UK Growth Companies With High Insider Ownership And 33% Earnings Growth

The United Kingdom's financial markets are experiencing a tepid start, with the FTSE 100 facing downward pressure amidst global uncertainties and domestic political challenges. In such a market environment, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

Velocity Composites (AIM:VEL) | 28.5% | 140.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Here's a peek at a few of the choices from the screener.

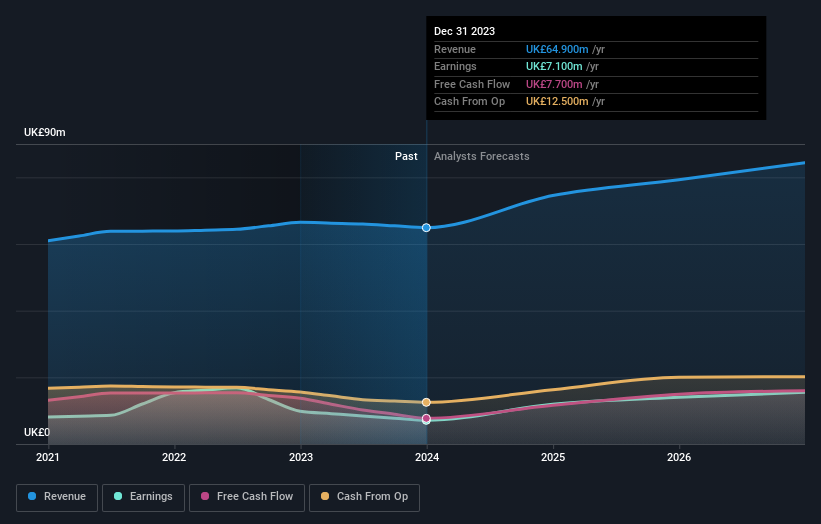

Fintel

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc operates as a provider of intermediary services and distribution channels to the retail financial services sector in the UK, with a market capitalization of approximately £315.77 million.

Operations: The company generates revenue through three primary segments: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Insider Ownership: 29.7%

Earnings Growth Forecast: 23.9% p.a.

Fintel Plc, a UK-based company, is trading at 12.7% below its estimated fair value and has shown significant insider selling in the past three months. Despite this, Fintel's revenue growth is forecasted at 8.6% annually, outpacing the UK market's 3.7%, with earnings expected to grow by a notable 23.88% per year over the next three years. However, its Return on Equity is projected to be low at 12.8% in three years' time.

Unlock comprehensive insights into our analysis of Fintel stock in this growth report.

The valuation report we've compiled suggests that Fintel's current price could be inflated.

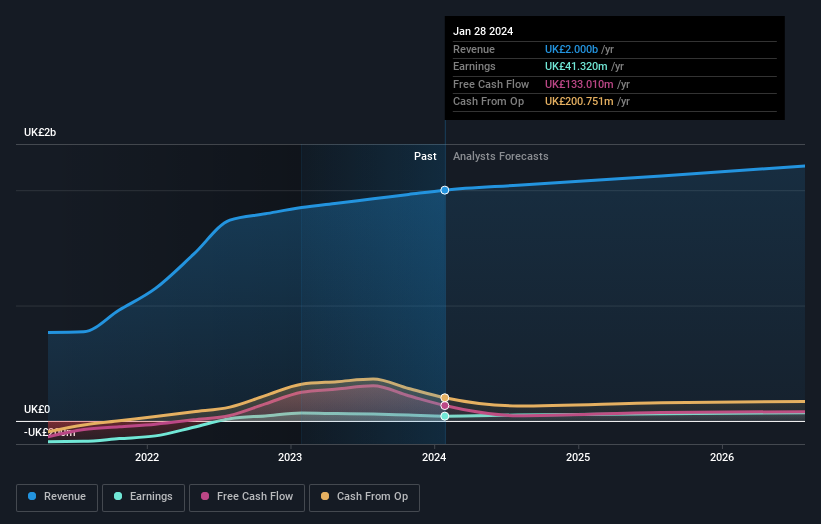

J D Wetherspoon

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J D Wetherspoon plc, with a market capitalization of approximately £0.92 billion, operates a chain of pubs and hotels primarily across the United Kingdom and the Republic of Ireland.

Operations: The company generates £2.00 billion in revenue primarily from its pub operations.

Insider Ownership: 25.8%

Earnings Growth Forecast: 20% p.a.

J D Wetherspoon, a UK-based hospitality company, is experiencing a steady recovery post-pandemic with sales and profits expected to be at the upper end of market forecasts. Despite challenges like lower profit margins compared to last year and earnings not sufficiently covering interest payments, the company's earnings are projected to grow significantly by 20% annually over the next three years. However, large one-off items have impacted its financial results. There's no recent insider trading activity reported.

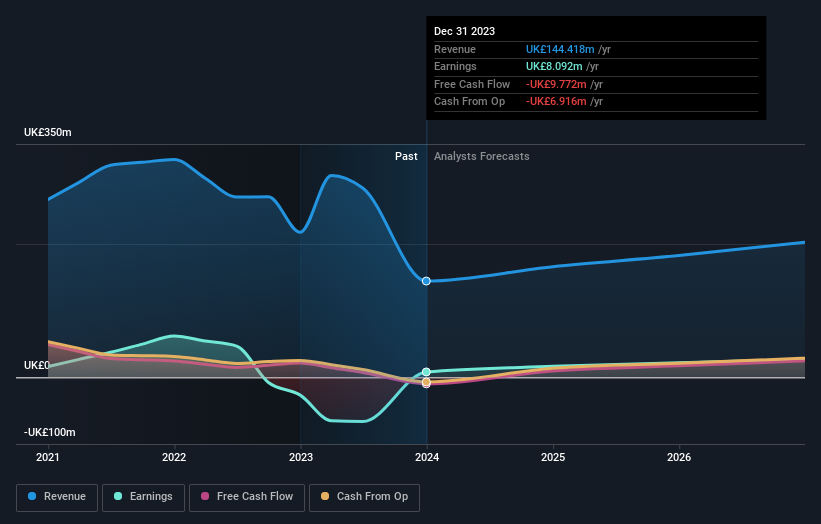

LSL Property Services

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the UK, offering services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market capitalization of £334.75 million.

Operations: LSL Property Services generates revenue through three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency excluding Financial Services (£24.89 million).

Insider Ownership: 10.8%

Earnings Growth Forecast: 33.3% p.a.

LSL Property Services, amidst a challenging financial landscape with a recent net loss, has shown resilience by implementing a share repurchase program valued at £7 million, signaling confidence in its future. The appointment of Adrian Collins as Non-Executive Chair could steer the company towards stability given his extensive experience. Despite lower revenues year-over-year and an uncovered dividend yield, LSL's earnings are expected to grow significantly over the next three years. This growth potential, coupled with strategic leadership changes and insider confidence reflected in the buyback initiative, positions LSL intriguingly for future developments.

Summing It All Up

Click this link to deep-dive into the 67 companies within our Fast Growing UK Companies With High Insider Ownership screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:FNTL LSE:JDW and LSE:LSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance