U.S. Steel (X) Sees Strong Q3 on Higher Flat-Rolled Prices

United States Steel Corporation X has issued guidance for third-quarter 2023. The company expects adjusted net earnings per share to be within the range of $1.10 to $1.15. Additionally, it anticipates adjusted EBITDA for the third quarter to be approximately $550 million.

The company is poised for a strong performance in the third quarter, with each of its operational segments exceeding prior expectations, leading to a healthy adjusted EBITDA. This enhanced performance results from a more resilient commercial portfolio and strategic management actions that have yielded increased cost efficiencies. Notably, the guidance considers the anticipated effects of the United Autoworkers union strike announced earlier this month. The company has devised a plan to temporarily halt operations at blast furnace 'B' located at Granite City Works in response to this challenge. Concurrently, it will redirect production volumes to other domestic facilities to effectively meet customer demand.

The company remains dedicated to executing its "Best for All" strategy, which involves advancing its portfolio of ongoing capital projects in a timely and cost-effective manner. One notable achievement highlighted is the successful launch of the non-grain-oriented electrical steel line at Big River Steel, with the production of the first coil anticipated by the end of this month. Additionally, the company emphasized the effective operation of the recently completed pig iron machine at Gary Works, providing cost-efficient pig iron to the electric arc furnaces at Big River Steel. The company's financial position remains robust as it allocates resources to these strategic initiatives while generating cash flow from operations. It projects a cash balance of approximately $3 billion at the close of the third quarter, with total liquidity expected to exceed $5 billion for the seventh consecutive quarter.

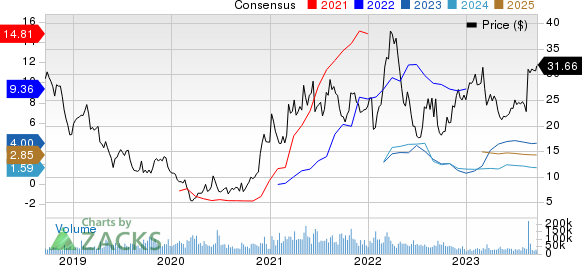

United States Steel Corporation Price and Consensus

United States Steel Corporation price-consensus-chart | United States Steel Corporation Quote

The adjusted EBITDA for Flat-Rolled Segment is expected to align with the second quarter. Although spot prices decreased sequentially, average selling prices are anticipated to be slightly higher than earlier projections, contributing to the segment's better-than-expected performance. The segment's diverse customer base has helped maintain a resilient order book.

The Mini Mill Segment's adjusted EBITDA is anticipated to be lower than the second quarter. While selling prices moderated during the quarter, the results are expected to benefit from better customer volume performance than previously expected and lower raw material costs. EBITDA margins are projected to remain in the low-to-mid teens.

Adjusted EBITDA for the European segment is expected to be lower than the second quarter. Economic challenges in the region and seasonal slowdowns are anticipated to lead to lower average selling prices and reduced shipment volumes. These challenges are expected to be partly offset by lower raw material costs.

The Tubular Segment's adjusted EBITDA is projected to be lower than the second quarter but still above historical levels. The primary drivers of this sequential EBITDA decline are anticipated to be softer market prices and demand as distributor inventory rebalances.

Shares of U.S. Steel have gained 55.7% in the past year compared with a 50% rise of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

U.S. Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS and Akzo Nobel N.V. AKZOY, both sporting a Zacks Rank #1 (Strong Buy), and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 84.5% in the past year.

The consensus estimate for Akzo Nobel’s current-year earnings is pegged at $1.44, indicating a year-over-year growth of 67.4%. In the past 60 days, AKZOY’s current-year earnings estimate has been revised upward by 3.6%. The company’s shares have rallied 23.3% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 7.5% upward in the past 60 days. The company’s shares have risen roughly 77.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance