Uber's Asia Peer Grab Taps OpenAI to Enhance App Navigation and Customer Support

Grab Holdings Inc (NASDAQ:GRAB) will partner with OpenAI to integrate generative AI into its app, marking OpenAI’s first collaboration in Southeast Asia.

The Uber Technologies, Inc (NYSE:UBER) competitor plans to use OpenAI’s text and voice capabilities to enhance app navigation for visually impaired and elderly users and to develop advanced chatbots for customer support.

Grab will also employ OpenAI’s image recognition technology to enhance its GrabMaps service by improving data quality and updating maps more quickly. This service relies on real-time feedback from partner drivers, including images from helmet-mounted cameras, the Nikkei Asia reports.

With nearly 40 million monthly users in eight Southeast Asian markets, Grab already uses conventional AI for service improvements like driver allocation and route optimization.

In February, Grab reported fourth-quarter fiscal 2023 revenue growth of 30% year-on-year to $653.00 million, beating the analyst consensus estimate of $628.98 million. EPS of $0.01 beat the analyst consensus loss estimate of $(0.01). The company announced first share repurchase program of up to $500 million.

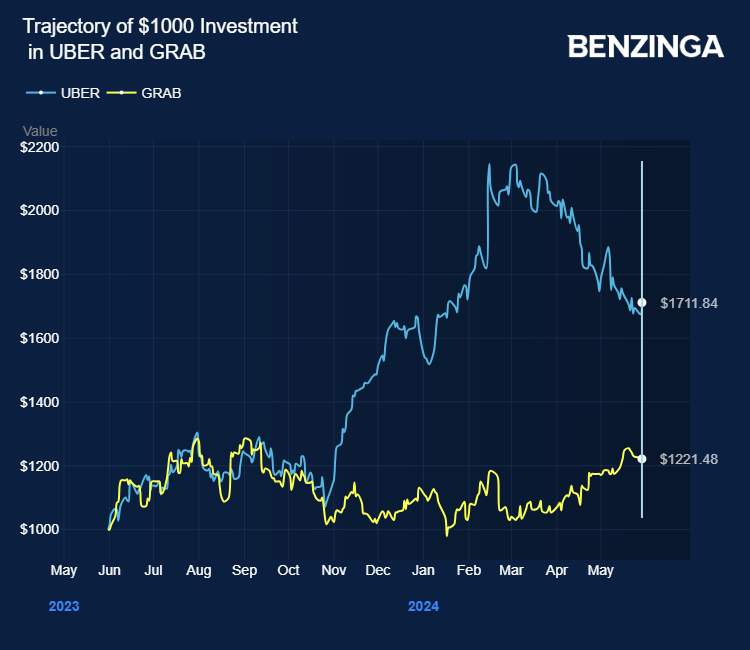

Grab Holdings stock gained 25% in the last 12 months. Investors can gain exposure to the stock via iShares MSCI EAFE ETF (NYSE:EFA) and iShares MSCI Singapore ETF (NYSE:EWS).

Price Action: GRAB shares traded lower by 1.10% at $3.60 premarket on the last check Thursday.

Photo via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Uber's Asia Peer Grab Taps OpenAI to Enhance App Navigation and Customer Support originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance