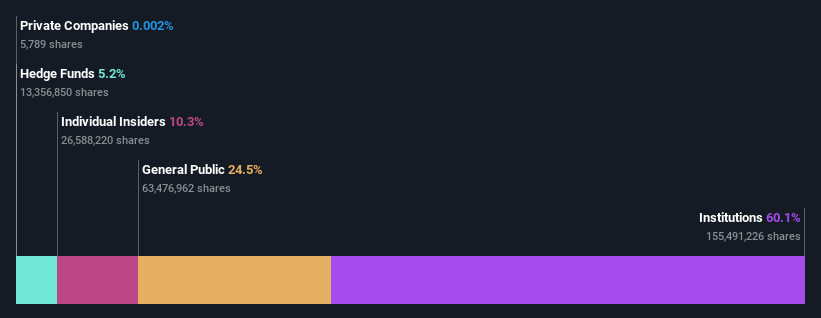

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.4% p.a.

Zalando SE, a German growth company with high insider ownership, reported first-quarter 2024 sales of €2.24 billion but faced a net loss of €8.9 million. Despite this setback, the company's earnings are expected to grow significantly at an annual rate of 26.42%, outpacing the German market forecast of 18.8%. Zalando's revenue growth is projected at 5.4% per year, slightly above the market average of 5.2%. However, its return on equity is anticipated to remain low at around 12.6%, indicating potential challenges in achieving higher profitability levels despite trading at a valuation deemed significantly below fair value.

Delve into the full analysis future growth report here for a deeper understanding of Zalando.

Our valuation report here indicates Zalando may be overvalued.

Key Takeaways

Click this link to deep-dive into the 18 companies within our Fast Growing German Companies With High Insider Ownership screener.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:HYQ XTRA:RDC and XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance