United Rentals (URI) to Buy HTD-5E E-Dumpsters, Aids Fleet Arm

United Rentals, Inc. URI inked a deal with JCB to purchase the industry’s first high-volume, fully-electric dumpsters for its rental fleet. URI will become the first equipment rental company to offer JCB’s HTD-5E E-Dumpsters to North American customers.

The HTD-5E E-Dumpster provides a high-performance carrying solution for various industries. Its electric drive reduces noise and carbon emissions, making it suitable for indoor work, tunneling applications and urban sites. The e-dumpster includes a SmartStep feature that offers increased safety and operator comfort.

United Rentals has been a leader in using 100% electric vehicles in the construction and industrial rental sectors. It has set a goal to reduce greenhouse gas emissions from its business by 35% by 2030. United Rentals expects to deploy the vehicles in fourth-quarter 2022.

Mike Durand, URI’s senior vice president, sales and operations, said, "As companies build plans to achieve sustainability goals, we can help them reduce the environmental impact of their equipment while also maintaining safety and productivity."

United Rentals’ Strategic Initiatives Driving Growth

United Rentals is expanding its geographic borders and product portfolio through acquisitions and joint ventures. As the largest equipment rental company in the world, United Rentals enjoys strong brand recognition, which enables it to draw customers and build customer loyalty. The company offers approximately 4,000 classes of rental equipment for rent on an hourly, daily, weekly or monthly basis.

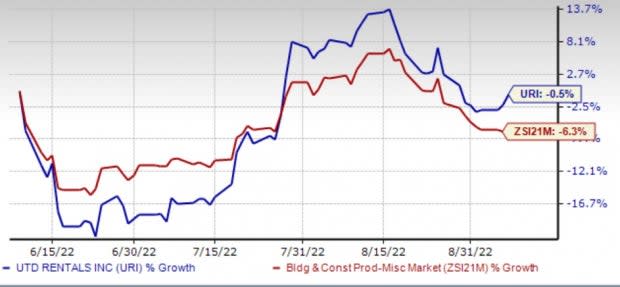

Image Source: Zacks Investment Research

United Rentals’ extensive and diverse fleet allows it to serve large customers that require a wide range of equipment. The company’s rental fleet is the largest and most comprehensive in the industry.

Shares of United Rentals have outperformed the Zacks Building Products - Miscellaneous industry in the past three months. The upside will likely continue to push the company into investing in fleet, accretive acquisitions and robust market demand.

Zacks Rank & Other Key Picks

Currently, United Rentals carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other top ranked stocked in the same industry are Gibraltar Industries, Inc. ROCK, Installed Building Products, Inc. IBP and Janus International Group, Inc. JBI, each carrying a Zacks Rank #2 (Buy).

Buffalo, NY-based Gibraltar manufactures and distributes products to the industrial and buildings market. The company has been benefiting from the three-pillar value creation strategy and robust Residential Products business. Also, the U.S. administration’s endeavor to boost renewable energy and infrastructure of the country and operational excellence are added positives. Its second quarter order backlog was up 5% because of robust end-market demand and new order activity across the business.

Gibraltar’s earnings for 2022 are expected to rise 19.4%.

Installed Building also carries a Zacks Rank #2 (Buy). The company is a leading installer of insulation and complementary building products. It primarily banks on a robust pipeline of acquisition opportunities across multiple geographies, products and end markets.

Installed Building’s earnings for 2022 are expected to rise 50.4%.

Headquartered in Temple, GA, Janus manufactures and supplies turn-key self-storage and commercial and industrial building solutions. Solid backlog level, impressive project pipeline, productivity improvements and commercial actions, including pricing, are expected to drive growth. The company is expected to benefit from its one-stop-shop offering with a leading market share position in self-storage doors and related design and installation services.

Janus’ earnings for 2022 are expected to rise 11.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance