UK Growth Companies With High Insider Ownership And 33% Earnings Growth

Amidst the backdrop of fluctuating indices and heightened market sensitivity ahead of the UK's pivotal election, investors are closely monitoring the performance and fundamentals of growth-oriented companies. In such a landscape, stocks with high insider ownership and robust earnings growth stand out as potentially resilient choices, aligning closely with investor interests in stability and informed leadership.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Plant Health Care (AIM:PHC) | 30.7% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

Velocity Composites (AIM:VEL) | 27.8% | 143.4% |

Belluscura (AIM:BELL) | 39.1% | 124.1% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Afentra (AIM:AET) | 37.2% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's explore several standout options from the results in the screener.

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £677.42 million.

Operations: The company generates revenue primarily through two segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.5%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific plc, a UK-based company, recently enhanced shareholder engagement by amending its corporate governance structure. Despite carrying high levels of debt and experiencing significant insider selling, the company is set to outpace the UK market with its revenue and earnings growth forecasts at 4.8% and 25.3% per year respectively. However, one-off items have impacted financial results, and profit margins have declined from last year's figures. The firm also increased its dividend payout to £0.68 per share in May 2024.

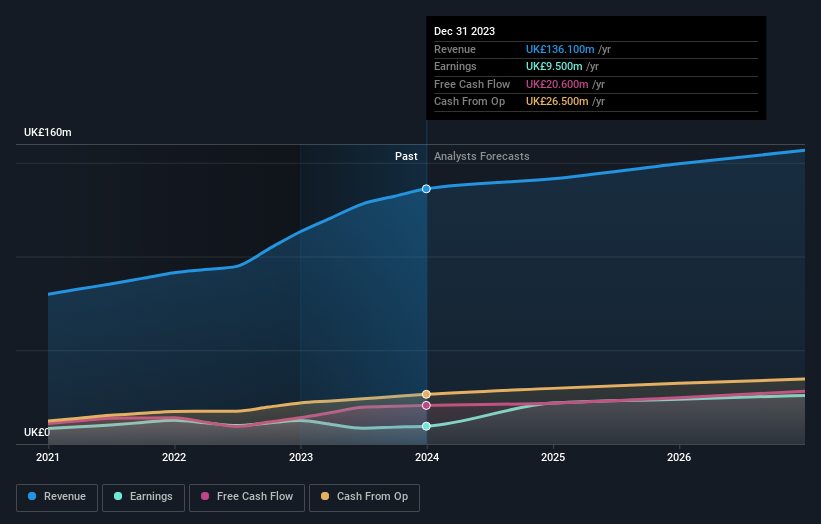

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is a company that manages infrastructure and private equity in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £551.42 million.

Operations: The firm generates revenue through three primary segments: Infrastructure (£84.17 million), Private Equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Insider Ownership: 31.8%

Earnings Growth Forecast: 33.1% p.a.

Foresight Group Holdings, a UK-based firm, is trading 28.3% below its estimated fair value and has experienced a revenue increase to £141.33 million this year from £119.16 million last year. Its earnings are expected to grow significantly at 33.1% annually, outpacing the UK market's 12.6%. Despite a substantial dividend increase to 22.2 pence this year, the payout ratio remains a concern as it is not well covered by earnings. The company also completed a share buyback of £0.97 million for 0.2% of its shares earlier this year.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a technology company that offers gambling software, services, content, and platform technologies across the globe, with a market capitalization of approximately £1.42 billion.

Operations: Playtech's revenue is primarily derived from its Gaming B2B and B2C segments, generating €684.10 million and €946.60 million respectively, along with additional contributions from HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based growth company with high insider ownership, is currently undervalued by 56.8% compared to its fair value. Analysts expect a significant rise in its stock price by 51.9%. The company's earnings have surged by 158.9% over the past year and are projected to grow annually by 20.62%, outperforming the UK market forecast of 12.6%. Recently, Playtech expanded its partnership with MGM Resorts, enhancing its live casino offerings and potentially boosting future revenues and market presence.

Key Takeaways

Get an in-depth perspective on all 65 Fast Growing UK Companies With High Insider Ownership by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:JDGLSE:FSG and LSE:PTEC

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance