TSX Growth Leaders With High Insider Ownership Featuring goeasy And Two More

The Canadian market has shown a robust performance in the first half of 2024, buoyed by positive economic indicators and anticipation of potential rate cuts. This environment sets a promising stage for exploring growth companies with high insider ownership on the TSX, which can offer unique advantages in terms of alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 71.7% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 12.6% | 64.7% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Artemis Gold (TSXV:ARTG) | 31.7% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

We'll examine a selection from our screener results.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of CA$3.31 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.5%

Revenue Growth Forecast: 32.4% p.a.

goeasy Ltd., a Canadian company with high insider ownership, demonstrates strong growth potential with revenue forecasted to increase significantly at 32.4% annually, outpacing the market's 7.2%. Despite challenges in covering dividends from cash flows and managing debt efficiently, goeasy's earnings have surged by 54.3% over the past year and are expected to continue growing at 15.84% annually. The recent appointment of Patrick Ens promises strategic enhancements, potentially bolstering future financial performance amidst these mixed indicators of financial health and growth sustainability.

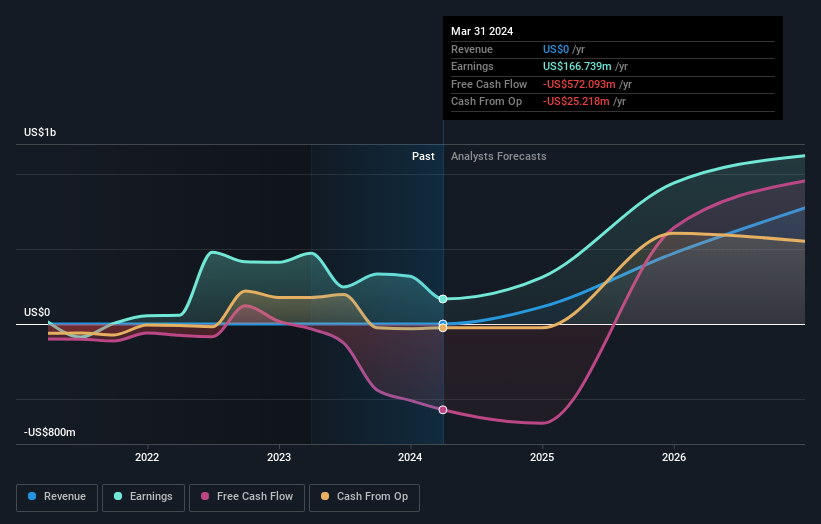

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. specializes in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$23.25 billion.

Operations: The firm primarily focuses on the extraction and processing of minerals and precious metals across various sites in Africa.

Insider Ownership: 12.6%

Revenue Growth Forecast: 83% p.a.

Ivanhoe Mines, a growth-oriented company with substantial insider ownership, has recently achieved significant milestones in its operations. The early and on-budget completion of the Phase 3 concentrator at the Kamoa-Kakula Copper Complex significantly enhances its production capacity, positioning it as one of the world's largest copper mining complexes. Despite a net loss in Q1 2024, Ivanhoe's revenue is forecasted to grow by 83% annually, outstripping market averages substantially. However, recent substantial insider selling raises caution despite these advancements and optimistic revenue forecasts.

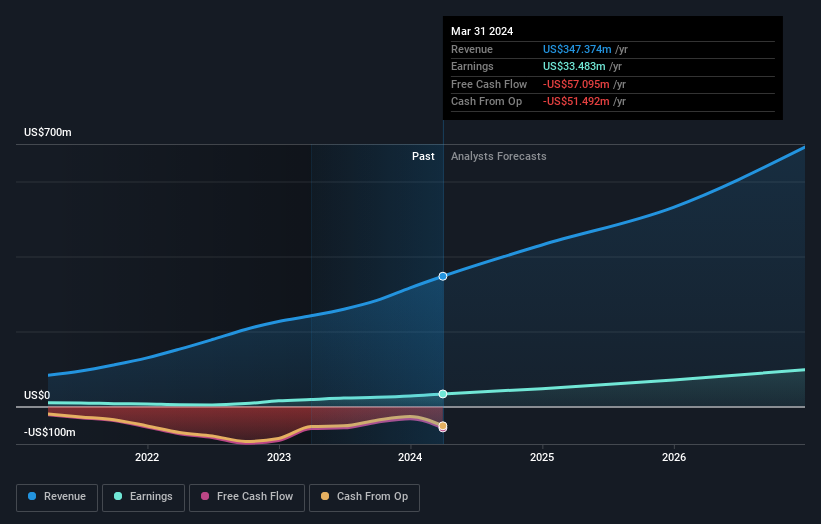

Propel Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market capitalization of approximately CA$841.08 million.

Operations: The company generates CA$347.37 million in revenue from providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 40%

Revenue Growth Forecast: 22.7% p.a.

Propel Holdings, a Canadian company, demonstrates robust growth with its revenue and earnings forecasted to increase by 22.7% and 36.4% per year respectively, outpacing the market. However, its dividend sustainability is questionable as it's poorly covered by cash flows. Recent activities include a dividend increase and strong quarterly sales growth from US$65.62 million to US$96.5 million, reflecting operational strength despite no significant insider buying in the last three months.

Take a closer look at Propel Holdings' potential here in our earnings growth report.

Our valuation report here indicates Propel Holdings may be overvalued.

Key Takeaways

Click through to start exploring the rest of the 25 Fast Growing TSX Companies With High Insider Ownership now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:GSYTSX:IVN TSX:PRL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance